The Debt Management Office (DMO) has clarified that recent news reports suggesting the appointment of transaction advisers for a potential Eurobond issuance are inaccurate.

Contrary to the report, the DMO said it has yet to receive the requisite approvals from the Federal Executive Council (FEC) and the resolution of the National Assembly for any Eurobond issuance.

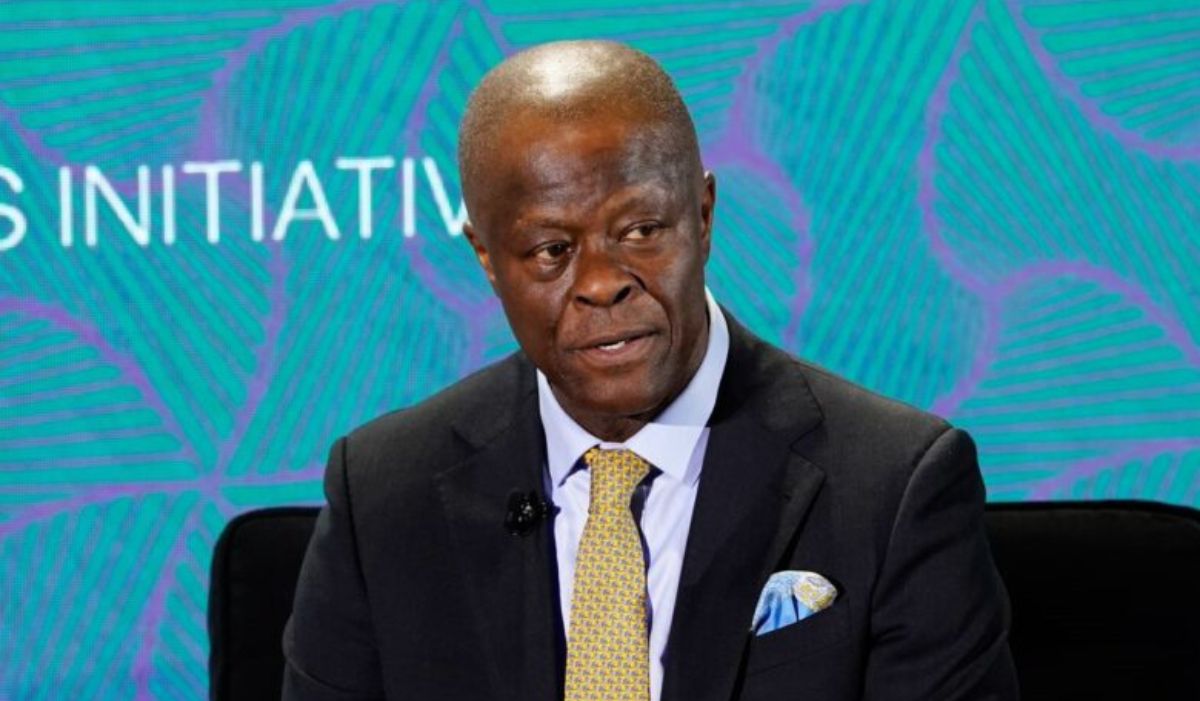

The clarifications come on the heels of a media report alleging that “Wale Edun’s (the Minister of Finance and the Coordinating Minister of the Economy) Chapel Hill landed a lucrative contract to secure $1 billion in Eurobonds for President Bola Tinubu’s government.

An online news platform reported that Nigeria has hired investment banks including Citigroup Inc., JPMorgan Chase & Co., and Goldman Sachs Group Inc. to advise it on the West African nation’s first eurobond issue since 2022.

It said:“Bloomberg reported on Thursday that the size of the eurobond offer, which was expected before June, had yet to be determined. This is according to the people who asked not to be identified because they are not authorized to comment publicly on the matter.

“Africa’s largest oil producer may raise as much as $1 billion in external borrowing in 2024 to meet its spending needs, they said.

“The report also said Nigeria had hired Standard Chartered Bank and Lagos-based Chapel Hill Denham as advisers.’’

Edun is alleged to be the founder of Chapel Hill Denham Group, an investment banking, securities trading, and investment management firm that provides comprehensive advisory services to a diverse client base, including financial institutions, multinationals, and governments.

However, the DMO, in a statement titled and given to Persecondnews, “Clarifications on Nigeria’s Eurobond Issuance’’, said: “The appointment of transaction advisers by the DMO is done in accordance with the provisions of the Public Procurement Act, 2007 and is subject to the approval of the Federal Executive Council (FEC).

“Also, the issuance of Eurobonds by the Federal Government of Nigeria in the international capital market is subject to the approval of the FEC and receipt of the Resolution of the National Assembly (NASS) in accordance with the provisions of the Fiscal Responsibilities Act, 2007 and the Debt Management Office (Establishment, Etc.) Act, 2003.

“Currently, the DMO has not received the requisite approvals from the FEC and Resolution of the NASS for any Eurobond Issuance.’’

The DMO urged the public to rely on official statements from the office for accurate updates on Nigeria’s debt management activities.

Leave a comment