UBA Surpasses N1trn Market Capitalisation Mark Amid Impressive Financials, Recognitions

.....Market Cap Hits N1.022tn, Emerges Best Performing Banking Stock in 2023

Related Articles

FG secures conviction of 125 Boko Haram terrorists, financiers

The Federal Government says it has secured the convictions of more than...

Nigeria’s economy on recovery path, says Tinubu

President Bola Tinubu has said the nation’s economy is on a gradual...

Ohanaeze President-General, 81-year-old Emmanuel Iwuanyanwu, exits

The President General of Ohanaeze Ndigbo, Chief Emmanuel Iwuanyanwu, is dead. Aged...

Breaking: Nationwide protest: Tinubu, APC governors hold closed-door meeting in Aso Rock

President Bola Tinubu is currently presiding over a closed-door meeting of the...

Breaking: Tragedy strikes in Lagos as building collapses, claiming three lives

A building collapsed in the wee hours of Thursday at Arowojobe Estate...

Nigeria, U.S. Customs partner to combat illicit drug, arms trade using AI

The Federal Government has concluded plans to curb illicit trade in drugs...

Netflix raises subscription fees in Nigeria, the second in three months

by Ramlat Ibrahim Netflix has again announced another tariff hike for its...

Mass trial of terrorism suspects resumes – FG

The National Counter-Terrorism Centre, Office of the National Security Adviser, has said...

Exciting prizes up for grabs with FirstBank Visa Gold and Visa Infinite Cards in 2024 summer campaign

First Bank, the West African premier financial institution and financial inclusion services...

Transcorp Hotels achieve 188 percent growth in 2024 half year

Transcorp Hotels, the hospitality subsidiary of one of Africa’s leading listed conglomerates,...

Why FG injected N1trn palliatives into manufacturing sector – Finance Minister Edun

The Federal Government has disclosed that a total sum of N1 trillion...

Tinubu urges Nigerian youths to shelve August 1 national protests

President Bola Tinubu has called on Nigerians to shelve the planned ‘EndBadGovernance’...

Breaking: Again, CBN increases interest to 26.75 percent

The Central Bank of Nigeria (CBN) has raised the monetary policy rate...

Just in: NNPC Ltd’s GCEO, Kyari, debunks claims he owns blending plants in Malta

The Group Chief Executive Officer of the Nigerian National Petroleum Company Limited...

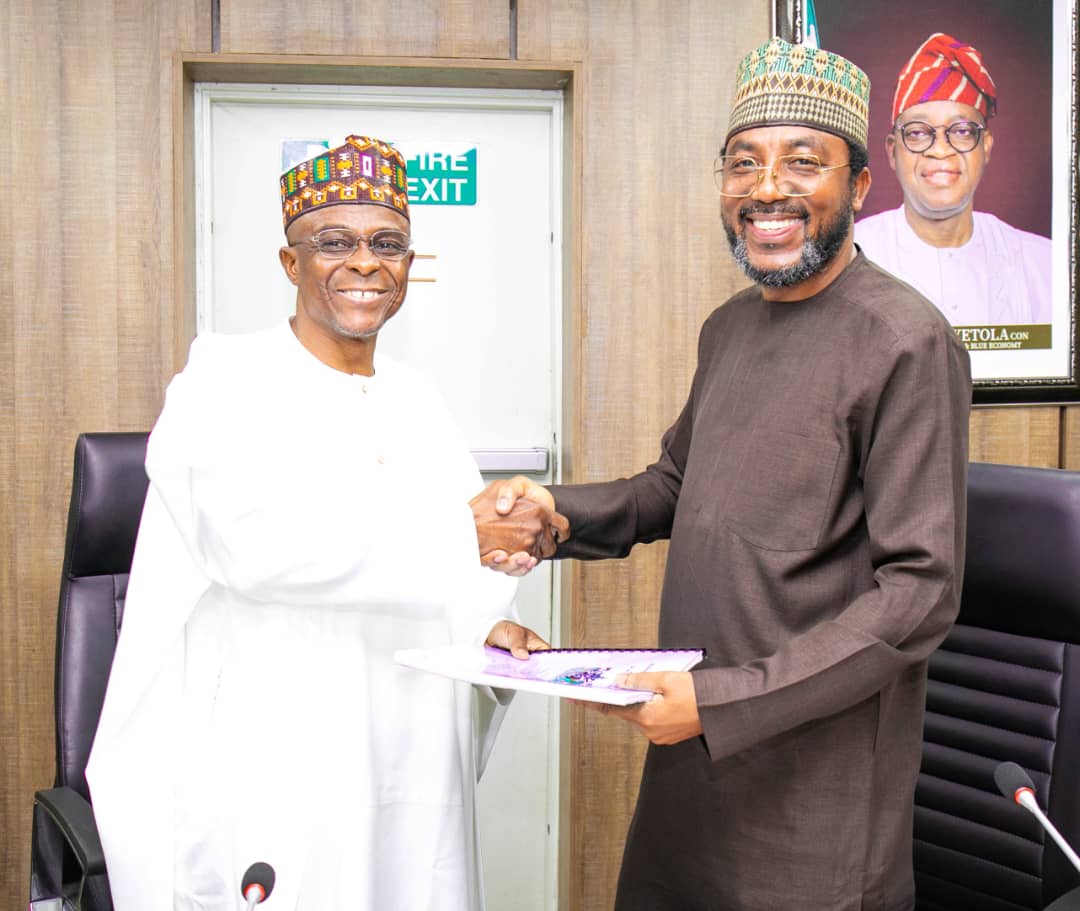

NPA generated N541bln revenue in first half of 2024, says outgoing MD, Bello-Koko

The Nigerian Port Authority (NPA) generated ₦541 billion revenue in the first...

Dr. Dantsoho, new NPA MD, assumes duty, commits to improved revenue generation, port efficiency

The new Managing Director/CEO of the Nigerian Ports Authority (NPA), Dr. Abubakar...

Just in: 119 passengers escape deaths as Max Air four tyres burst during takeoff at Yola airport

The Max Air Boeing 737, with registration 5N-ADB and 119 passengers and...

AU’s 6th mid-year meeting: Pres. Tinubu addresses African leaders on ECOWAS status, highlights achievements, challenges

Pres. Bola Tinubu on Sunday in Accra, Ghana addressed African leaders on...

I’m no longer interested in investing in Nigeria’s steel industry, says Aliko Dangote

Alhaji Aliko Dangote, the Chairman of Dangote Industries Limited, has halted the...

Leave a comment