The Central Bank of Nigeria (CBN) said on Wednesday that the over 60 percent reduction in revenues accruable to the Federation Account, significant drop in foreign currency inflows, and a rise in inflation due to the exchange rate have impacted negatively on the country’s economy.

It also said the Nigerian economy was not immune to the global economic crises occasioned by COVID-19 lockdown.

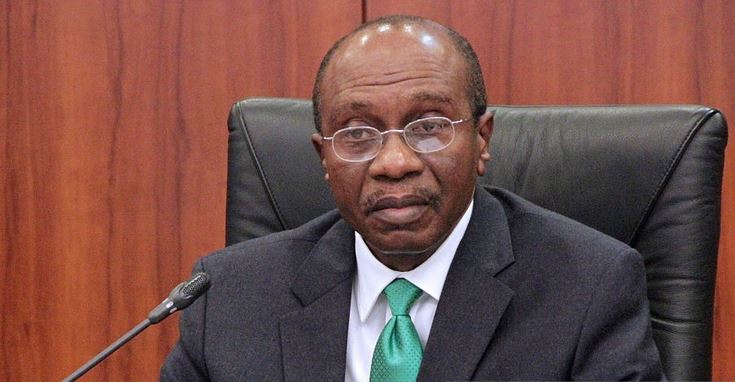

The Apex Bank’s statement came against the backdrop of a press release titled, “Matters of Urgent Attention” by the Nigerian Economic Summit Group (NESG) which calls into question some of the measures taken by the CBN to support the stability of our financial system and enable faster recovery of our economy following the negative impact of the COVID-19 pandemic on Nigeria.

“As we all are aware, the impact of COVID-19 on countries across the world resulted in a significant downturn in the global economy. Consequently, countries including Nigeria were forced to impose lockdown measures in order to contain the spread of the pandemic.

“This action resulted in depressed economic activity in the first half of the year. Except for China and Vietnam, advanced, emerging and frontier market economies, all experienced significant negative growth in the first half of 2020, and some are currently in a recession.

“In response to these unfortunate events across the globe, central banks have embarked on measures aimed at stabilizing their respective economies by reducing lending rates, which declined to negative territory in several advanced economies, in addition to increasing the scale of their asset purchase programmes.

“It is, therefore, pertinent to state that the Nigerian economy is not immune from these crises given the over 65 percent drop in commodity prices; disruptions in global supply chains and the unprecedented outflow of over $100bn of debt and equity funds from emerging markets between March and May 2020; in addition to the impact of the lockdown on economic activities.

“These activities resulted in an over 60 percent reduction in revenues due to the Federation Account, a significant drop in foreign currency inflows, which led to downward adjustments in the naira/dollar exchange rate and a rise in inflation due to the exchange rate pass through effect of imported inflation,’’ the CBN said in a statement made available to Persecondnews.

It stated: “Indeed, after reducing its Federal Funds rate to 0 percent, the US Federal Reserve Bank implemented a huge securities purchase programme, which included purchase of corporate bonds (including those below investment grades).

“The Reserve Bank also provided credit facilities to non-bank institutions which included, money market funds and corporations. The balance sheet of the US Federal Reserve in support of these activities increased by over $3 trillion, while the European Central Bank expanded its balance sheet by over $1 trillion.

“Furthermore, the Bank of England in an unusual move gave an open check to the UK Government in order to fund its recovery efforts.’

Leave a comment