The Securities and Exchange Commission, SEC, Wednesday sealed off the premises of Dantata Success and Profitable Company, Kano for engaging in illegal capital market activities.

“They do not have registration with the SEC and the Commission has powers according to Section 13 of ISA 2007, to shut down any company carrying out capital market activities without due registration, SEC said in a statement

” Nigerian laws provides that business activities in the country has to be regulated, in this case SEC is supposed to regulate them”.

The company was shut down for carrying out investment operations that falls within fund management without registration with the apex regulator.

The strategy of the company is to solicit for funds from unsuspecting members of the public by enticing them with returns of monthly interest on investment of between 25 percent to 50 percent depending on the nature and investment type.

They also indicated a registration period of 5th February to 15th February in one of their numerous notices directing all prospective customers to make deposits into their bank accounts.

The company sells its forms to prospective investors according to their investment plans ranging from N1,000 to N3,000. The minimum amount investable is N50,000 while the maximum is N5,000,000

The investment period of the scheme is pegged at a minimum of 30 working days to a maximum period of 12 months with offer of interest rates on short and medium term basis.

It claims to be involved in trading, general merchandise supply, oil and gas, transportation, import, export and general contract.

The commission had established that the company’s activities also constituted an infraction of the Investments and Securities Act (ISA), 2007.

The SEC Management said the closure was to end unlawful activities of the company against unsuspecting investors and therefore urged investors to ensure they only deal with fund managers that are registered with the Commission.

“The account of the company have been frozen, the promoters have been arrested by the Nigeria Police Force and are undergoing interrogation.

The Commission wishes to notify the investing public that the company is not licensed to carry out investments business of any type and as such its operations are illegal.

The SEC therefore advises the public to exercise due diligence and caution in the course of making investment decisions adding that valid licence of lawful operators could be obtained on the commission’s website by members of the public to confirm the licences of firms with which they intend to carry out investment activities.

SEC shuts down Dantata Success and Profitable Company Ponzi Scheme in Kano

Related Articles

Industry and Trade Minister promises Nigerian Breweries, business community enabling environment

The Minister of Industry, Trade, and Investment, Dr. Doris Uzoka-Anite, has reaffirmed...

Transcorp Power Plc grows topline by 57.03%, profit up by 75% in 2023 audited results

Transcorp Power Plc (Transcorp Power), one of the power subsidiaries of Nigeria’s...

UBA records impressive gross earnings rise of 143%, profit hits N757.7bn in financial year 2023

The United Bank for Africa (UBA) Plc has recorded a 143 per...

Breaking: Nigeria to get oil-backed $1bln Afreximbank loan in May

Nigeria is set to receive $1.05 billion from a syndicated loan backed...

Breaking: CBN sells $10,000 to BDCs at N1,101/$

The Central Bank of Nigeria (CBN) on Monday announced the sale of...

Premium Pension Ltd., industry leader, records impressive N1.134trn revenue growth in 2023

A leading pension fund administrator in Nigeria, Premium Pension Limited, has said...

Transcorp Group records robust growth in 2023, revenue up by 47.3%, profit-before-tax of 93.5% Transnational Corporation Plc

(“Transcorp” or the “Group”), Nigeria’s leading listed conglomerate, has announced its financial...

Updated: We raised interest rate to 24.75 percent to fight inflation – CBN

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN)...

Don’t sell dollar above N1,269, CBN orders Bureau de Change

As part of measures to strengthen the naira against the dollar, the...

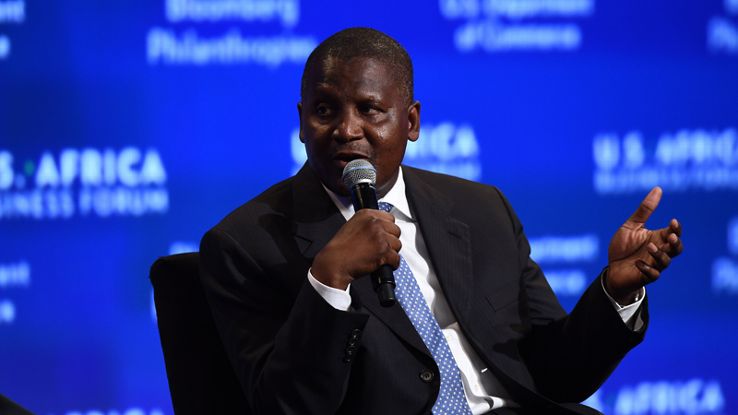

Dangote set to disburse N15bln food items to 774 LGAs to cushion harsh economic conditions

Nigerian businessman and industrialist Alhaji Aliko Dangote says he has allocated N15...

Naira strengthens to N1400/$ at parallel market as speculators sell

The naira strengthened on Wednesday to close at N1400/$1 in the parallel...

Just In: Zenith Bank names Adaora Umeoji as its first female Group Managing Director

The Board Directors of Zenith Bank Plc has announced the appointment the...

Nigerian Business Community to FG: Use Ghana Trade Office to solve our problems

The Nigerian business community in Ghana has urged the federal government to...

Heirs Holdings tells story of transformational investment in Africa, launches its first-ever TV commercial

Heirs Holdings has launched its first-ever television commercial (TVC), showcasing the company’s...

Aig-Imoukhuede, co-founder, returns to Access Holdings as Chairman

Access Holdings PIc has announced the return of Mr. Aigboje Aig-Imoukhuede as...

CBN to sanction MfBs over late non-rendition of statutory monthly returns

The Central Bank of Nigeria (CBN) has directed all microfinance banks (MfBs)...

In a great leap forward, Heirs Holdings launches Heirs Technologies, set to lead Africa’s digital evolution

Heirs Holdings, a leading African investment company dedicated to improving lives and...

Transcorp Group announces listing of Transcorp Power Plc by introduction on Nigerian Exchange’s Main Board March 4

Transnational Corporation Plc (Transcorp Group) wishes to announce the listing of its...

CBN to sell N1.64trn Treasury bills in Q2 2024

The Central Bank of Nigeria (CBN) has said it will sell Treasury...

Nigeria lacks sufficient reserves to tackle FX demands, backlog in the market, says expert

An economist, Mr. Esili Eigbe, has said Nigeria lacked sufficient reserves to...

Leave a comment