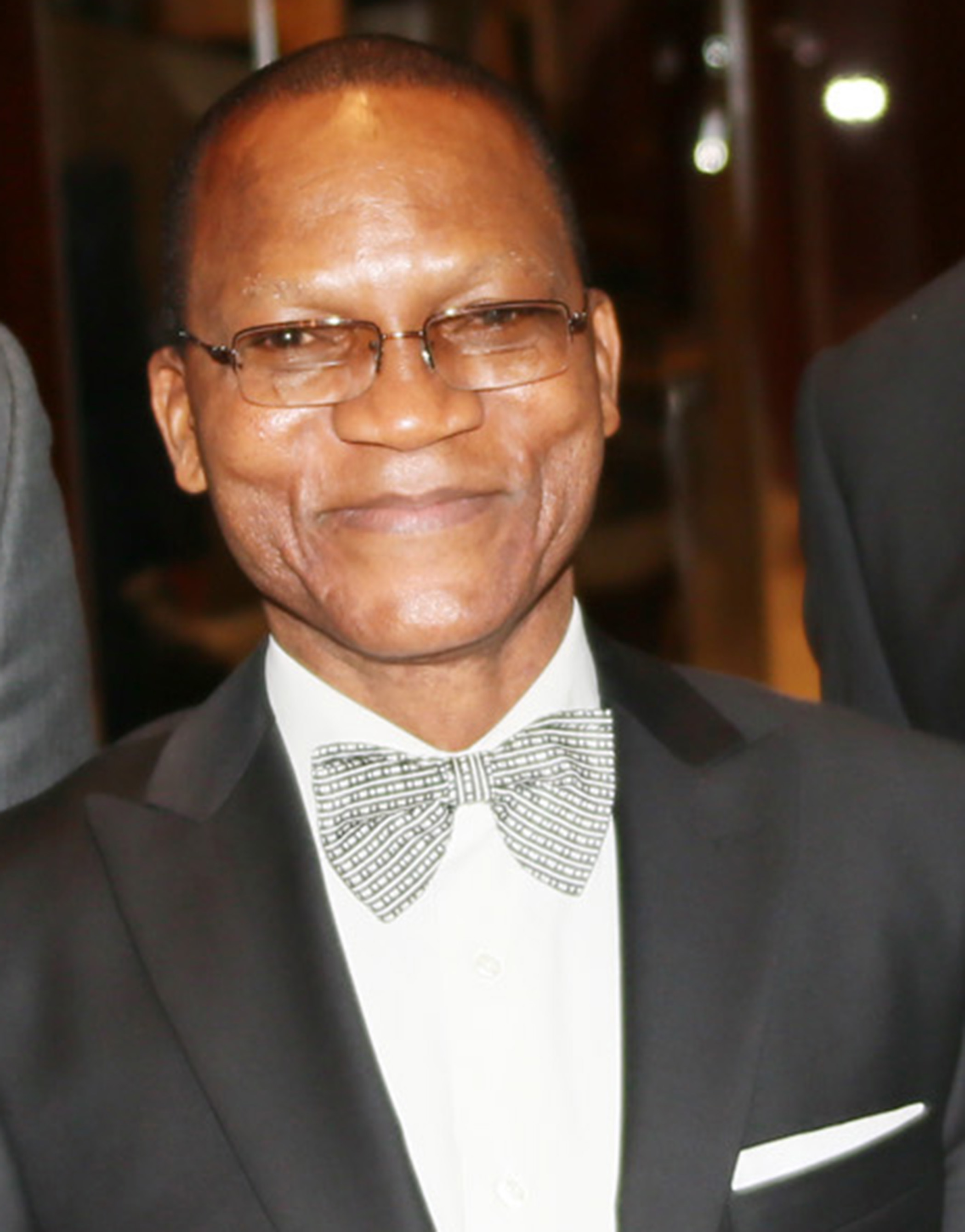

Wale Suleiman

The immediate past Director General of the Debt Management Office in Nigeria, Dr Abraham Nwankwo, has admonished African leaders to initiate robust macroeconomic, transformation plans to drive debt-financed sustainable economic growth and prosperity.

Speaking on the topic “Sapping Africa’s Debt Financing Strategy: Removing Some Mental Cobwebs”, at the Fourth London Stock Exchange LSEG Africa Advisory Group (LAAG) Meeting in Nairobi, Kenya, Nwankwo said such a transformation plan is needed as a formal policy document, “narrating how debt financing will be applied to launch economy unto a trajectory of self-sustaining prosperity; with credible macroeconomic figures at the beginning, intermediate and concluding stages: GDP figures, inflation, interest rates, exchange rates, reserve position, etc.”

Nwankwo, who holds a PhD in economics, said Debt Financing, particularly external debt financing from the international capital market, appears to be the most predictable source for financing and refinancing Africa’s economic and social transformation over the next decade.

However, he stated that the real job for governments, particularly officials in charge of planning, finance and central banking is “to demonstrate with detailed credible macroeconomic plan, how this prospect can be safely actualized.”

He stressed that many African countries have failed to initiate credible transformation plan thereby squandering the opportunity to grow their economies through debt financing. “The government may be keen on debt financing but lazy to articulate a credible implementation plan, with macroeconomic deliverables, around debt financing.”

Added to this intellectual laziness on the part of economic planners is also what he called the “Rigid, non-imaginative advice from the IMF in particular, which encourages policy timidity, instead of planned boldness.”

He said the IMF usually relies on past and present deficiencies to preach against the possibility of future progress instead of focusing on how to cage or degrade those deficiencies to create a new trajectory of efficiency and prosperity.

He said: “Much of IMF advice on Africa’s debt financing misleads countries to commit what I first referred to in a 2017 publication as the “sin-of-avoiding-a-sin’(SAS)”

He further stressed that African countries would continue to rely on debt financing from the international capital market due to acute fiscal constraints, huge infrastructure deficit and huge reserves of exploitable opportunities in agriculture and agro-processing, manufacturing, solid minerals, tourism and other sectors

Leave a comment