The Federal Government on Tuesday acknowledged that the monies remitted into Nigeria by Nigerians abroad has helped in no small measure to stabilize the country.

In appreciation of their contributions to the nation’s economic growth, the government has decided to launch a special mortgage loan scheme for Nigerians living in the diaspora before the end of 2022.

Available statistics indicate that there are over 20 million Nigerians in the diaspora and in the last one year, monies remitted into Nigeria is in excess of $20 billion.

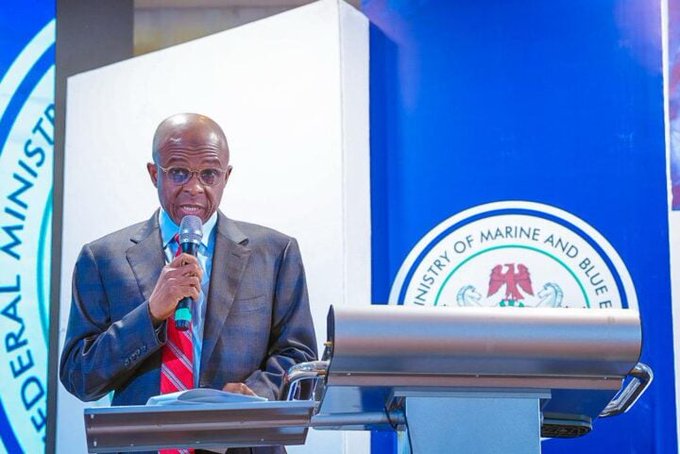

The Managing Director of the Federal Mortgage Bank, Mr Hamman Madu, announced this at the opening of a three-day 5th Nigeria Diaspora Investment Summit, dubbed, “NDIS22’’ with the theme: “Optimizing Investment Opportunities for National Development”.

Madu said this has become imperative to provide opportunities for them to own property in the country without being physically present to accomplish it.

According to him, the diaspora mortgage loan scheme, an initiative of the bank, will help to bridge the housing deficit back in the country.

“The Federal Mortgage Bank of Nigeria has recognized that Nigerians in the diaspora have contributed significantly to their host communities and Nigerian economies.

“You invest in your family, friends and the country leading to a huge economic transformation. It is in view of the foregoing and in order to broaden the mandate of Federal Mortgage Bank of Nigeria, that we developed a national housing fund product for Nigerians in the diaspora.

“This product will afford Nigerians in diaspora the opportunity to register with the National Housing fund Scheme, make monthly contributions and ultimately be able to access mortgage loans at reasonable rates in order to own their own houses back home without having to physically come to Nigeria before they can participate.

“The product is the Diaspora National Housing Mortgage fund. The long window offers the Nigerians in the diaspora mortgage loans to build or to develop houses or to buy and develop houses in Nigeria,’’ Madu said.

Stressing on the mortgage loans, he also said: “So why this product or this type? The product provides an opportunity to own a decent home at home. Man naturally ventures out to search for enduring means of livelihood and thereafter instinctively head home.

“His only impediment usually in any home is the absence of a decent accommodation to go back to. This product therefore provides him the opportunity to own such a decent home anywhere in the country.

“That is why the bank, the Federal Mortgage bank of Nigeria developed the Diaspora mortgage bank programme targeted at Nigerians living outside the shores of this country to give them an opportunity to participate and benefit from the national housing scheme.

“It is also established that the volume of money remitted to Nigeria by our brothers and sisters in the diaspora is usually large. Though part of these remittances are for family upkeep and other needs.

“A large chunk of it is usually meant for investment in residential development back home. And many of such investments, usually fail to achieve the aspiration of our Nigerians in diaspora and therefore end up alienating them from coming back to Nigeria.’’

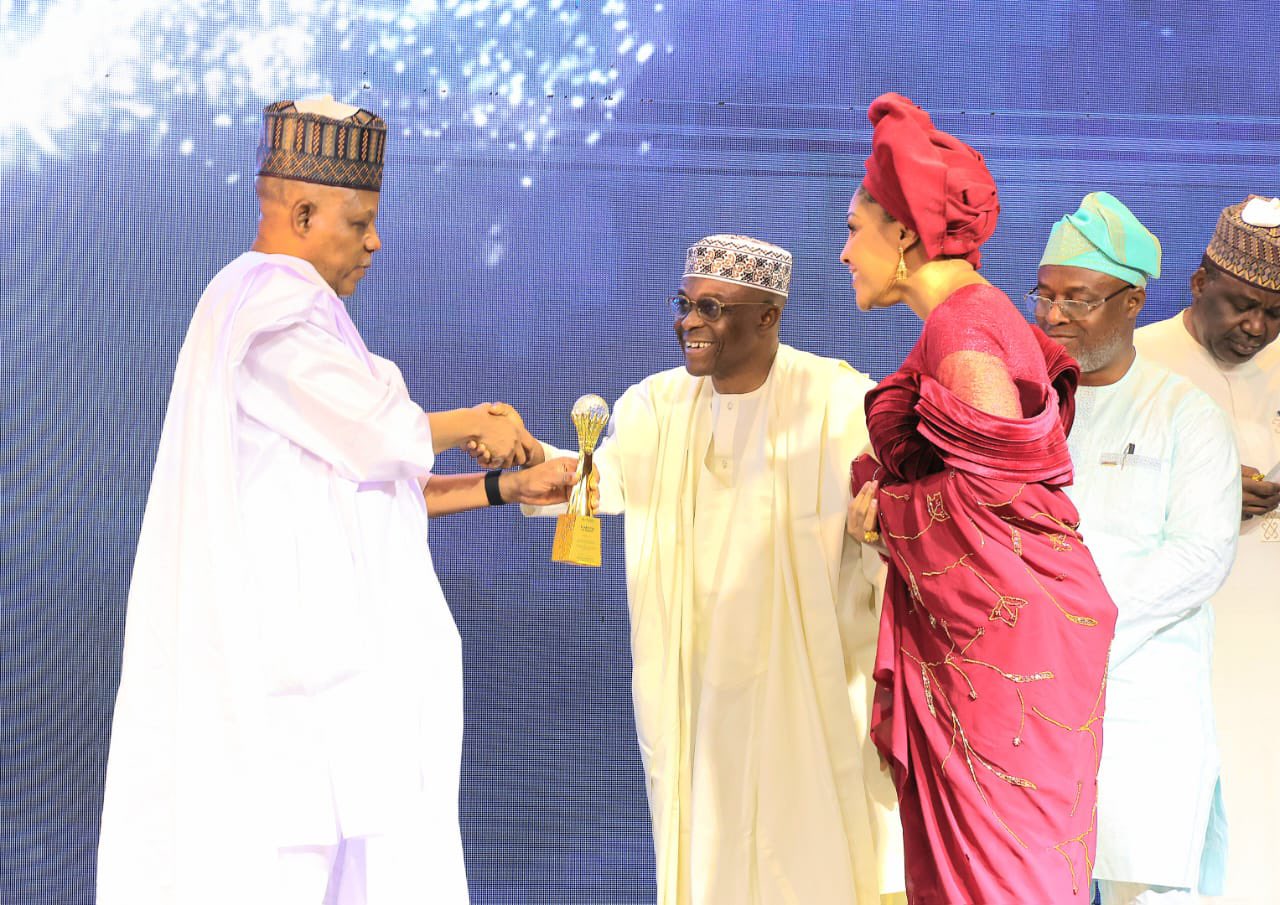

Earlier, Dr Badewa Adejugbe-Williams, the Coordinator/Chairman, Board of Trustees of Nigeria Diaspora Investment Summit, said NDSI is made up of Nigerians in the diaspora who come together to give back.

“This began in 2018 with the aim of exposing the diaspora to investment opportunities in Nigeria, thus attracting diaspora investment into the country.

“I don’t have to speak to the choir, I don’t have to tell you the enormous attributions that diaspora Nigerians have brought into the nation by their remittances like taking care of the social and economic needs of their family members.

“To achieve this, a lot of things was channeled into structuring the NDIS as a platform where diaspora private business owners, notable sponsors and partners as well as government agencies to interact to explore investment opportunities and make business deals for the economic growth of our motherland,’’ she said.

According to her, the summit’s attendance has grown from 400 in 2018 to 4,000 during the pandemic.

She said one of the success stories of the NDIS is that of one major organization made up of about 500 investors that picked five different projects that they invested in.

“The non-profit foundation identify about 10 different NGOs that they gave grants to as donations to help them with nonprofits.’’

Mrs Abike Dabiri-Erewa, the Chairman/CEO, Nigerians in Diaspora Commission (NiDCOM), said the platform provides for Nigerians in diaspora to interact with potential investors and partners, collaborators and government officials with a view to investing their resources, skills, talents and global exposure in Nigeria’s economy.

Leave a comment