Revenue: Future of crude oil bleak, taxation only sustainable source – FIRS boss

Related Articles

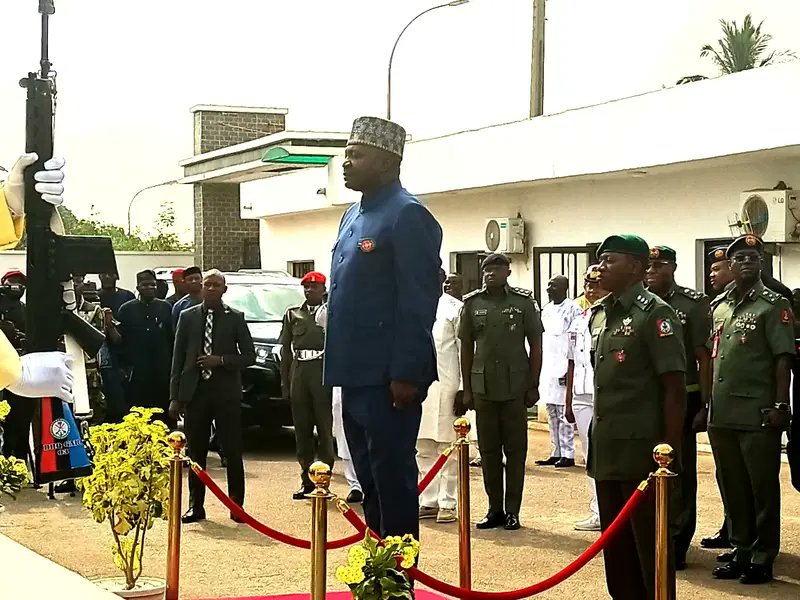

Defence Minister Musa Meets with Service Chiefs Behind Closed Doors

In a bid to hit the ground running on assumption of office,...

Maritime Workers Union Meets NPA, Pledges Support for Sector’s Growth

The Maritime Workers’ Union of Nigeria (MWUN) has reaffirmed its commitment to...

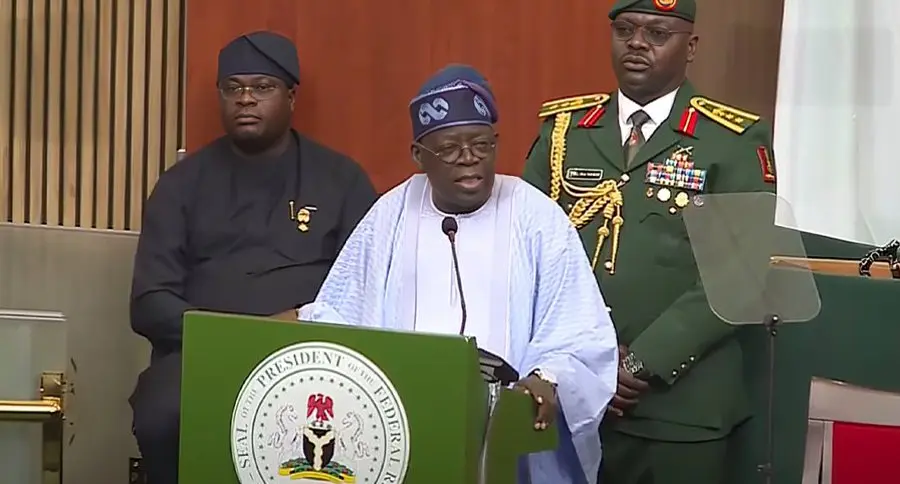

Tinubu Seeks Senate’s Confirmation of Omokri, Fani-Kayode, Other Ambassadorial Nominees

President Bola Tinubu on Thursday transmitted a fresh batch of 32 ambassadorial...

NASS to FG: Name Terrorism Financiers Now

The National Assembly has called for the public naming and prosecution of...

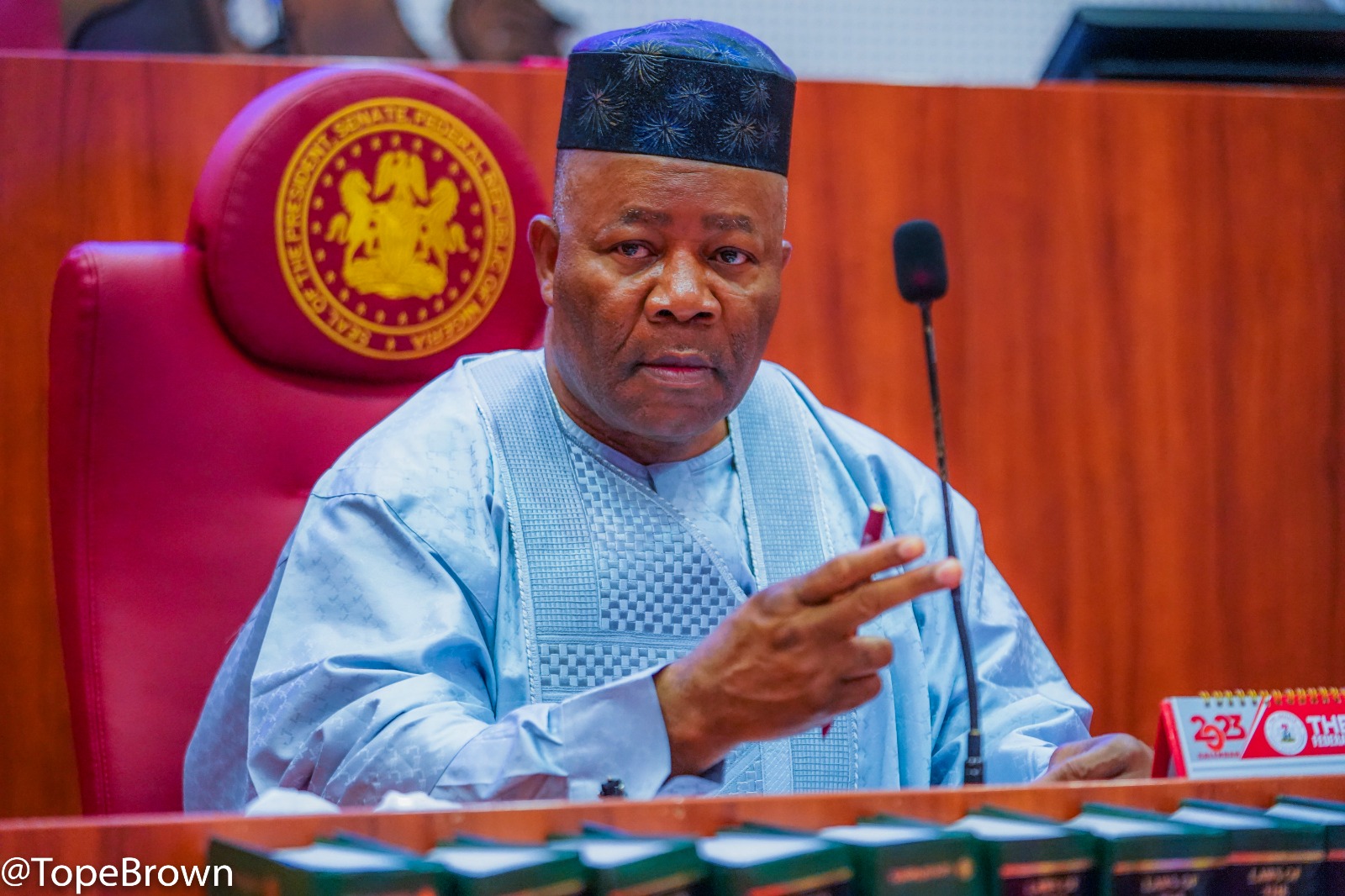

“Trump Is On Our Neck”: Akpabio Alerts Senate

Senate President Godswill Akpabio openly declared the intense pressure Nigerian leaders and...

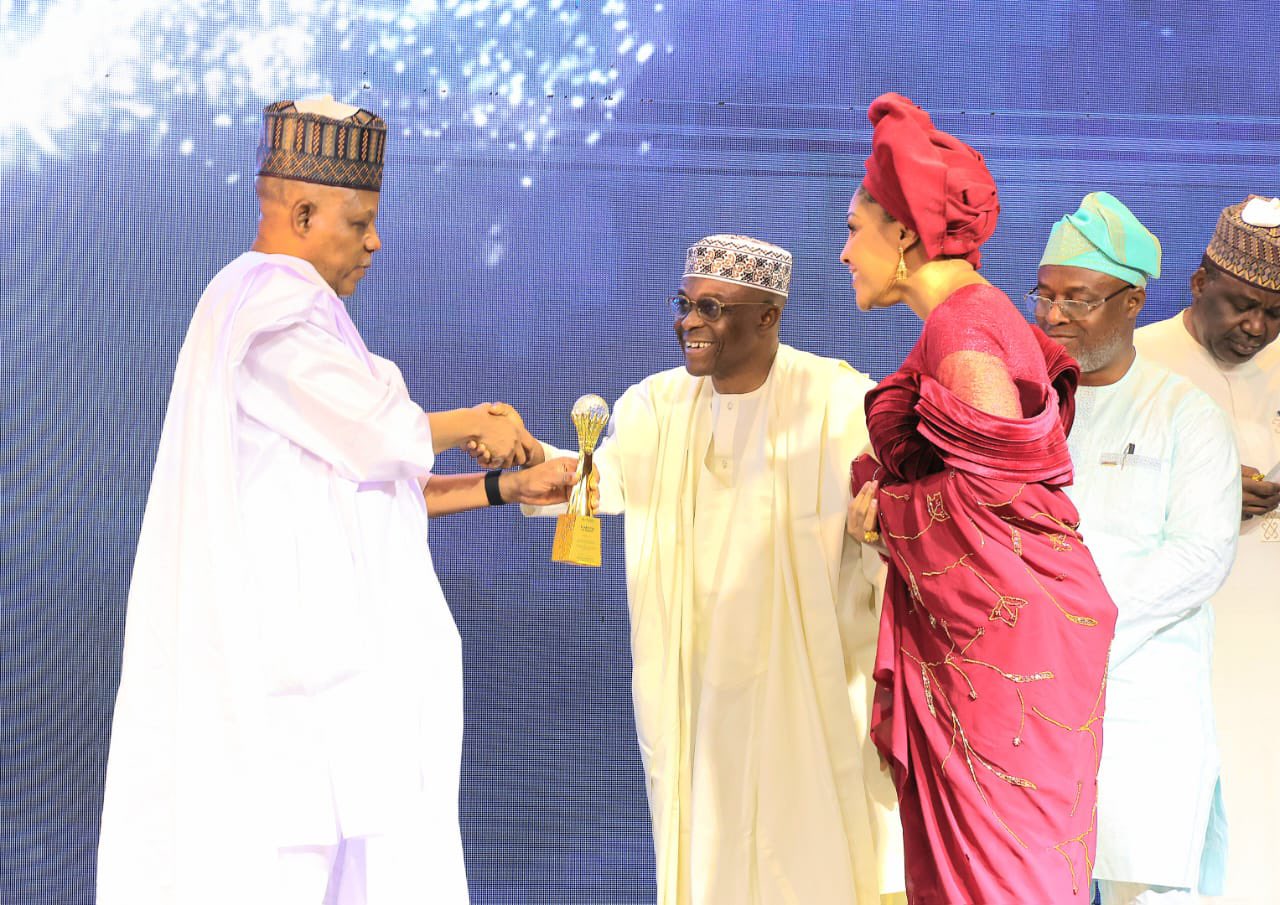

Nigerian Ports Authority Receives Prestigious Leadership Award

Vice President Kashim Shettima has presented the “Leadership In Action” Award to...

Just In: US Slaps Visa Restrictions on Nigerians Linked to Christian Killings

The United States has announced new visa restrictions targeting individuals in Nigeria...

Wike, Fayose, Anyanwu, Others Get PDP’s Expulsion Certificates

The People’s Democratic Party (PDP) announced that it has formally issued certificates...

Tinubu Orders Security Chiefs to Intensify Fight Against Insecurity

President Bola Tinubu has directed Nigeria’s security chiefs to step up efforts...

Breaking: Tinubu Nominates Ex-CDS Christopher Musa as New Defence Minister

President Bola Tinubu has nominated Gen. Christopher Musa, the immediate past Chief...

2Face’s Marriage to Natasha in Turmoil After Dramatic Confrontation on Daddy Freeze’s Show

Nigerian music icon Innocent Idibia, popularly known as 2Baba, appears to be...

Breaking: Nigeria’s Defence Minister Quits

Nigeria’s Minister of Defence, Mohammed Badaru Abubakar, has resigned from his position,...

Just In: Insecurity : Northern Govs, Emirs Converge in Kaduna for Meeting

Northern governors and traditional rulers have gathered for an urgent meeting at...

Just In: Abia Gov. Otti Meets Detained Kinsman Nnamdi Kanu in Sokoto Prison

Abia State Governor Alex Otti has visited the detained leader of the...

Presidency Vows to Unmask Terrorism Financiers in Nigeria

President Bola Tinubu’s administration is poised to reveal the identities of those...

California’s Stockton Shooting: 3 Kids Among 4 Fatally Shot at Birthday Bash

Three children were among four people who died in a mass shooting...

Arsenal Holds Chelsea to 1-1 Draw at Stamford Bridge

Arsenal and Chelsea played out a thrilling 1-1 draw in their English...

Gunmen Attack Kogi Church During Sunday Service, Whisk Away Pastor, Wife, Worshippers

Gunmen have struck again, this time targeting the Cherubim and Seraphim Church...

FCT land revocation: Ex-First lady, David Mark, Lamido, Sen. Ndume, Iyabo Obasanjo, Oyinlola, ex-PDP chair, Idiagbon, others on the list

A total of 1,095 properties in the Federal Capital Territory (FCT), owned...

Breaking: Pres. Tinubu Nominates 32 More Ambassadors

President Bola Tinubu has forwarded 32 additional ambassadorial nominees to the Senate...

Leave a comment