Unemployment, inflation, and the cost of living have all risen sharply in Nigeria in recent times, and this is fuelling the rapid increase in online money lenders better known as loan sharks.

Adverts for quick loans without collateral have been popping up on almost all internet sites, hence increasing the temptation by Nigerians, who are having financial challenges to apply for loans desperately from them.

Mary Daniels (not real name), 36, a receptionist at a private firm, needed urgent cash to offset her mother’s hospital bills. She called about two persons to lend some money from, but couldn’t get from them because they didn’t have.

“At that moment, the only thing that came to my head was to check one of these loan apps to see if I can get the money. The hospital bill was N35,800 and I had just N15,000 on me.

“I downloaded the loan app, filled in my details, accepted the company’s terms and conditions without even reading through because I was desperate.

“I applied for a loan of N20,000 at first, but the company stated that N14,200 will be disbursed to me because N5,800 will be deducted as charges.

“I was angry because asides the fact that the money won’t be enough to settle my bills, I will also pay back N20,000 when my loan expires. I had no other option than to go for a higher loan; I went for N31,000 instead because of the deduction for charges.

“My account was credited with N26,400 within 5 minutes, to payback N31,000 in 14 days,” she explained.

Applying for that loan was the beginning of Miss Daniel’s nightmare. The deadline for the repayment of her loan had barely elapsed before she started receiving automated calls to pay back her loan and later from their customer-agents.

“Three days before the payment deadline, I received approximately 10 to 12 automated calls reminding me to payback my loan. The day my loan expired, I received abusive calls and WhatsApp voice notes from the money lending company giving me till 12 p.m that day to pay my debt.

“When it was 12 p.m., I received a call from the company’s debt officer insulting and threatening to share my information with all my contacts that I am a fraudster and thief, who defrauded the company and urged people not to do any business with me.

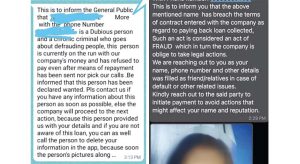

“Before I could wrap my head around the whole situation, they sent a WhatsApp message with my picture and a message that read: ‘This is to inform the general public that ******** in the above picture and with phone number 090********, is a fraudster, a scam who defrauded our company of N31,000 and has refused to pay. If you know her, tell her to pay or we will report her to security agencies for further actions’.

“I was startled by the message because at that moment I didn’t have the money as It wasn’t the end of the month, hence salaries had not been paid. I didn’t want to be embarrassed by them so I downloaded another loan app, borrowed from there to pay back this one; borrowed from another to pay another and on and on.

“By the end of it, I had taken loans from about 5 different loan apps, and the money had accrued. This worsened my predicament as I was owing over N160,000,” she lamented.

Miss Daniels became depressed as a result of the harrasment from the undignified ways these lenders employ to recover their loans.

“I began to loose weight, wasn’t eating well, lost concentration in whatever I was doing, couldn’t sleep. My salary wasn’t enough to offset the debt.

” I became depressed to the point I even contemplated suicide as I struggled to pay my debts. I finally got help from a cousin of mine, when I opened up to her. I can never forget that harrowing experience,” Daniels added.

She is, however, not alone in her anguish as her experience is one out of many that have been stung by these lenders. Findings by Persecondnews revealed that there are thousands of similar cases involving online money lenders who force re-payment of loans on clients by sending caveat SMS to their mobile contacts in ways that damage their customers’ reputation by portraying them as people of questionable character.

Modus Operandi

These online money lenders run by individuals or companies, coerce people to borrow using their sham loan apps hosted on Google Play Store and Apple store. Low-income earners are those who mostly fall prey.

They promise people access to quick loans as low as N2,000 with no collateral except provision of bank verification number (BVN). As a condition for a loan, the application process requires access to your contacts, workplace and in some cases social media accounts.

They send random SMS to people introducing their loan company with the hope of luring lenders.

A copy of one of such SMS’ obtained by Persecondnews reads: “<CashMama>Dear Client, we pre-approved NGN60,000.00 loan for you, now register with ONLY this mobile number can take the money immediately. Click this link********to access your loan.”

Millions of low-income earners in Nigeria who are going through financial challenges give in to their enticement for loans. In turn, they experience character assassination, cyberbullying, physical abuse, public shaming, and extortion among other violations from these loan sharks when they fail to pay on the due date.

They also charge customers dubious interest rate as high as 25 percent to 35 percent, giving out loans for only seven to 14 days, instead of a minimum of 30 or 60 days as stipulated in the law.

Some of these online lenders who have been subjected to investigation and even removed from the google play store and Apple store, due to numerous complaints and bad reviews about their services, have devised new methods to leverage technology and other financial services alternatives to circumvent account freezing and app suspension. They send apk links to interested lenders to download.

Persecondnews also gathered that recently, they have resorted to calling people randomly to lure them into taking loans from their companies. They go as far as lying about their interest rates and duration for repayment.

Speaking on why they resort to bullying and shaming their clients who default in payment, a customer agent of one of these loan sharks, Swiftkash, who are among those guilty of these dubious acts told Persecondnews in a phone interview that they do that because they are under pressure from their employee and they receive bonuses when they meet their debt collection target.

The agent who declined to mention her name also disclosed that they use the recovered money to pay other other people waiting for loans.

“It’s not also easy for us as customer agents. The way we put our clients under pressure is the same way our employees put us under pressure to recover debts from lenders.

“Our job is on the line when we fail to recover debts from loan defaulters or we fail to meet our target of bringing lenders. We are not paid much, we depend on the bonuses from meeting our targets to augment our salaries.

“Some lenders actually collect money without plans to pay back and when you call them, they won’t pick your calls. So the only way we get our money back is by threatening to expose or embarrass them. That is the only method that works for us,” she said.

She however declined speaking on the high interest rate and duration of repayment.

FG orders clampdown of online loan sharks

On August 19, 2022, the federal government directed Payment System Operators (PSOs) and telecommunications companies to stop providing access to illegal digital money lenders in Nigeria.

The Executive Vice-Chairman of the Federal Competition and Consumers Protection Commission (FCCPC), Mr Babatunde Irukera, said the FCCPC would work to protect citizens by limiting violators’ ability to bypass regulatory efforts.

According to him, FCCPC barred technology companies from providing payment or transaction services to these online money lenders.

Some of the affected online money lending banks who were barred for rights violations and unfair practices, include GoCash, Okash, EasyCredit, Kashkash, Speedy Choice and Easy Moni, Lcredit among others.

The government disclosed that most of these online money lenders did not register their platform with the Corporate Affairs Commission (CAC) and also engaged in activities that were against the rights of Nigerian consumers, adding that their interest rates violated the ethics of lending.

Irukera disclosed that the commission was working closely with the Independent Corrupt Practices Commission (ICPC), the National Information Technology Development Agency (NITDA) and the Central Bank of Nigeria (CBN) to end the menace.

“We have so far frozen 50 accounts. We have taken over 12 applications off the Google Play Store and we are in discussions with more than 10 companies right now. The rate of defamatory messages has dropped by at least 60 per cent.

“I am not saying they have stopped but they have dropped by at least 60 per cent. More than half of the companies that are currently before us have agreed that they will have to modify their behaviour, including sacking some employees who sent defamatory messages.

“We are developing a regulatory framework that will involve other regulators, and we are prosecuting at least one company right now,” he announced.

Also, on December 23, 2022, the House of Representatives mandated its Committee on Banking and Currency, Financial Crimes and Telecommunications to investigate the alleged sharp practices and abuses by fintech and loan shark firms in Nigeria.

The resolutions followed the adoption of a motion raised under matters of urgent national importance on the “urgent need to investigate sharp practices by unregulated online Fintech lending companies and abuse of mobile digital loan apps in Nigeria” sponsored by Alhaji Satomi at plenary.

According to him, the COVID-19 pandemic which affected many economies including Nigeria, led to job losses as a result of the lockdowns, restrictions of movement and face-to-face interactions.

This, he said, “sped up the pace of digitalization of financial services and the infiltration of some unscrupulous unregulated financial service operators.”

Satomi also noted that most of the loan applications run by companies and individuals, operate with no regulation by government, expired licenses and in some cases, none at all.

He further raised concerns that searches for the registration status of loan apps in Nigeria from the Corporate Affairs Commission (CAC) showed that founding directors of such apps or companies were foreign nationals without the required licences to operate the volume of financial transactions and are illegally operating in the country.

“The operations of Kash Kash with a hosted operating account under the name Super Car Universal Limited with a certain commercial bank in Nigeria where Kash Kash, carries out activities of the loan app, such as the exorbitant interest rates they collected from customers and defamatory messages sent to contacts of their customers when they missed their repayment date,” he explained.

The battle against loan sharks far from over?

Despite the clampdowns by regulators, especially the Federal Competition and Consumer Protection Commission (FCCPC) to address the prevailing menace and abusive practices of these online money lenders, new ones keep springing up on a daily basis.

The moves by the federal government and even National Assembly seem not to deter their operations, as they have resorted to creating apk apps, and the suspended ones are also operating under different names to continue with their “profit-making business”.

Also, due to the current hardship in the country, many Nigerians have formed the habit of taking loans from these platforms; some without the intention to pay back.

Hence the question, will Nigerians ever stop patronizing these online money lenders?

“The truth of the matter is that Nigerians will never stop, as far as the economy keeps getting tougher. There are a few good ones. I will advise you always read reviews about these online money lenders; usually situated under their apps, before downloading them.

“By reading reviews, you will be able to differentiate the good ones from the bad ones, and so you don’t fall prey to their ill-treatment,” a lender who simply gave his name as Moses told Persecondnews.

Leave a comment