The plan by the Federal Government to devalue the naira came to the fore on Friday as the Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, disclosed that the ministry is discussing with the Central Bank of Nigeria (CBN) on the issue.

Giving a fillip to the ongoing debates on the fate of the Naira which is trading at N415.07 on the Investors’ and Exporter Forex Window and about N572 in the black market, Ahmed harped on reducing the gap between the official rate and the parallel market rate.

The gap between the rates is about N156.3 for every dollar.

She spoke against the backdrop of whether the ministry has plans to follow Vice-President Yemi Osinbajo’s recommendation to the CBN to devalue the naira or if it was working with the CBN.

Ahmed confirmed that there are plans to accommodate the VP’s suggestion.

“We are working with the Central Bank to do that (move the official Naira rate to a market based system). “For us it is a journey, it is not an event. It is our desire to be able to reduce the gap between the unofficial market rate and the official market rate.

“Again, what we have to do is to improve the sources of foreign exchange and right now the predominant source for us is oil and gas.

“So, when oil and gas revenues are not coming, as we projected or when we have huge expenditure in terms of subsidy, we have this problem of supply not being able to meet demand.

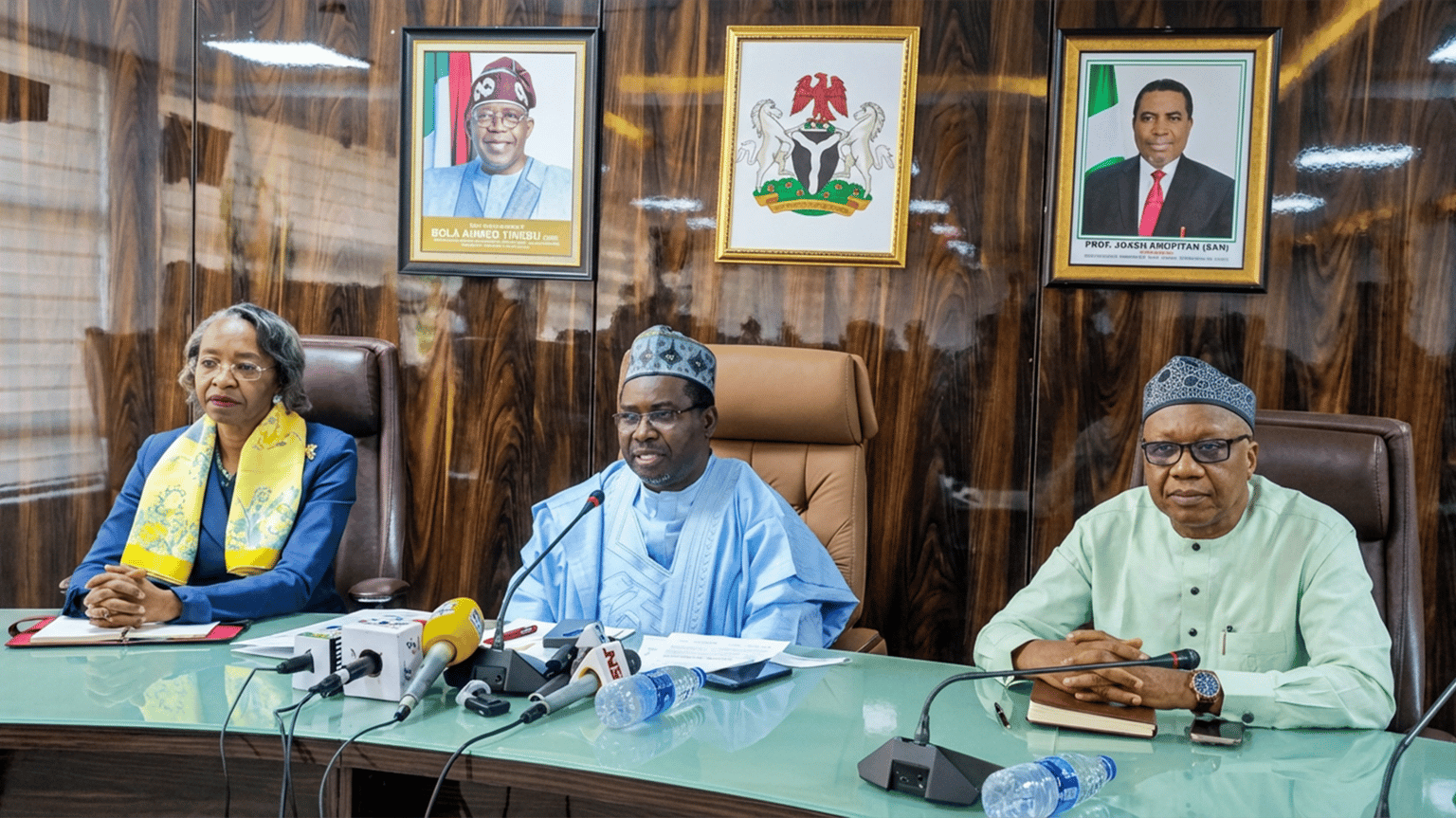

“With savings of up to 30 per cent of our foreign expenditure from the removal of the need to buy PMS from outside the country, we will have more FX and we will be able to meet the demand,’’ the minister said at the ‘Mid-Term Ministerial Performance Review Retreat’ held in Abuja.

She expressed worry that the disparity between the naira and dollar at the official and unofficial rate is wide.

Osinbajo had last week said:“As for the exchange rate, we have to move our rates to a more reflective market as possible in my own respective view is the only way to improve supply. We can’t get new dollars in the system where the exchange rate is artificially low and everyone knows by how much our reserves can grow.

“So, I am convinced that the demand management strategy currently being adopted by the CBN needs (a) rethink and that’s just my view about that. But anyway, all those are issues I am sure that when the CBN has time to address, it will be able to address in full.”

Persecondnews recalls that the International Monetary Fund (IMF) and the World Bank had pressured Nigeria to unify the exchange rates which will help to attract more foreign exchange into the Nigerian economy.

Leave a comment