In a bid to stimulate the economy post-COVID-19, the Central Bank of Nigeria (CBN)’S Monetary Policy Committee (MPC) has announced the reduction of its benchmark interest rate, the Monetary Policy Rate (MPR) to 12.5 percent from 13.5 percent.

The Cash Reserve Ratio (CRR) and the Liquidity Ratio (LR) at 27.5 per cent and 30 per cent respectively were, however, retained by the Committee as well as the Asymmetric Band at plus 200 basis points and minus 500 basis points around the MPR.

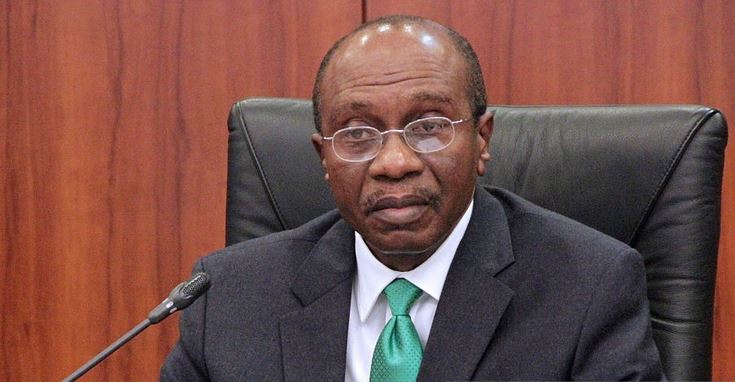

Announcing this at the end of the MPC meeting, the CBN Governor, Mr Godwin Emefiele, said seven members of the committee voted to cut the MPR by 100 basis points, while two members voted for a 150bps rate cut with one member electing for a 200bps rate cut.

Stakeholders including a Professor of Finance and Capital Market, Uche Uwaleke, have lauded the cut, saying it will boost the economy.

Emefiele said:“The MPC observed the weakening of the global macroeconomic environment due to the adverse impact of COVID-19 and drop in crude prices which has resulted in negative outputs for most economies.

“Excess liquidity engendered by loosening may overshoot the economy’s capacity and accelerate inflationary pressures, it nevertheless feels that given the slow rate of acceleration of inflation, the accommodative stance will stimulate aggregate demand and supply in a short term.

“This is because an accommodative stance through a lowering of policy rates will stimulate credit expansion to critically important sectors that will also stimulate employment and revive economic activities for quick growth recovery.

“Policymakers must take action to stimulate growth and recovery. For Nigeria, although first-quarter gross domestic product turned out pleasantly at 1.87 percent and the race of inflation somewhat moderated, Nigeria may escape a recession if concerted efforts are sustained to stimulate output.”

On why the MPC decided against a tightening monetary stance, the CBN boss explained that a tightening would also increase the cost of credit, reduce investment and impact negatively on output growth.

“A hold may indicate that the monetary authorities are insensitive to prevailing weak economic conditions. There is, therefore, the need to signal a direction towards immediate recovery.”

While lauding the initiative, Prof. Uwaleke of Nasarawa State University, Lafia, said : “The MPC decision to cut the benchmark interest rate by 100 basis points down to 12.5 percent is a demonstration of the CBN’s sensitivity to the need to stimulate the economy and enable it withstand the negative impact of COVID-19 as well as the drop in oil revenue.

“Having signaled intention to adopt an accommodative stance in favour of growth, the CBN should put in place measures to ensure that it translates to lower lending rates by the banks to the real sectors of the economy.”

Leave a comment