…ratify N1.00 total dividend

…bank assures of huge returns on sharehokders’ investment

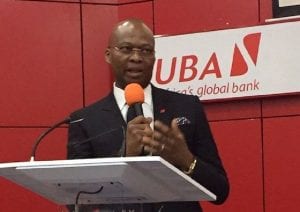

UBA shareholder and President of Association for the Advancement of the Rights of Nigeria Shareholders (AARBS), Dr Umar Farouk, has lauded the bank’s handsome contribution of N5 billion to the fight against Covid19 both in Nigeria and on Africa continent.

Speaking at the bank’s first ever virtual Annual General Meeting, Farouk also hailed the 20% increase in dividends that the bank proposed to pay shareholders.

PerSecondNews reports that the Pan-African financial institution, UBA Plc, held its first ever virtual Annual General Meeting by proxy since it began operations 71 years ago.

The meeting which had in attendance shareholders, management and staff members and representatives of key regulatory bodies, was held virtually via an Online Meetings Platform in line with Guidelines issued by the Corporate Affairs Commission (CAC).

Shareholders at the meeting had commended the Board of Directors and Management of UBA for the proactive role that the Bank has been playing in helping to lessen the negative effects of the Coronavirus pandemic across the African continent.

Farouk said the move was unprecedented and will certainly go a long way in supporting governments as they work hard to tame the scourge.

“I am also happy that you fulfilled the promise you made at the AGM last year to pay dividends in Naira and not kobo, by paying N1 per 50 kobo shares to shareholders in this difficult economy.

“We have seen the first quarter results, and we are happy about the performance of our subsidiaries across Africa ” he said.

“I want to thank the UBA Board of Directors who have been responsive in this time of crisis, as the bank donated $14m to assist governments to fight the COVID-19 Pandemic in Nigeria and Africa.

“As I have always said, our commitment to improving lives in Africa is a long-term one which we do not take lightly, as we support governments in Africa to curb this pandemic and help to sustain employment across the continent.”

Also speaking, the President of Pacesetters Shareholders Association of Nigeria, Alex Adio said he was impressed that the bank’s indices were looking up despite the challenging times.

“This shows that we are making good use of the technology we have invested in, over the years. UBA has done very well and we commend the management and staff and hope that you will keep the flag flying,” he said.

On his part, the National Coordinator Emeritus, Independent Shareholders Association of Nigeria (ISAN), Sir Sunny Nwosu, also praised the virtual meeting and advised the bank to ensure that more transactions are carried out by customers without getting to the banking halls.

“Also, we want to be assured on the level of our exposures to the oil and gas sectors especially in view of the challenges that the oil sector is faced with” Nwosu said.

UBA offers banking services to more than 18 million customers across 1,000 business offices and customer touch points in 20 African countries.

Leave a comment