- Wants VAT on Renewable Energy Reduced to 2%

The Environmental Rights Action/Friends of the Earth Nigeria (ERA/FoEN), has urged the National Assembly to exercise its powers of oversight on the Ogoni clean-up process.

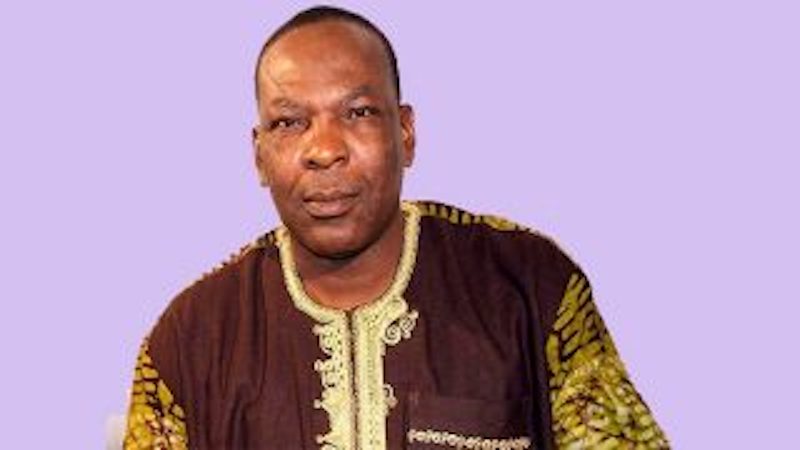

ERA/FoEN’s Executive Director, Dr. Godwin Uyi Ojo, who made the appeal in Abuja, observed that contractors procured for the clean-up exercise lacked the capacity to achieve the objective, adding that key deliverables in critical areas, such as transparency, accountability and local participation, had not been clearly articulated let alone achieved.

He expressed concern that three and half years after President Muhammadu Buhari flagged off the Ogoni clean-up process, there are signs that the project may fail if remedial actions are not taken.

According to Ojo, immediate intervention of the National Assembly would save the country from wasting billions of naira at this early stage and also halt the drift of the hydrocarbon pollution remediation project (HYPREP), towards the fate of similar laudable interventions in the Niger Delta that ended up in private pockets.

The group maintained that HYPREP had failed to demonstrate capacity to spend the monies so far appropriated for the clean-up exercise, warning that if urgent and decisive action is not taken to refocus HYPREP, it may become another “white elephant intervention” in the Niger Delta region.

He, therefore, urged the lawmakers to adopt the HYPREP gazette and rework it with appropriate modification and pass it into law to provide backing with independent status, adding that this

measure will ensure a more robust and legally binding supervision of HYPREP.

The executive Director urged early release of the $600 million for the clean-up, due by 2020.

Further speaking, the group also called on the federal government to reduce the tax burden on renewable energy products, by reducing the Value Added Tax (VAT) from 5 per cent to 2 per cent.

Ojo noted that 60 per cent to 70 per cent of Nigeria’s 200 million population does not have access to electricity, adding that renewable energy is the best option, in diversifying energy sources that is sustainable.

He disclosed that while the federal government had made some good initiatives through the solar panel production, by the National Agency for Science and Engineering Technology, the agency requires more capacity building for efficiency to produce optimally.

Ojo said: “The diverse sources of tax are worrisome with 5 per cent Stamp Duty, 5 per cent on solar panels, 25 per cent on batteries and inverters and other sundry taxes which raises the tax burden to about 30 per cent on products.

“We strongly propose that lowering taxes on renewable energy products will go a long in the promotion of energy access for all. Therefore the proposed hike on VAT from 5 per cent to 7.5 per cent in Nigeria; if at all it will be implemented, should not be extended to solar lighting equipment and clean cook-stoves.

“We strongly advocate for reduction of VAT to 2 per cent on renewable energy products; five years tax moratorium for new renewable energy products to improve energy access for all; five years tax holiday for pioneers status in indigenous renewable energy businesses in Nigeria.”

Leave a comment