- As company’s gross earnings hit N88.9bn, digital retailing rose to 80%

HI 2018: Fidelity Bank grows profits by 31%, posts N11.8 in PAT

Related Articles

Breaking: Nigerian chess master Tunde Onakoya breaks world record for longest chess marathon

The Nigerian chess master, Tunde Onakoya, has set a new Guinness World...

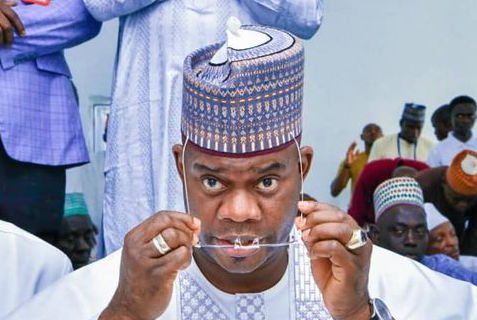

Update: Nigeria Immigration Service has put former Gov. Yahaya Bello on the watchlist

More woes for the former Kogi State Governor, Mr. Yahaya Bello, as...

Tinubu directs overhaul of nation’s tiers of education system

President Bola Tinubu has approved the comprehensive overhaul of Nigeria’s educational system...

Pres. Tinubu commends Dangote Group over new gantry price of diesel

President Bola Tinubu has applauded Dangote Oil and Gas Limited for reducing...

EFCC operatives allegedly barricade ex-Kogi Gov. Yahaya Bello’s Abuja residence

Operatives of the Economic and Financial Crimes Commission (EFCC) have allegedly barricaded...

Cubana Chief Priest arraigned in Lagos, gets N10m bail after pleading not guilty

Businessman and socialite, Pascal Okechukwu, popularly known as Cubana Chief Priest, was...

Pres. Tinubu launches National Single Window project, to generate annual $2.7bln revenue

“This initiative will link our ports, government agencies and key stakeholders, creating...

FG has rescued over 1,000 abductees without ransom payment — NSA Ribadu

The National Security Adviser, retired AIG Nuhu Ribadu, says the Federal Government...

Breaking: FG kicks start disbursement of N200bln palliative business loans

President Bola Tinubu administration’s promise to give the needed fillip to entrepreneurial...

Senate President to Police I-G: Rid Police Force of corrupt officers

“As we honour the good officers, let us weed out the bad...

Industry and Trade Minister promises Nigerian Breweries, business community enabling environment

The Minister of Industry, Trade, and Investment, Dr. Doris Uzoka-Anite, has reaffirmed...

Invasion of Oyo Govt Secretariat: Police parade 21 suspected Yoruba Nation agitators in Ibadan

The police in Ibadan paraded no fewer than 21 suspected Yoruba Nation...

Breaking: Emefiele gets N50m bail

A former Central Bank of Nigeria Governor, Godwin Emefiele, was on Friday...

Transcorp Power Plc grows topline by 57.03%, profit up by 75% in 2023 audited results

Transcorp Power Plc (Transcorp Power), one of the power subsidiaries of Nigeria’s...

UBA records impressive gross earnings rise of 143%, profit hits N757.7bn in financial year 2023

The United Bank for Africa (UBA) Plc has recorded a 143 per...

EFCC to clampdown on schools, hotels, supermarkets, others dollarizing transactions

….vows to put in jail anyone found to be dollarizing the economy...

Breaking: Nigeria to get oil-backed $1bln Afreximbank loan in May

Nigeria is set to receive $1.05 billion from a syndicated loan backed...

Breaking: CBN sells $10,000 to BDCs at N1,101/$

The Central Bank of Nigeria (CBN) on Monday announced the sale of...

Breaking: Court remands Binance executive in Kuje prison

A Federal High Court in Abuja has remanded Binance executive, Tigran Gambaryan,...

Ex-CBN Gov. Emefiele arrives Lagos court, faces fresh 26-count charge

Godwin Emefiele, the immediate past Central Bank of Nigeria Governor, has arrived...

Leave a comment