In spite of the increase in Nigeria’s total debt stock from N97.34 trillion in December 2023 to N121.67 trillion in March 2024, the Debt Management Office (DMO) says the country’s debt-to-Gross Domestic Product (GDP) ratio is in compliance with the World Bank and International Monetary Fund’s (IMF) guidelines for countries with comparable economic indicators.

The DMO reported a significant increase in the country’s total debt stock, from N97.34 trillion in December 2023 to N121.67 trillion in March, representing a surge of N24.33 trillion, according to Persecondnews.

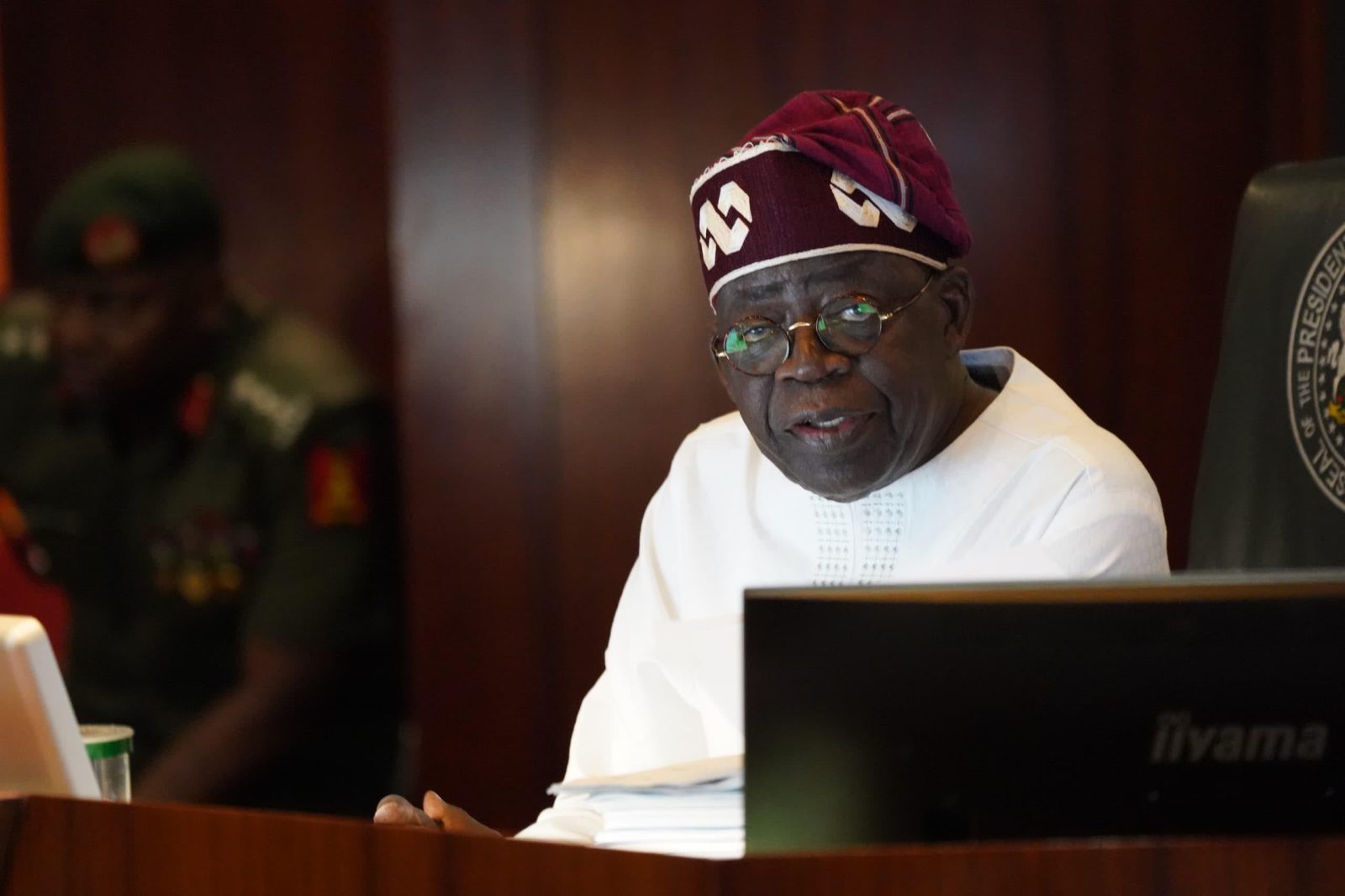

The Director-General of the DMO, Mrs. Patience Oniha, said this on Tuesday in Abuja, responding to media claims that Nigeria’s 52% debt-to-GDP ratio surpassed the World Bank and IMF’s recommended limit for countries with similar economic profiles.

She clarified that the actual prudential ceiling for countries in Nigeria’s peer group was 55%, not 40%, and emphasized boosting revenue generation to achieve rapid socio-economic growth and sustainable debt management.

Oniha lauded the Federal Government’s recent policies aimed at boosting revenue generation, stating that the efforts are crucial steps towards alleviating the country’s debt burden.

She said: “We cannot discuss growth, development, or debt without giving due consideration to revenue.

”It is now imperative that we confront revenue and take decisive actions to further strengthen our revenue streams from all sources.”

Oniha advised the government to focus on reducing fiscal deficits while implementing measures to attract foreign exchange inflows, which would boost external reserves and stabilize the naira’s exchange rate.

According to her, the rise in debt stock was partly driven by exchange rate fluctuations and the securitization of N4.90 trillion, which was a portion of the N7.3 trillion Ways and Means Advances authorized by the National Assembly.

The DMO DG said the total debt stock figure includes both domestic and external debt owed by all 36 states and the Federal Capital Territory (FCT), in addition to the federal government’s debt.

Leave a comment