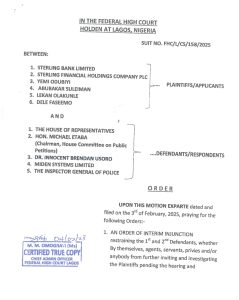

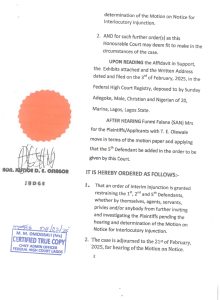

A Federal High Court in Lagos has issued an interim injunction restraining the House of Representatives and the Chairman of the House Committee on Public Petitions, Mike Etaba, from further inviting and exploring Sterling Bank Limited, its parent company, and its executives.

The ruling, delivered in suit number FHC/L/CS/158/25, reinforces the constitutional principle of

separation of powers, emphasizing that the legislature lacks the authority to summon private individuals and corporate entities for matters already adjudicated by the judiciary.

The court’s decision follows a motion filed by legal luminaries, including Femi Falana (SAN), Funmi Falana (SAN), and Taiwo E. Olawanle of Falana & Falana’s Chambers.

Sterling Bank and its parent company initiated the legal action against the House of Representatives, Hon. Mike Etaba, Dr. Innocent Brendan Usoro, Miden Systems Limited, and the

Inspector General of Police (IGP), citing undue interference in a concluded judicial matter.

The case originates from a long-standing financial dispute in which Miden Systems Ltd and Dr. Usoro

defaulted on a multi-million dollar loan facility granted by Sterling.

According to court documents, Dr. Usoro and Miden Systems secured a vessel lease facility from the bank in 2009, which was later restructured several times due to defaults by the debtor.

In 2021, the Federal High Court issued Mareva injunctions against Dr. Usoro and Miden Systems after they failed to meet their loan obligations.

The matter was resolved through a consent judgment, with the debtors admitting liability for debt owed to the bank.

Despite the binding court judgment, Dr. Usoro and Miden Systems sought to overturn the ruling, a move the Federal High Court dismissed on November 20, 2024, citing an abuse of process.

However, in an attempt to delay enforcement, the debtors escalated their claims to the House of Representatives Committee on Public Petitions, accusing the Central Bank of Nigeria, Sterling Bank, and Shell Petroleum of financial mismanagement.

In January 2025, Sterling petitioned the IGP, raising concerns over the misuse of political connections to obstruct justice and intimidate bank executives.

The Bank noted attempts by Dr. Usoro and his associates to leverage the National Assembly and law enforcement agencies to evade financial and legal accountability.

The Federal High Court’s latest ruling effectively safeguards Sterling from further undue legislative probes and harassment, reaffirming that the House of Representatives lacks the authority to override court verdicts or interfere in private financial disputes already resolved through due legal process.

This decision is a crucial victory for corporate governance and the protection of financial

institutions from undue political interference, setting a significant legal precedent in Nigeria’s banking and legislative landscape.

Leave a comment