One week to the deadline, the Senate has urged the Central Bank to extend the January 31st deadline for the deposit of old naira notes by six months.

A resolution to this effect was passed during Tuesday’s plenary session in the hallowed chambers of the Senate.

Persecondnews reports that but Sen. Sam Egwu, a former governor representing Ebonyi North District in the current 9th Assembly, objected to the call for an extension.

He said if it is extended again, Nigerians will still ask for another extension as there would not be enough time for some people to deposit their old notes.

Also, the Central Bank of Nigeria has insisted that there is no going back on the January 31 deadline for the old 200, 500 and 1,000 naira notes, as they will cease to be legal tender in the country..

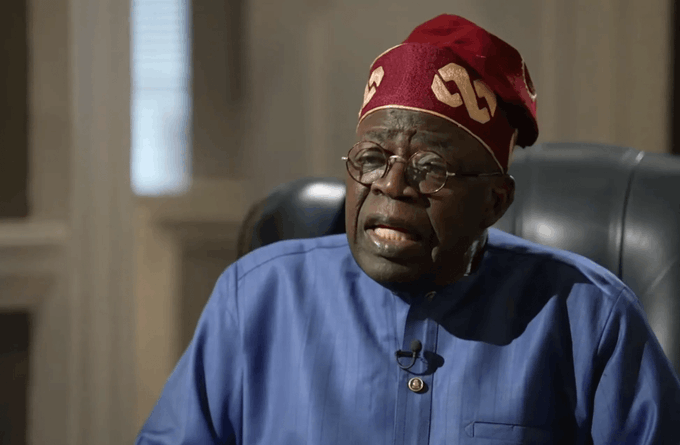

The CBN Governor, Mr Godwin Emefiele announced this after the apex bank’s Monetary Policy Committee (MPC) meeting in Abuja on Tuesday, January 24, 2023

The CBN also raised the Monetary Policy Rate (MPR), which measures interest rate, to 17.5 percent.

According to him, kidnapping and ransom-taking have reduced since the three banknotes were redesigned.

He also said the time given for the swap of the old naira notes with new ones were enough for Nigerians to go to commercial banks and get new notes.

Earlier, Senator Sadiq Umar while moving the motion for an extension, cited Order 41 and 51 seeking the leave of the Senate to extend the deadline to July 31 2023.

The lawmakers pointed out the long hours Nigerians spend on queues in banks across the country, and also an exchange window for those in the rural area without bank accounts.

However, during the end of the Monetary Policy Committee meeting in Abuja, Dr Emefiele disclosed that they are over 1,000 agent spread across the country, saddled with the responsibility of cash swap from old Naira to new Naira notes.

The Senate in plenary resolutions include: “The Central Bank of Nigeria should immediately extend the use of the old notes by six months from January 31st to July 31st 2023 with immediate effect.

“The Central Bank Governor should compel banks to open an exchange window where people who don’t have bank account can exchange their old notes with the new notes.

“In most parts of Nigeria, there are no banks & our people transact in cash most often than not. There is no doubt that we must have a policy of inclusion in getting our people who have no banks available to them and the CBN can have a special programme for that.”

Senate President Ahmad Lawan also urged the apex bank to establish more commercial banks in rural area.

He said: “We must have policies by the CBN to ensure that we have branches of banks established more in our rural areas.”

Leave a comment