Mr Tony Elumelu, the Chairman of Heirs Holdings and Founder, Tony Elumelu Foundation, has called for the flushing out of non-registered and non-compliant members from the Nigerian Council of Registered Insurance Brokers (NCRIB).

Elumelu said those tarnishing the image of the broking profession and the industry at large should be weeded out without further delay.

Speaking on Thursday in Lagos as the keynote speaker at the Nigerian Council of Registered Insurance Brokers 60th anniversary, Elumelu said:“We as an industry needs to enforce strict adherence to corporate governance by all NCRIB members. We should weed out non-registered and non-compliant members; the ones who tarnish the image of the broking profession and the industry at large.

“An insurance broker must be professional at all times. In redefining the practice and practitioners in the broking profession, NCRIB should lead the war against many of the unethical practices that have troubled the industry for years.’’

Persecondnews.com reports that the theme was “60 Years of Insurance Broking: Redefining the Practice and the Practitioners.’’

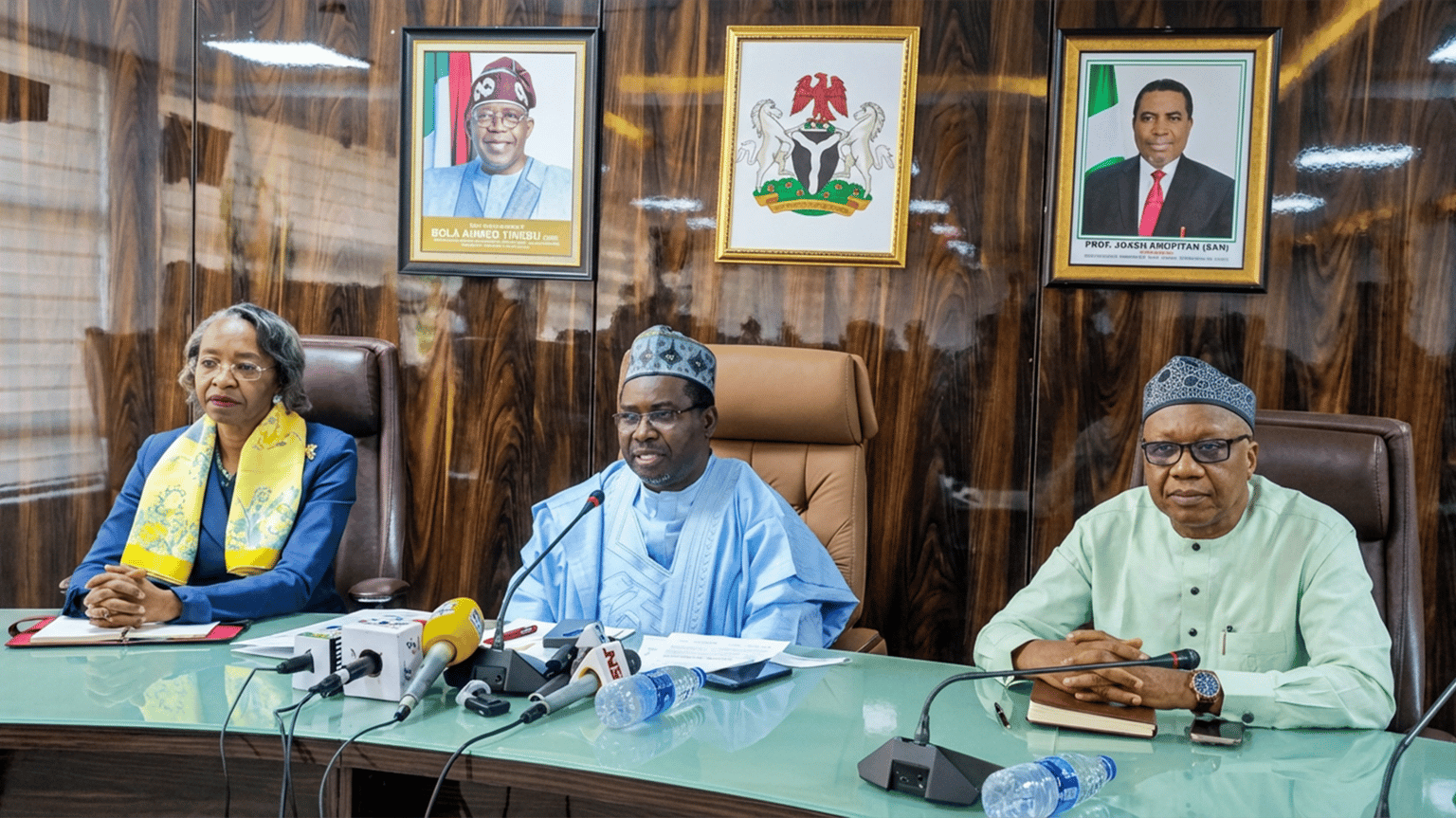

Mr Babajide Sanwo-Olu, the Governor of Lagos State was the host while Mr. Rotimi Akeredolu (SAN), Governor of Ondo State presided at the occasion as the Chairman.

The President and Chairman of the Governing Board of the Nigerian Council of Registered Insurance Brokers, Mr Rotimi Edu, also co-hosted the event.

He listed the unprofessional practices as premium rate cutting, delayed premium remittance, unremitted premiums, overloading of premium, returned premium, fake documents and fraudulent claims.

Others are collusion to defraud, mis-selling, unhealthy competition, misrepresentations, manipulation of policy conditions, and self-enrichment methods disguised as marketing expenses, among others.

On the importance of insurance in the life of the people, Elumelu said insurance plays a pivotal role in any society.

“Our industry provides the much-needed safety and security. We allow our people to save, to think ahead, to secure their futures – what we do is precious.

As an industry, we mobilize funds and we should be deploying those funds for the broader benefit of our economy. Families receive financial security, assets are protected against hazards, and businesses continue to run.

“An economy is therefore as advanced as its insurance sector. But let us ask ourselves are we doing enough? We need to be candid and frank. Our industry’s contribution to national GDP is tiny. Our reputation could be better, our practices more professional, our promises to our customers always honoured.

“A deep, well-regulated industry is a benefit for all – not least for the professional broker – the trusted and necessary confidant of the client. It is a time of great pessimism – but I am not a pessimist. I see the opportunities, I see our industry’s potential, so let us all join together for the common good,’’ the UBA Group Chairman said.

Lauding NCRIB’s contributions in the past 60 years, Elumelu noted that it has contributed significantly to the quality of governance, institutions, and practitioners of the sector.

“That is why we are celebrating 60 years of the NCRIB – an institution almost as old as our country. Let me celebrate your commitment to professionalism, to education and to our industry.

“Members of NCRIB have, over the years, facilitated insurance businesses in hundreds of billions of naira, delighted millions of Nigerians with your insurance services, and ensured that claims are settled.’

On the need for a deep and well-regulated financial services, Elumelu stressed that there was still much to be done in the industry to realise its potential and serve our common good.

“We are here to celebrate the past, but also to look forward – let us be candid, there is much to be done in our industry, if it is to truly to realise its potential and serve our common good.’’

On his contributions, he said: “As the Chairman of Heirs Holdings, my family-owned investment company, we change lives in Africa and are transforming our continent – Financial services are critical pillar of what we do – that is why we launched Heirs Insurance and Heirs Life.

“That is why at United Bank for Africa – UBA – we transformed access to banking, made banking available to the people, in Nigeria – but also across Africa. That is why UBA is present both on our continent and also in France, USA, UK, and, most recently, the UAE, in Dubai.

“At the Tony Elumelu Foundation, we are empowering young Africans across the 54 countries of our continent So far, over 15,000 young African entrepreneurs have benefitted directly from our Foundation. We know that access to capital is scarce, and support networks are poor – we fill the gap.

“We democratise luck – just as we democratised banking and are democratising insurance. Simply put – financial services are not a privilege, but a right – we want to make simple, smart insurance available to all.

“Our two insurance companies, Heirs Life Assurance and Heirs Insurance Limited, are both committed to democratizing access to insurance – which is a great tool for financial inclusion, employment creation, poverty eradication and women inclusion.’’

Leave a comment