By Sufuyan Ojeifo

As the central bank and apex monetary authority of the country, the major regulatory objectives of the Central Bank of Nigeria (CBN) as mirrored in the institution’s enabling Act are to maintain the external reserves of the country, promote monetary stability, a sound financial environment and to act as a banker of last resort.

In this strategic turf of central banking, the establishment must adroitly read and proactively react to a laundry list of fluid scenarios, which include geopolitical and trade tensions that unquestionably impact the dynamics of global trade. These strains often spawn threats to macro-economic stability and even the monetary policy footing of the nation.

For instance, a combination of factors, including financial market volatilities, trade war between the US and key allies, continuing monetary policy normalization by the US, BREXIT, the termination of the European Central Bank’s (ECB) asset purchase programme in December 2018 and the slowdown in the Chinese economy, has further heightened uncertainties for the global economy in 2019. Consequently, global growth has been downgraded by the IMF to 3.5 per cent in 2019 from 3.7 per cent in 2018.

To manage this seismic environment requires a bold, well-informed and experienced administrator on duty. Tossed in the circumspect engagement with aggravations seeded by rising tendencies and incidences of protectionism, new nationalism and anti-globalisation – especially in the western hemisphere – it’s then clear that greenhorns have no business in the apex bank’s command room.

No less a juggler’s nightmare, among other critical regulatory responsibilities, tracking monetary-cum-fiscal policy parameters in the turbulent sea of financial world and making delicate adjustments as necessary with the ship of state steaming at full speed requires no less a navigator with adroit multi-tasking skills and a cool head. Leadership continuity at the helm is also crucial to avoid the consequences of changing captain mid-voyage.

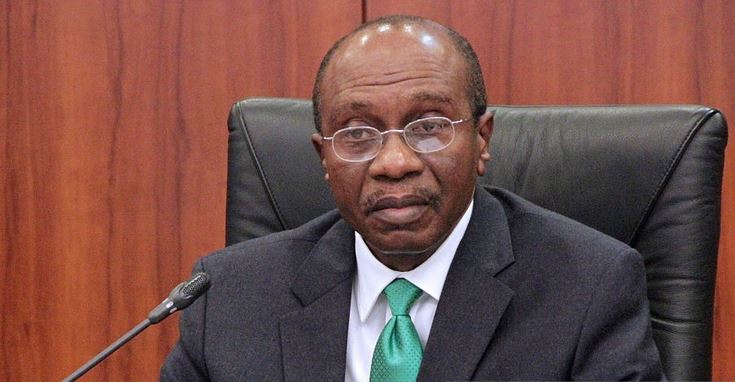

It is to this complex, fluid turf of apex banking, that the CBN Governor, Mr. Godwin Emefiele, CON, has brought over three decades of both theoretical and practical experience from top-flight academic and hands-on banking turfs to. In a change regime, Emefiele has admirably deployed governance skills groomed in the stern, high-octane financial industry, in effectively driving CBN’s command room these past five years.

To critical industry stakeholders, this unassuming banking sage certainly deserves kudos for keeping faith and demonstrating uncommon commitment and professionalism in a particularly challenging period of the national journey. Governor Emefiele’s track record of remarkable performance at the nation’s apex bank strongly recommends the renewal of his tenure by the federal government.

Logic and reason reinforce this position. As of June 3, 2014 when Emefiele assumed office, Nigeria’s reserves had fallen from a peak of US$62b in 2008 to US$37b! But following the sharp drop in crude oil prices, the nation experienced a plummeting of the CBN’s monthly foreign earnings from as high as US$3.2 billion to as low as US$700 million monthly. To avoid further depletion in the reserves, the CBN took a number of countervailing actions including the prioritization of the most critical needs for foreign exchange.

In this regard, and in order of priority, it decided to provide the available but highly limited foreign exchange to meet important needs such as matured letters of credit from commercial banks, importation of petroleum products, importation of critical raw materials, plants, and equipment, payments for school fees, BTA, PTA and related expenses.

Over the intervening period, it is heartening to note that these policies yielded positive results. In particular, the CBN managed to stabilise the exchange rate around February 2015, thereby creating certainty for both household and business decisions. It largely eliminated speculators and rent-seekers from the Foreign Exchange Market.

Reserves, despite having fallen, were still robust and able to cover about five months of Nigeria’s imports as against the international benchmark of three months. The domestic production of items prohibited from the Foreign Exchange (FX) market is picking up nationwide, thereby creating more jobs for many more Nigerians.

The demand for foreign exchange by mostly domestic importers has risen significantly. For example, the last time the nation had oil prices at about US$50 per barrel for an extended period of time was in 2005. At that time, the average import bill was N148.3 billion per month. In stark contrast, Nigeria’s average import bill for 2015 was over N1 trillion monthly, though oil prices are now less than US$60 per barrel but picking up.

The net effect of these combined forces unfortunately is the depletion of the nation’s foreign exchange reserves. The stock of Foreign Exchange Reserves had declined to around US$25.4 billion.

Further, as part of its long-term strategy for strengthening the Nigerian economy, the Central Bank established specific initiatives to resolve the underlying factors goading challenges to long-term GDP growth, economic productivity, unemployment and poverty that had pervaded the economy over the past decades. Measures were taken to increase credit allocations to pivotal productive sectors of the economy. This is with a view to stimulating increased output in these sectors, creating jobs on a mass scale and significantly reducing import bills.

These targeted interventions have so far impacted such sectors as agriculture, power, micro, small and medium-scale enterprises (MSMEs), workers’ salary/pensions assistance fund, infrastructural assistance for states, emergency fiscal spending, improving FX supply and financial inclusion

This week, Emefiele, during a meeting with textile manufacturers and cotton farmers, announced the inclusion of textile products on the long list of items restricted from foreign exchange (FX) for import into the country. The restriction order, which takes immediate effect, has brought the number of such items to 44. It could be recalled that earlier this year, cement and tomatoes paste were added to the list.

His words: “Effective immediately, the CBN hereby places the access to FX for all forms of textile materials on the FX restriction list. Accordingly, all FX dealers in Nigeria are to desist from granting any importer of textile material access to FX in the Nigerian foreign exchange market. In addition, we shall adopt a range of other strategies that will make it difficult for recalcitrant smugglers to operate banking business in Nigeria.”

He explained to his rapt audience why textile products had to be included on the forex restriction list: His words: “Today, Nigeria currently spends above $4 billion annually on imported textiles and ready-made clothing.

“With a projected population of over 180 million Nigerians, clearly the needs of the domestic market are huge and varied, with immense prospects, not only for job creation, but also for growth of the domestic textile industries.

” A quick example that highlights the potential of this local market is the need to support the provision of uniforms and clothing apparels for school students, military and paramilitary officers as well as workers in the industrial sector.”

All these policy measures by the Emefiele-led CBN were conceptualized and deployed in boosting the Nigerian economy and aiding the economic transformation effort of the Muhammadu Buhari administration. Little wonder, the emerging consensus is that to sustain CBN’s nimble governance trajectory under Emefiele’s nous and vision, continuity is key.

* Ojeifo contributed this piece from Abuja via ojwonderngr@yahoo.com

- a sound financial environment and to act as a banker of last resort. In this strategic turf of central banking

- Emefiele and the stakes at CBN By Sufuyan Ojeifo As the central bank and apex monetary authority of the country

- promote monetary stability

- the establishment must adroitly read and proactively react to a laundry list of fluid scenarios

- the major regulatory objectives of the Central Bank of Nigeria (CBN) as mirrored in the institution’s enabling Act are to maintain the external reserves of the country

Leave a comment