By Maryanne Awuya

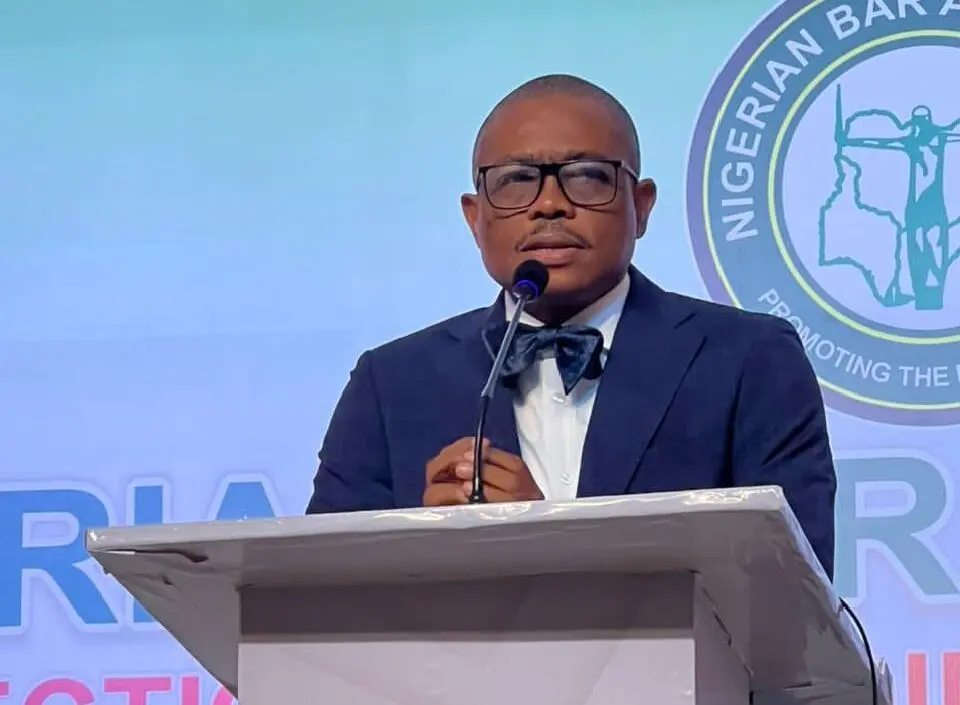

Mr. Oguche Agudah, the Chief Executive Officer of the Pension Fund Operators Association of Nigeria (PenOp), has said that inadequate salaries and poor remuneration, not the Contributory Pension Scheme (CPS), are the primary reasons for the meager pensions received by police retirees.

Agudah’s comments came after a video went viral in late June, showing a retired police officer refusing a N3 million gratuity.

Persecondnews reports that the video sparked significant public concern regarding police pensions.

The officer, who had served for 35 years before retiring in October 2023, expressed discontent over the poor pension payments he received.

Appearing on Arise TV’s “The Morning Show” in Abuja on Tuesday, monitored by Persecondnews, Agudah said: “If you have worked for many years, you deserve your pension, and that is what retired police officers are getting.

“It may not be what they expect, but inflation plays a significant role. Ten years ago, this N3 million was probably a huge amount of money due to its higher value then compared to now.”

Agudah clarified that the comparison between police and military pensions is not equitable.

He explained that it is widely known military personnel receive higher remuneration than police officers, which directly translates to larger pension payouts.

He further noted that the military’s pension system, a defined benefit scheme, isn’t inherently better and frequently encounters its own set of challenges.

He said: “Their pension is not funded. It depends on the government’s budget and the willingness of military pension boards. That is why we still hear complaints from them.”

Reacting to the specific case of the retired officer in the video, Agudah said it appears to be an isolated incident, adding that many police officers receive between N500,000 and N10 million upon retirement, depending on their exit salary.

Agudah explained that investigations showed the retired officer had inadvertently chosen the wrong Pension Fund Administrator (PFA).

This mistake led to his pension funds being sent to an incorrect, unregistered account, which caused the payment issues, he added.

To avoid similar problems, Agudah urged all pensioners to check their statements monthly and report any irregularities if they don’t receive regular updates.

He emphasized that the Contributory Pension Scheme (CPS) is stable, reliable, and transparent.

“Nobody has said they did not receive their pension. What people are saying is that it is not enough. That is a different conversation, and it is one we need to have,” he said.

Agudah explained that pension payments under the CPS are determined by the worker’s final salary and the total contributions made during their years of service.

According to him, currently, 8% of an employee’s monthly salary is deducted, while the employer contributes 10%, with these funds being allocated to a pension contributions account.

He further noted that police officers receive relatively low remuneration and suggested that they could establish additional benefits using their internally generated revenue (IGR) to supplement their pensions.

Agudah stated that this is precisely what PenOp is advocating for the police, similar to other institutions such as the Central Bank of Nigeria(CBN) and the Federal Inland Revenue Service(FIRS), which are also under the CPS.

He said: “We have already seen pension payments rise by over 40% due to strong investment returns. What we need now is to improve salaries, deepen pension education, and strengthen the support structure for our retirees.”

Agudah cautioned against abandoning the CPS for an opaque and corruption-prone scheme, saying the CPS is actively working to grow contributions and enhance returns by investing in infrastructure, real estate, and other lucrative sectors.

Leave a comment