The controversy surrounding President Bola Tinubu’s Tax Reform Bills is finally subsiding with the House of Representatives adopting the report on the bills and approving a new Value Added Tax (VAT) sharing formula.

This revised formula allocates 55% of VAT revenue to states and 35% to local government councils, marking a significant shift in the country’s revenue distribution framework.

The House made the decision on Thursday, adopting a report by the House Committee on Finance on four tax bills President Tinubu had submitted to the National Assembly in October 2024.

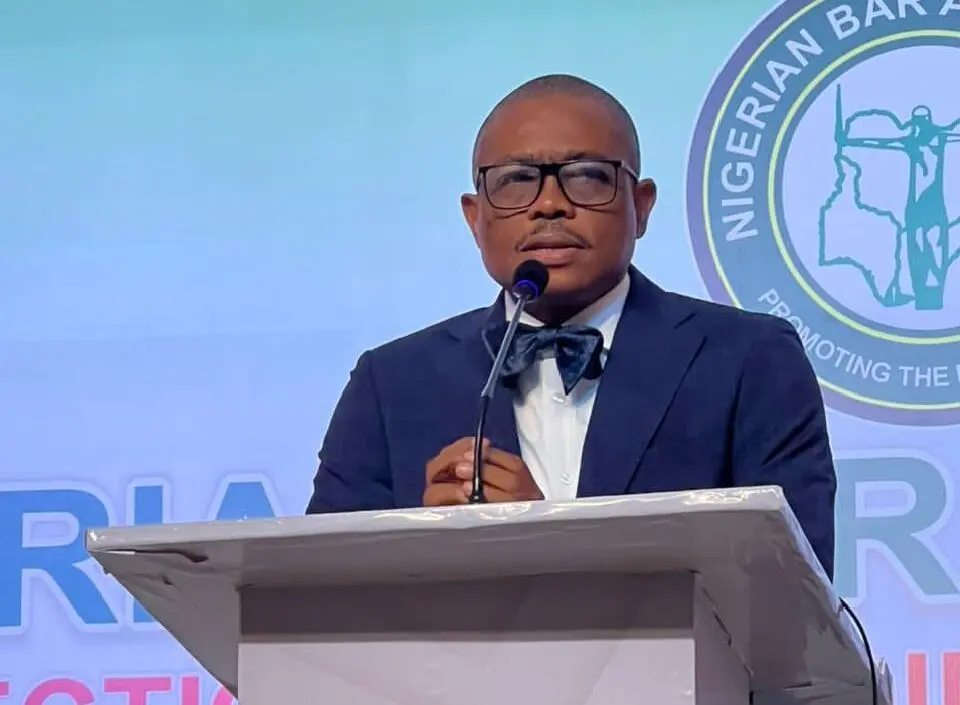

While presenting the report, Chairman of the Committee, Rep. Abiodun Faleke (Ikeja, Lagos) summarized the extensive review process that followed a public hearing held from February 26 to 28, 2025.

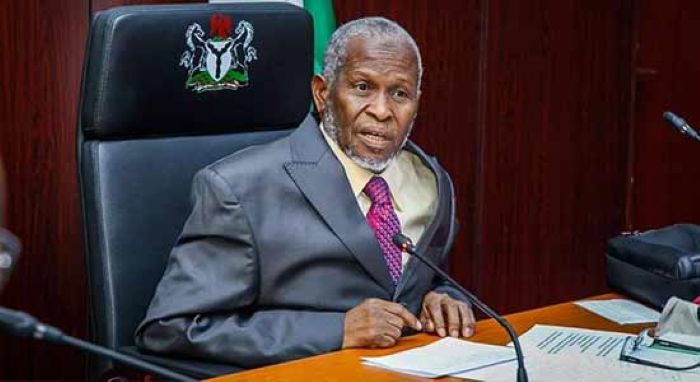

The report was thoroughly examined and ultimately adopted during a session presided over by Speaker Tajudeen Abbas on Thursday.

The committee made 19 key recommendations under the Nigerian Tax Administration Bill, introducing a revised VAT distribution framework that aimed to resolve the long-standing contentious issue between state governors and the Presidency.

Section 77 of the report outlines a revised VAT distribution structure.

The 55% VAT allocation for states will be disbursed in three tiers: 50% shared equally, 20% proportionate to population, and 30% based on consumption.

The distribution structure prioritizes the actual place of consumption when allocating revenue, rather than where tax returns are filed.

Similarly, local governments will be allocated 35% of VAT revenue, with the distribution based on a comparable formula.

The timeline for issuing Taxpayer Identification Numbers has been extended from two to five working days to accommodate possible administrative challenges.

The new regulation stipulates that any denial of a Tax Identification Number (TIN) must be duly justified and promptly communicated to the applicant.

To minimize revenue losses, companies that cease operations are now required to file their tax returns within three months, a significant reduction from the previous six-month deadline.

The committee also recommended that taxable supply consumption should determine tax allocation, ensuring fairness in regions where company headquarters are concentrated.

On fiscal issue, the Federal Inland Revenue Service will establish further regulations to enforce the newly introduced system.

Additionally, Section 74 mandates that any tax remission by the President or a governor must receive approval from the National Assembly or respective state Houses of Assembly.

According to Section 75, any presidential tax exemptions will require formal approval from the National Assembly, ensuring greater transparency and oversight.

Meanwhile, Section 76 authorises the Office of the Accountant General to deduct unremitted taxes from Ministries, Departments, and Agencies at the source, subject to National Assembly’s approval.

To boost representation, the committee proposed appointing six Executive Directors to the FIRS Board, one from each geopolitical zone, in a rotational order.

Furthermore, to uphold federal character principles, each state and the Federal Capital Territory will be represented by an appointed member.

The committee recommended a fixed 4% cost of collection for FIRS, to be appropriated by the National Assembly.

To ensure judicial neutrality, the proposal suggests allocating funds to the Tax Appeal Tribunal directly from the Consolidated Revenue Fund, thereby reducing its reliance on the Federal Inland Revenue Service (FIRS).

According to Section 27 of the Nigeria Tax Bill, companies benefiting from priority sector incentives are now mandated to obtain a Certificate of Acceptance in order to claim capital allowances.

The Federal Ministry of Industry, Trade, and Investment’s Industrial Inspectorate Department has been designated as the authority responsible for certifying expenditures that qualify for incentives.

The committee abandoned its initial plan to gradually reduce the corporate income tax rate, instead opting for a more streamlined approach.

Companies will maintain a standard tax rate of 30%, whereas businesses operating in priority sectors will be eligible for a reduced tax rate of 25%, applicable for a period of five years.

The revised bill also expands the beneficiaries of the Development Levy.

The Tertiary Education Trust Fund will receive 50%, the Nigerian Education Loan Fund will get 3%, the National Information Technology Development Fund will receive 5%, and the National Agency for Science and Engineering Infrastructure will get 10%.

The Defence Infrastructure Fund will receive 10%, the Nigeria Police Trust Fund 5%, the National Sports Development Fund 5%, the Social Security Fund 10%, the National Board for Technological Incubation 10%, and the National Cybersecurity Fund 1%.

Following a third and final reading scheduled for next week, the bills are anticipated to be passed into law.

Persecondnews recalls that the bills, drafted by the Presidential Committee on Tax Reforms and Fiscal Policy, aim to revolutionize Nigeria’s tax landscape by overhauling the existing tax laws, promoting exports, and streamlining tax administration.

However, the bills have faced stiff opposition, mainly from the Northern parts of the country, particularly from Northern governors who had described the bills as “anti-North.”

The debates on the bills took a divisive turn, pitting the North against the South, with the contentious issue of VAT sharing formula at the forefront of the controversy.

The National Economic Council (NEC) chaired by Vice-President Kashim Shettima had urged President Tinubu to withdraw the tax reform bills for further consultations.

Tinubu, however, stood his grounds, asserting that all concerns regarding the bills should be addressed during deliberation in the National Assembly, instead of withdrawing the bills.

Leave a comment