Nigeria’s net domestic credit has witnessed a significant decline, dropping to N99.41 trillion in January 2025.

This represents a contraction of N16.17 trillion from the N115.58 trillion recorded in November 2024.

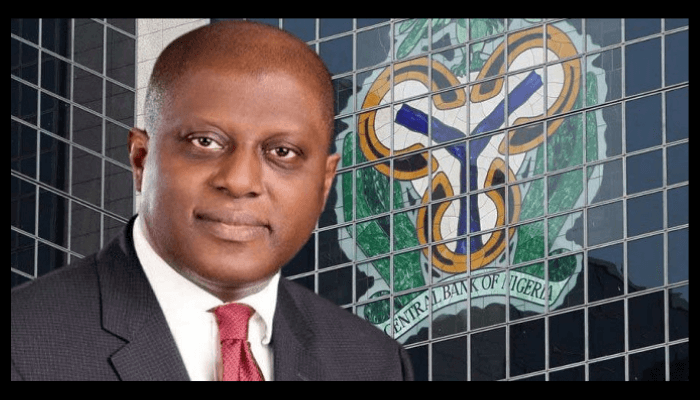

The latest Money and Credit Statistics report by the Central Bank of Nigeria (CBN) reveals fluctuations in domestic lending over the past year.

To put this into perspective, net domestic credit stood at N99.99 trillion in January 2024 and N85.35 trillion in November 2023.

The sharp decline suggests a contraction in domestic credit issuance, which could be attributed to various factors.

These include monetary tightening by the CBN to curb inflation and stabilize the naira, reduced government borrowing, and private sector caution amid economic uncertainty.

The CBN’s decision to retain the interest rate at 27.50% during the 299th MPC meeting may have also contributed to the decline.

The missing December 2024 figures could provide further insights into the credit movement during the peak holiday spending period.

Leave a comment