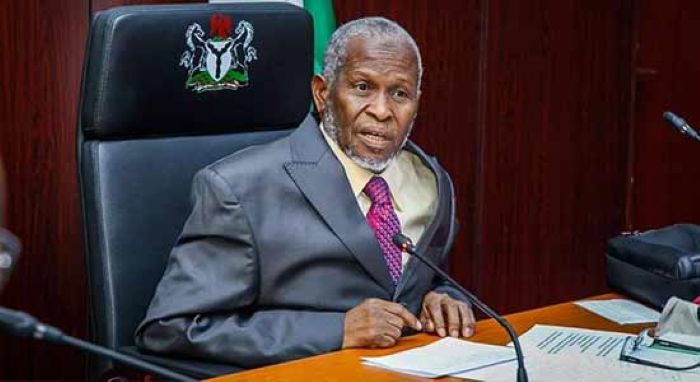

Mixed reactions have continued to trail the directive of the Police Inspector General, Dr. Kayode Egbetokun, asking officers and men across the country to begin the enforcement of the Mandatory Third Party Insurance from February 1, 2025.

Persecondnews recalls that IGP gave the directive on January 10, 2025, while receiving the Commissioner for Insurance/CEO of the National Insurance Commission (NIC), Mr. Olusegun Ayo Omosehin, in his office in Abuja.

The move aims to protect vehicle owners and road users from financial burdens in case of accidents.

The order is premised on Section 68 of the Insurance Act 2003, which provides for the obligatory insurance of any vehicle (with the minimum being third-party insurance) and also stipulates punishments.

However, the directive has been criticized that it will only exacerbate the financial burden on car owners.

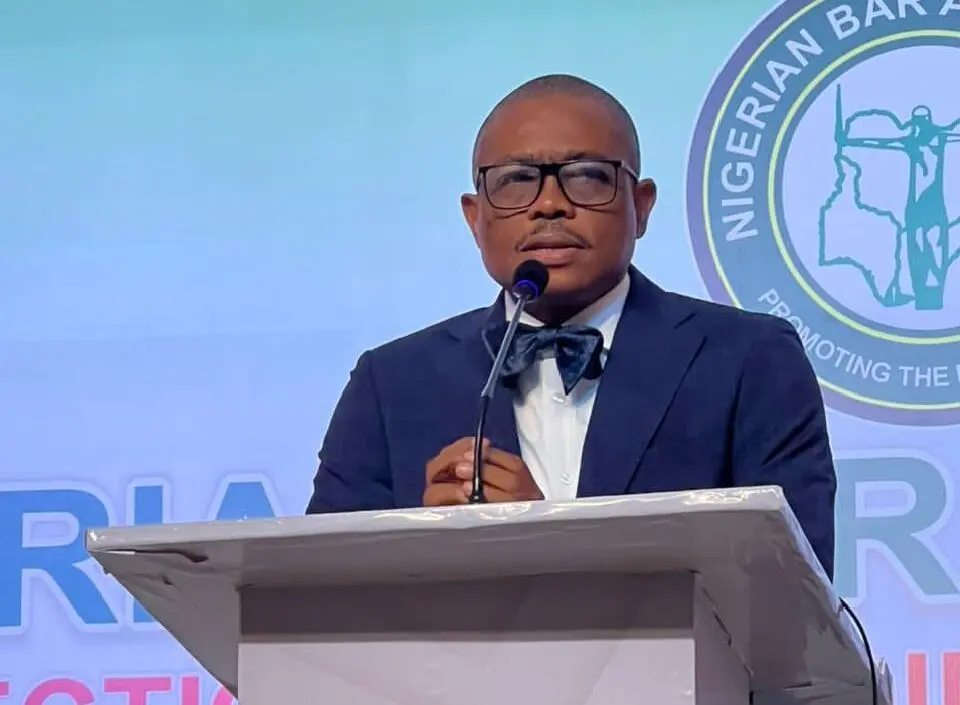

In an exclusive interview with Persecondnews, an Abuja-based lawyer and Executive Director of Citizens Advocacy for Social and Economic Rights (CASER), Mr. Frank Tietie, said he has been at the forefront of pushing for the enforcement of mandatory third-party insurance for a very long time.

According to Tietie, the fundamental principle of insurance is to provide compensation for accidents on Nigerian roads.

He, however, noted that in reality, insurance companies often collect premiums for decades without providing compensation to victims when accidents occur.

He said: “It is a welcome development that it is being enforced. For example, the law says that no vehicle should be on a Nigerian road without being insured.

“I think we should be talking about reviewing the compensation. For example, there were petrol tankers that fell recently and caused casualties, resulting in scores of fatalities in states like Jigawa, Niger, and Enugu.

“We do not know the details of how the insurance company compensated those whose vehicles were burnt; each and every one of those victims ought to be paid serious compensation as a result of having a vehicle insured on Nigerian roads.

“The enforcement is a welcome development; however, a review is necessary because the Motor Vehicle Third-Party Act of 1945 prescribes a ridiculously low amount as the penalty payable.

“The IGP should monitor the enforcement against the companies to ensure payment to victims so that we do not end up producing more billionaires among insurance brokers who fail to pay claims.

“The enforcement is two-fold: drivers should pay their premiums now, and when accidents occur, companies should pay claims to the victims.”

Also reacting to the directive, the Director General, Centre for Credible Leadership and Citizens Awareness (CCLCA), Dr. Gabriel Nwambu, said it represents a significant step towards enhancing road safety and accountability in Nigeria.

Nwambu acknowledged the concerns of many Nigerians regarding the short three-week notice period for obtaining necessary insurance, but he believed that if implemented effectively, the insurance would ultimately benefit Nigerians.

He emphasized that Nigerians should also consider life insurance, quoting data from the Federal Road Safety Commission (FRSC), which reported that 5,081 Nigerians died in road accidents in 2023 and 5,421 in 2024.

He recommended that the government should initiate comprehensive educational campaigns to enlighten drivers on the significance of third-party insurance and the procedures for acquiring it.

He further advised that the government should collaborate with insurance companies to simplify the policy purchasing process, making it accessible and affordable for all vehicle owners.

He added that a reasonable grace period should be granted to citizens to obtain the necessary insurance coverage, allowing them to comply without incurring penalties.

Another Abuja-based lawyer, Mr. Obinna Ugwu, told Persecondnews that the law has always been in effect, making it unusual for the police to announce a specific start date for enforcement.

According to Ugwu, once a law is enacted, it is automatically in force, and it is the police’s duty to enforce it.

“Anyone driving without third-party insurance has been violating the law; it is not even an issue for national discourse or any discourse at all.

“A third-party insurance is coverage against unforeseen or unpredictable events on the road, benefiting not the driver, but the other party involved.

“There is also comprehensive insurance, which relates to vehicle licences. This insurance covers both the insured driver and the other party involved in the event of a road accident.

“But the comprehensive insurance is optional, as you may choose not to cover yourself. However, if you cause harm to someone while driving, they have the right to be compensated, and that is the essence of third-party insurance,”he said.

Contacted for an extension of the grace period, the Federal Capital Territory (FCT) Police Command’s spokesman, SP Josephine Adeh, said: “There would not be any further grace period. The law has been in existence for a long time, and they are simply implementing enforcement measures.

“Section 68 of the Insurance Act 2003, which provides for the obligatory insurance of any vehicle (with the minimum being third-party insurance) and also stipulates punishments.”

Persecondnews also spoke with drivers to gauge their compliance with the Mandatory Third Party Insurance policy and to gather their views on whether an extension of the grace period would be necessary.

Cab driver Maiva expressed frustration, saying that Nigerians are suffocating under the weight of countless financial pressures.

He complained about the numerous directives from the Federal Capital Territory Administration (FCTA), including repainting cabs and installing fire extinguishers, which have added to their financial burdens.

Maiva passionately appealed to the government to consider the everyday struggles of Nigerians and refrain from imposing additional financial obligations on them.

Private car owner Kennedy Onokpasa expressed surprise that many people are reacting to the Mandatory Third Party Insurance directive as if it is a new requirement.

Onokpasa revealed that he had already obtained the insurance when he purchased his vehicle in 2021, emphasizing that the policy is not novel.

He criticized the government’s sudden enforcement, likening it to a rash “fire brigade” approach, and instead advocated for a more phased implementation.

Onokpasa suggested a six-month grace period before imposing penalties to allow car owners to comply without undue hardship.

Leave a comment