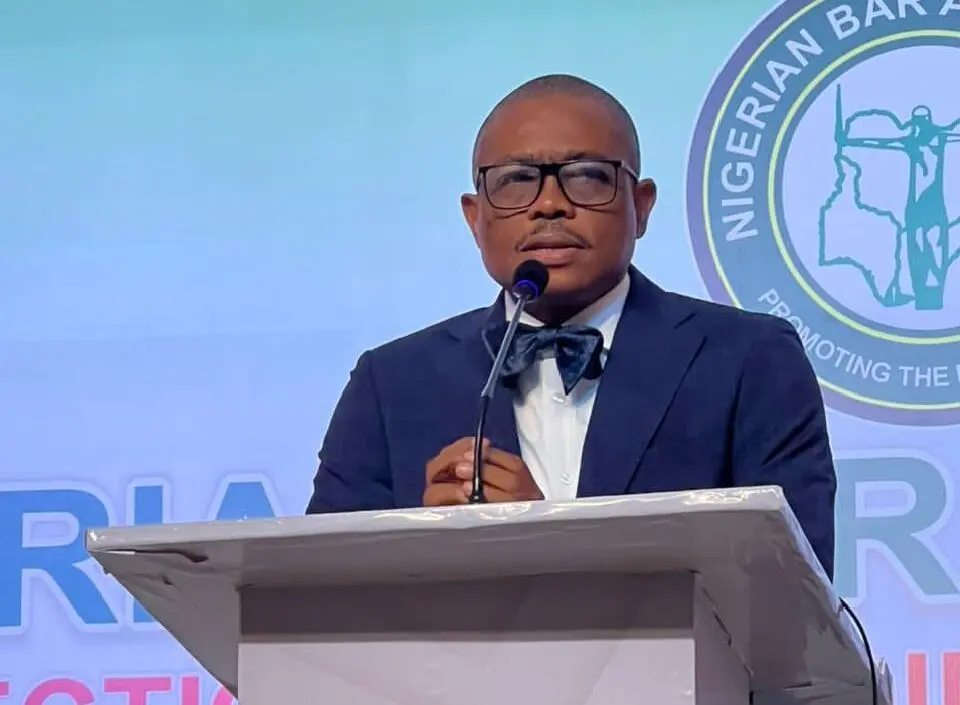

The governor of the Central Bank of Nigeria (CBN), Mr. Olayemi Cardoso, has called on Nigerians to cut down on their demands for forex.

Cardoso, who disclosed this during a briefing of the Joint Senate Committee on Finance, Banking, Insurance, and Financial Institutions on Friday, said the apex bank had little power to intervene but would explore partnerships to ease the forex crisis.

Persecondnews reports that the committee summoned the Central Bank Governor to appear before it on January 31 amid concerns about the state of the economy and the sharp decline of the naira in the foreign exchange market.

He said: “We must moderate our demands for forex. Where there are opportunities to substitute locally, we should.

”The total quantum for education and medicine is more than our external reserves. If we can up our game in education and medicine, there won’t be a need for our people to go abroad.”

The continual scramble for the dollar by Nigerians to pay tuition fees as well as medical and import bills has continued to pile pressure on the Naira, as many have turned to the black market as a viable option due to limited access to forex, Persecondnews reports.

Speaking on monetary policies to tackle the ongoing inflation in the country, the CBN governor insisted the switch to a single rate was an intentional model to help improve investment credibility in the country.

Cardoso said: ”We are working very hard to bring back credibility to the CBN.

”If we are doing the right thing, investors will come. For them to come, they have to believe that you will do the right things. I also want to say that in establishing credibility, there are certain things that we need to do.”

Speaking further, the CBN governor revealed that the apex bank’s interventions have resulted in an influx of $1 billion into the Nigerian market in recent days.

“We have already begun to see shifts in the positive direction. Indeed, the measures have already started yielding early results with significant interest from foreign portfolio investors, which was a concern.

“That has already begun to supply much-needed foreign exchange to the economy.

“For example, upward of the past few days, we have had over $1 billion that has come into the market, and this quite frankly has answered the question of if our policies are working,” Cardoso added.

Leave a comment