Unreported currency worth $68,000 was confiscated by U.S. Customs and Border Protection agents from a Nigerian family en route to Washington Dulles International Airport today.

Travellers must present all currency in their possession to a CBP officer upon entering or exiting the United States.

Travellers are not restricted in the quantity of currency or other monetary instruments they are permitted to transport into or remove from the United States. Nonetheless, travellers are obligated by federal law [31 USC 5316] to disclose to a CBP officer any currency worth $10,000 or more, along with the U.S. Treasury Department Report of International Transportation of Currency or Monetary Instruments [FINCEN 105]. Learn more about the requirements for currency reporting.

The family was encountered by CBP officers who were conducting outbound inspections of passengers boarding a flight to Cairo, Egypt. Officers inquired as to the quantity of currency the family possessed after elucidating the currency reporting laws of the United States. In formally disclosing the family’s possession of $10,000, the FINCEN 105 form was duly signed by the father.

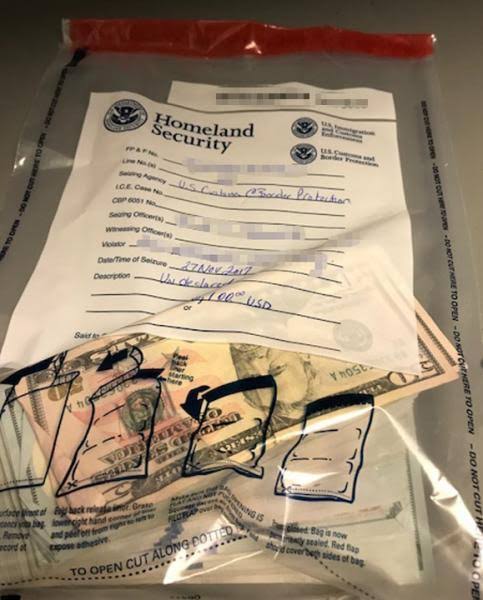

CBP officers discovered currency in numerous envelopes during a subsequent search of the family’s carry-on bags, in addition to the currency that the family had presented to the officers. The aggregate value of the currency was $68,216.

The officers seized the currency and transferred $216 as a humanitarian release to the family. Officers of CBP permitted the passengers to continue their voyage.

“Seizing a traveller’s currency is a very serious consequence, but it is easily avoidable if the traveller discloses all of the currency they are carrying with them to a Customs and Border Protection officer in good faith,” said Marc E. Calixte, Area Port Director for the CBP’s Area Port of Washington, D.C.

Travellers who do not accurately disclose all of their currency run the risk of experiencing significant repercussions, such as being denied boarding and having their vacation plans disrupted, having their entire currency confiscated by a CBP officer, and potentially being charged with criminal smuggling of bulk currencies.

The family carried $68,216 on their trip to Nigeria, but only $10,000 was reported in their possession.

Instances arise in which unreported bulk currency may constitute the illicit proceeds of money schemes and financial fraud. Additionally, some travellers may be motivated by avarice to smuggle unreported currency they have lawfully obtained to conceal it from family or business associates.

To proactively disclose their currency, travellers may complete the fillable FINCEN 105 form before the occurrence of CBP arrivals or departure inspections.

Along the borders of the United States, CBP officers and agents seized an average of $217,700 in unreported or illicit currency per day in 2022.

At the nation’s ports of entry, CBP officers and agriculture specialists from the Office of Field Operations oversee the agency’s border security mission.

Counterintelligence Bureau (CBP) conducts inspections of international cargo and travellers, as well as searches for weapons, unreported currency, illicit narcotics, counterfeit consumer goods, prohibited agriculture, invasive weeds and pests, and other products that have the potential to endanger the safety and economy of the United States, U.S. businesses, or the American public.

Leave a comment