The Federal Government unveiled fresh fiscal incentives to enhance Nigeria’s oil and gas industry’s competitiveness, setting it up for a major boost.

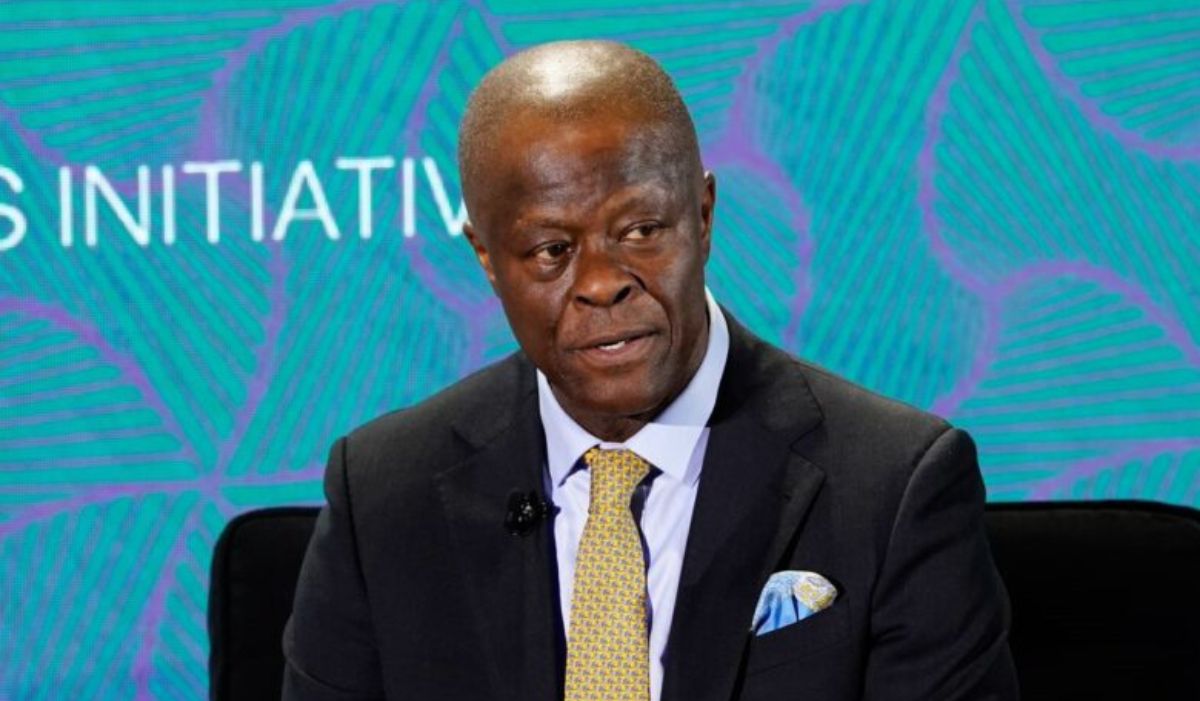

Mr. Wale Edun, Minister of Finance and Coordinating Minister of Economy, announced two significant fiscal incentives: the Value Added Tax (VAT) Modification Order 2024 and the Notice of Tax Incentives for Deep Offshore Oil & Gas Production.

The VAT Modification Order 2024 introduces exemptions for essential energy products and infrastructure, including diesel, feed gas, liquefied petroleum gas (LPG), compressed natural gas (CNG), electric vehicles, liquefied natural gas (LNG) infrastructure, and clean cooking equipment.

Persecondnews reports that these exemptions aim to reduce living costs, enhance energy security, and accelerate Nigeria’s transition to cleaner energy alternatives.

In addition, the Notice of Tax Incentives for Deep Offshore Oil & Gas Production provides new tax relief options for deep offshore exploration projects.

Edun said: “This initiative seeks to establish Nigeria’s deep offshore basin as a top-tier destination for international oil and gas investments.

“These reforms are part of a larger set of policy initiatives focused on investment, advocated by President Bola Ahmed Tinubu, as outlined in Policy Directives 40-42.

“The administration is committed to promoting sustainable development in the energy sector and enhancing Nigeria’s competitiveness in global oil and gas production.”

The Special Adviser to the President on Energy, Mrs. Olu Verheijen, said the incentives will attract over $10 billion in new investments within the next 12–18 months and help Nigeria reach its long-term oil production target of 4 million barrels per day.

The guidelines were developed in collaboration with key stakeholders, including the Federal Inland Revenue Service (FIRS), the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

Leave a comment