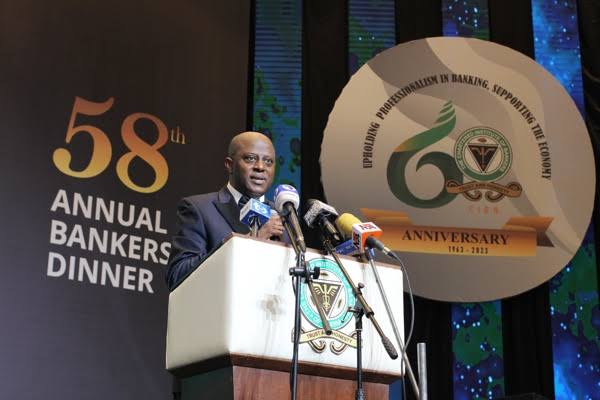

The CBN Governor, Dr. Olayemi Cardoso, announced this at the 58th Annual Bankers Dinner by the Chartered Institute of Bankers of Nigeria (CIBN) on Friday night in Lagos.

The Central Bank of Nigeria (CBN) is set for a recapitalization of the nation’s banks to secure enough capital to achieve President Bola Tinubu’s $1 trillion Gross Domestic Product (GDP) target.

The CBN Governor, Dr. Olayemi Cardoso, announced this at the 58th Annual Bankers Dinner by the Chartered Institute of Bankers of Nigeria (CIBN) on Friday night in Lagos.

According to him, the last capitalisation of banks cannot handle the $1 trillion GDP size in seven years of Tinubu’s economic plan.

“Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1.0 trillion economy in the near future? In my opinion, the answer is “No!” unless we take action.

“Therefore, we must make difficult decisions regarding capital adequacy. As a first step, we will be directing banks to increase their capital.

“The administration, as outlined in the widely circulated Policy Advisory Council report on the national economy earlier this year, has set an ambitious goal of achieving a Gross Domestic Product (GDP) of $1.0 trillion over the next seven years, with clearly defined priority areas and strategies,” Cardoso said.

Attaining this substantial target necessitates sustainable and inclusive economic growth at a significantly higher pace than current levels, he added.

The CBN boss also said:“The administration has already commenced this journey through fiscal reforms, including the removal of petrol subsidy and the unification of the foreign exchange market rate.

“The CBN will be directing banks to increase their capital base. Indeed, despite the challenging global and domestic macroeconomic environment, Nigeria’s financial sector has demonstrated resilience in 2023, with key indicators of financial soundness largely meeting regulatory benchmarks.

“Stress tests conducted on the banking industry also indicate its strength under mild-to-moderate scenarios of sustained economic and financial stress, although there is room for further strengthening and enhancing resilience to shocks.

“Therefore, there is still much work to be done in fortifying the industry for future challenges, a topic that I will delve into later in my address.”

Cardoso said that over N10 trillion CBN interventions in the real sector affected the banks in achieving their goals, and took the lenders to areas where they had limited expertise.

“Under my leadership, the CBN will address these issues. We will tackle institutional deficiencies, and implement prudent policies.

“Our economy will experience significant improvement as we implement these far reaching measures. The primary mandate of the CBN is to ensure price and exchange rate stability.”

On crude oil prices, Cardoso said the sustained high crude oil prices, exceeding $80 per barrel, have posed challenges for import- dependent countries like Nigeria in managing prices.

Cardoso said with recent developments within the domestic economy, it is evident that we are facing significant macroeconomic and social challenges.

He listed high level of insecurity which has resulted in decreased national output and productivity, infrastructure constraints, business bottlenecks and a culture of poor service delivery, particularly within the public sector, as some of the challenges that further hinder the fortunes of the economy.

“These challenges have led to increased interest rates, discouraging investments in productive activities. Within the banking system, high inflation has affected asset quality and solvency ratios.

“Additionally, the persistent depreciation of the naira poses a significant risk for domestic banks with foreign exchange exposures.

“I want to assure you that while it is indeed a formidable challenge, it is not insurmountable. With the right policy measures, we can overcome these obstacles and pave the way for progress and prosperity,” the CBN Gov. said.

Cardoso said the removal of petrol subsidy and the adoption of a floating exchange rate, among other government policies, are anticipated to have positive effects on the economy in the medium-term.

Also speaking on the occasion, the Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, said the Tinubu administration has introduced some far-reaching reforms.

He called for resilience in the face of challenges, adding that the banking industry is healthy and thriving.

“Taking the Nigerian banks to Europe and America is a sign to what Nigeria can deliver to the world. The economic reforms are difficult but we need to stay the course and the results are beginning to show,” he said.

Leave a comment