Prior to the inauguration of the Petroleum Industry Bill (PIB) and its signing into law, the nation’s oil industry was a cesspool of corruption and a state-run Nigerian National Petroleum Corporation (NNPC) with the government in control of its day-to-day running.

Like any other institution of state, government’s meddlesomeness and interference has compromised transparency, accountability and mandate performance.

NNPC was being run at a loss as it failed to generate enough revenue for government, talkless of declaring profit.

Accounts of the corporation was not regularly audited and the audit report made public.

Again, appointments and recruitments into the corporation were shrouded in secrecy and drawn from one or two ethnic groups to the exclusion of others.

These and many more were the situation and state of NNPC before Malam Mele Kyari, who transited from the Managing Director of the corporation in 2019 to the Group Chief Executive Officer (GCEO) of the now incorporated Nigerian National Petroleum Company Ltd in 2022.

Persecondnews reports that NNPCL is now a for-profit-oil company as the only commercial entity licensed to operate in the nation’s petroleum industry, partnering with foreign oil companies to exploit fossil fuel resources of the country.

Established in 1977 about 46 years ago by the military government, the oil firm’s products include petroleum products, petrolchemicals, gas and crude.

Kyari immediately unveiled his TAPE agenda with its central components as Transparency, Accountability and Performance Excellence with the Nigerian Extractive Industries Transparency Initiative (NEITI) deepening collaboration to promote transparency in the oil and gas industry.

The trajectory of NNPC with its unbundling to free it from government control in a deregulated environment all happened under the leadership of Kyari with the game-changer PIB signed into law by the immediate past President Muhammadu Buhari in August 2021 which was first presented to the National Assembly in 2008 during the administration of the late President, Umar Yar’Adua.

Stuck in the legislature for 15 years, the resuscitation of PIB excited energy experts and other stakeholders, who were confident that the bill would turn around the ill-fortunes of the industry.

In spite of the several roadblocks encountered then, the experts were hopeful that it was only a matter of time that things will begin to take shape for the industry and the country as European and American companies dominated the nation’s oil exploration.

Shell Petroleum Development Corporation, Chevron, Total Energies and ExxonMobil had taken over being the front liners while attempts were made to incorporate companies from China, Saudi Arabia and India into the country’s oil exploration.

This move to attract foreign investment to the sector was impeded by the existing Nigerian laws that would not allow the leasing of oil wells to prospective companies from abroad since most of the Oil Mining Leases (OMLs) were in firm grip of the existing International Oil Companies (IOCs).

The firms had held the OMLs for many years before the bill was proposed, and to change the situation, an overhaul was needed in the country’s energy law and interestingly, this development had necessitated the introduction of the PIB which has birthed reforms in the oil industry.

After assenting the PIB, Buhari approved a steering committee to oversee its implementation, stressing that Nigeria lost an estimated $50 billion worth of investments in just 10 years created by the uncertainty as a result of non-passage of the bill.

Kyari recently made moves to set new investment benchmark post-Petroleum Industry Act (PIA) 2021 with the NNPCL sealing multiple deals running into over $48.15 billion to rejuvenate the hitherto moribund company.

Other key investment project slated for Final Investment Decisions (FID) by the NNPCL, include the $25 billion West African Gas Pipeline project (Nigeria-Morocco gas pipeline).

The company will stake $12.5 billion to secure a 50 per cent equity and the $2.8 billion Ajaokuta-Kaduna-Kano (AKK) gas pipeline project among others.

Also, in its quest to boast it financial base, the Nigerian government in June 2022 renewed talks with Algeria and Niger to kickstart the $13 billion (€12.8 billion) Trans-Saharan Gas Pipeline (TSGP).

Commenting on the various projects and policies, an Associate Professor of Energy and Natural Resources, Olanrewaju Aladeitan, said what NNPCL was doing with the Trans-Sahara Gas Pipeline (TSGP) project was what Nigeria should have done in 1970s, or thereabout.

According to him, Nigeria would have taken advantage of the vacuum created by the non-supply of oil to Europe by Russia and expand its gas projects penetration the European market as a result of the Russia-Ukraine conflct.

“If we had done that, by now we would be smiling to the bank because we would have utilized the opportunity of market that was left by the withdrawal of Russia. So if we can achieve the same aim through the Trans-Sahara pipeline, it will be fine.

“We also have the West African Gas Pipeline, which passes through Benin Republic, Togo to Ghana, and that has also been in the works for some time.

This is what has informed Nigeria looking at constructing these pipelines to Europe and the gas can flow from there,” Aladeitan said.

The need for the NNPCL model of investments was also highlighted at the Nigeria International Energy Summit (NIES 2023).

Speaking during business leaders and regulatory dialogue session at the event, Mrs Nkechi Obi, Group Managing Director of Techno Oil Limited, an indigenous oil and gas company,

called for significant investments and infrastructure to achieve global energy mix and sustainable energy.

“There are about eight mitigants to achieving the global energy mix but the provision of infrastructure, reduction in biomass and fossil fuel were key to achieving success, especially in the downstream sector.

“Nigeria needs an enabling environment to drive investments to position itself strategically in view of global trend to transit to cleaner energy. The passage of the Petroleum Industry Act (PIA 2021) was a big relief in pursuit of a cleaner energy,’’ she said.

Obi’s call was not different from what the country is trying to achieve through the investments embarked upon by the NNPCL, as gas is expected play a bigger role in the global energy mix and that Nigeria had enough of it to drive the industry.

Mr Olabode Sowunmi, a senior legislative aide to the former Senate President on Gas and Power, said the industry particularly the gas sector, offers Nigeria great opportunities for industrialisation.

Sowunmi advocated consistency in the Nigeria Gas Master Plan, especially on projects such as AKK, Trans-Saharan Gas Pipeline and West African Gas Pipeline, expressing satisfaction that some reforms have started in the industry in view of the implementation of the PIA 2021.

Besides the multiple investments stakes, the company under the leadership of Kyari, has also taken positive measures aimed at blocking the loopholes in crude oil leakages, theft and vandalism.

Energy experts expressed the hope that the step is expected to propel NNPCL into a global profit-making brand like other major oil giants across the globe.

In pursuit of this role, the company in the last 24 months engaged in exploring new business ventures, investment opportunities and has also taken measures that had seen the nation’s dismal crude production of less than a million barrels per day increase to over 1.6 million barrels per day in the last 12 months.

The company successfully signed and acquired a 20 per cent Federal Government stake in the Dangote 650,000-barrel-per-day oil refinery for $2.76 billion.

It also secured over $3 billion local and foreign investment interests in the Kolmani Integrated Development Project.

The Kolmani project houses a 120,000-barrels per day refinery, a 500-million standard cubic feet per day gas processing plant, a 300-megawatt capacity power plant, and a fertilizer plant of 2,500 tons per day.

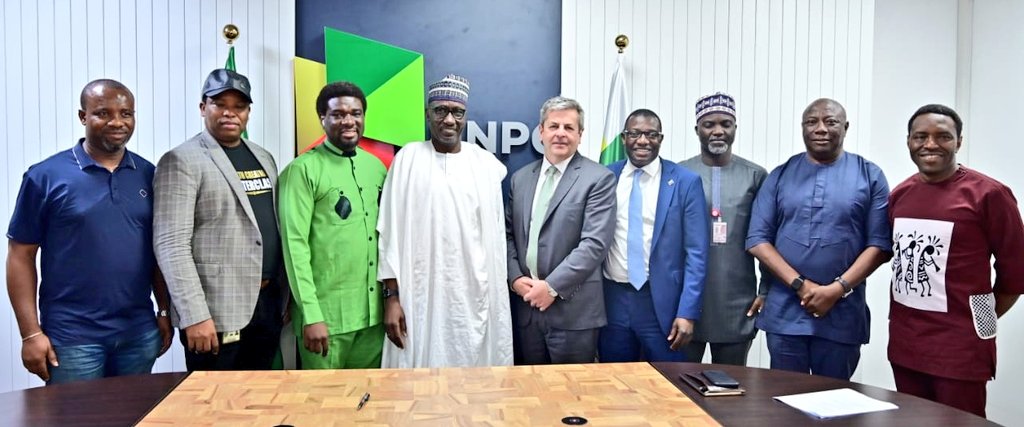

Earlier in 2023, the NNPC Renewed Oil Production Pact With its Partners For 10 billion barrel aimed at putting an end to the protracted dispute between the state-owned company and the contractor parties in OMLs 128, 130, 132 and 133, as well as 138 PSCs.

The agreements are the Production Sharing Agreement, Dispute Settlement Agreements, Settlement Repayment Agreement, and Escrow Agreement.

The signing of the agreement took place at the NNPC headquarters office in Abuja.

According to the NNPC Limited, the signing of the new PSCs is a key milestone achievement, which will ultimately unlock opportunities within the Nigeria upstream sector.

Only last Thursday, the NNPCL signed a Heads of Terms (HoT) agreement with UTM Offshore Limited for the construction of the nation’s first indigenous floating liquified natural gas (LNG) project with a $5.6 billion funding package from Afreximbank.

Speaking on the UTM deal, Mr Garba Deen Muhammad, Chief Corporate Communications Officer, NNPCL, in a statement said the agreement was a step towards bolstering Nigeria’s energy security and promoting the utilisation of its abundant gas resources.

“In a major step towards bolstering Nigeria’s energy security and promoting the utilisation of its abundant gas resources, the NNPC Ltd and UTM Offshore Limited have today in Abuja signed a Heads of Terms (HoT) agreement.

“It is for the construction of the nation’s first indigenous Floating LNG project,” the company said.

The NNPCL as a company grew its profit after tax from N287 billion in 2020 to N674 billion in 2021.

It would be recalled that for the first time in the history, the company, last Thursday, July 20, 2023, it commenced the payment of interim dividend and Petroleum Sharing Contracts (PSC) profit oil into the Federation Account Allocation Committee (FAAC) with the of N123 billion.

A breakdown of the amount showed that the National Oil Company paid N81 billion as monthly interim dividend and N42 billion as 40 per cent PSC profit oil, this is in addition to compliance on payment of royalties and taxes.

Commenting on the NNPC Limited’s performance, Mr Horatius Egua, spokesman of the immediate past Minister of State for Petroleum Resources, Chief Timipre Sylva, said Sylva’s in ensuring the passage of the PIA was instrumental to the new feats.

According to Egua, all that NNPC Limited has achieved today would not have been possible if the Petroleum Industry Bill (PIB) was not passed into law.

“Thumbs up must be given to Chief Sylva, the leadership of the National Assembly and former President Muhammadu Buhari”, he said.

He also lauded Kyari for providing the leadership in the NNPCL that had enabled the company attain its present status.

“It is one thing to have a law but if you don’t have competent people to drive and implement that law, it becomes useless. So Malam Kyari has done well in his own capacity as the boss of the NNPC Limited.’’

Egua, however, believes that Kyari should still do more to take the company to a greater height like the Saudi Aramco, China Petroleum & Chemical Corp., Exxon Mobil Corp. among others.

Leave a comment