United Bank for Africa (UBA) Plc, as part of efforts to boost up the spirits of its employees and better the performance of the bank, it has employed about 4,000 staff and promoted another 5000 employees.

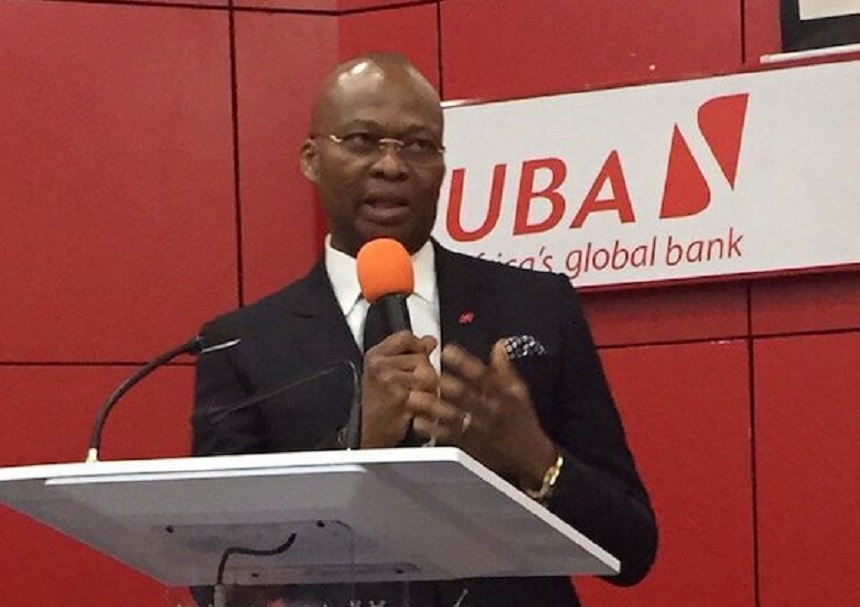

“As a leading financial institution, we do not take issues relating to our staff lightly, said UBA’s Group Managing Director/Chief Executive Officer, Kennedy Uzoka, in a bank-wide live broadcast to employees.

” We take great pride in being a listening bank that has the ears of our employees as they turn the wheels which make the organisation successful for our customers and shareholders. UBA recruits highly talented staff who perform at the best standards and deserve to be remunerated accordingly’

Continuing, Uzoka said ‘ we have also taken steps to ensure that our bank remains at the top tier as it relates to talent pool. We want to train the best and we have crashed the grade structure to make it easier and faster for our employees to progress along their careers. With this new grade structure, it will be possible for a new graduate employed at UBA to rapidly chart their own careers and become GMD by the age of 36.”

Those who are beneficiaries of this exercise will receive up to 170% increase in their salaries and benefits, whilst a good number have been moved to higher grade levels, the bank said.

In a carefully planned restructuring embarked upon by the bank in the last quarter of 2019, UBA has transformed its grading system and processes to become one of the most competitive within the industry. The bank crashed its grade levels to 12 levels from entry level to the top of the pyramid where previously it had been 16 levels. This means that staff will now find it much easier to attain top leadership management positions at UBA as their careers progress much faster.

In a massive recruitment drive , over 4000 new staff members resumed in the last week of December 2019 in Nigeria alone at the bank. UBA currently stands as the highest employer of labour amongst Nigerian banks with a staff strength of close to 20,000.

UBA is one of Africa’s leading banks with operations in 20 African countries. The bank also has presence in the global financial centres of London, New York and Paris. UBA provides banking services to more than 17 million customers globally, through diverse channels.

Leave a comment