… CBN technically refused to comply with Presidential directive

|

In a bid to get to the root of the matter, the Senate has begun investigations into a

Consequently, the Upper chamber has directed the Committee on Finance to investigate the

It will start from 2013 to 2016 about the financial accountability of stamp duty collections

Senate’s resolution was sequel to a motion entitled, “The need to improve Internally

Persecondnews reports that the motion was moved by Senator Patrick Akinyelure from Ondo

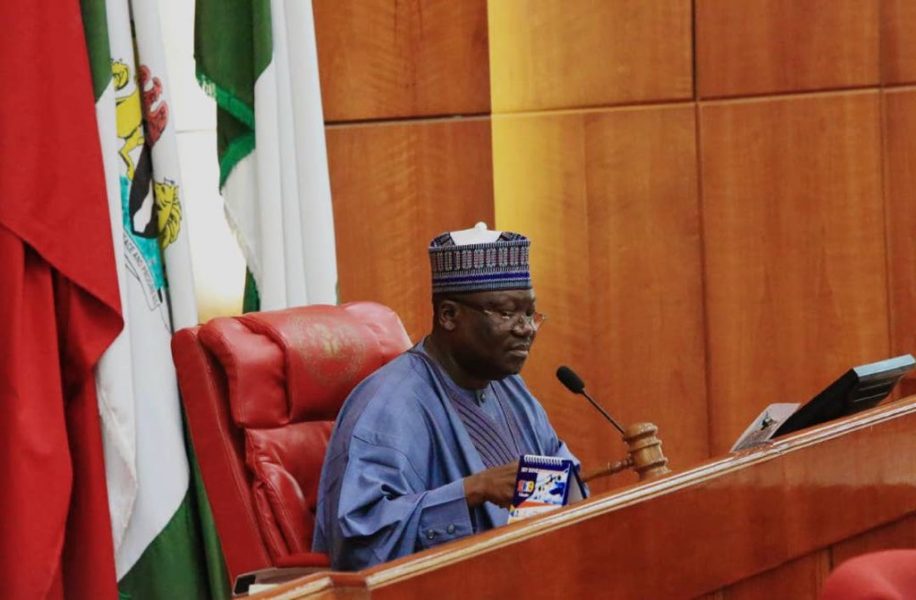

While contributing to the debate, Senate President Ahmad Lawan, blamed the non-remittance

“What we have been expecting to be available as stamp duty is not so and what has happened

“I believe from January, the stamp duty collection will be significantly improved. We have

“The idea is not to allow agencies just do what they want,” he said.

Opening the debate earlier, Akinyelure said the Federal Government had projected revenue of The Ondo Central Senator said that the Central Bank of Nigeria (CBN) had issued a circular directing all banks and other financial institutions to charge stamp duty of N50 on lodgment into current accounts with value of N1,000 and above towards the realization of the revenue projection.

He noted that the CBN’s cash-less policy started from six pilot states in 2012, and that the

Akinyelure said following the CBN’s circular, all Deposit Money Banks and other

In spite of the appointment of a consultant by the Federal Government in 2017 to help recover |

Leave a comment