The Central Bank has revealed that the apex bank’s stress test shows that 7 banks out of the 24 operating in Nigeria were not adequately funded in 2018.

The stress test is part of CBN’s efforts to significantly minimise the impact of risks on the Nigerian financial system.

The CBN disclosed In a financial stability report published on its website on Thursday, October 17th, that in less than 30-day period analysis, seven Nigerian banks were not adequately funded, while in the 31-90 day bucket, nine banks had funding gaps.

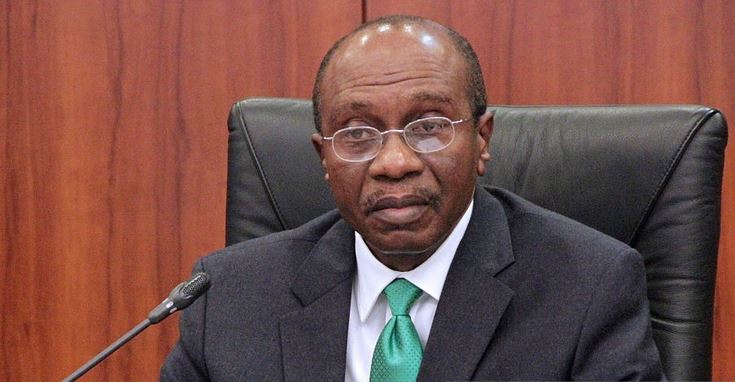

On the strategic health of the Nigerian banking industry. First, I will reiterate that the strategic health of the Nigerian banking industry remains very strong, the CBN governor Mr. Godwin Emefiele, stated in Washington at the IMF/World Bank annual meetings.

” So the fact that you have read that seven banks failed stress test does not mean that those banks are weak, Emefiele stressed.

” If for instance Bank A fails in liquidity, we will try to work with that bank to make sure it address its liquidity, if they fail capital adequacy which is also part of the stress testing parameters that we use, we also counsel them about the best ways of o address the capital adequacy issue.

” So it has nothing to do with the weakness of any bank in the industry that will lead to any panic or system crisis in the banking industry.

Leave a comment