…..21.7% Return on Average Equity; Declares N0.20 Interim Dividend

Africa’s leading financial institution, United Bank for Africa Plc has announced its audited half year financial results for the period ended June 2019, showing impressive growth across key performance indices as well as a significant contribution from its African subsidiaries.

In spite of the increasingly unpredictable environment witnessed in some of its countries of operations, the pan African financial institution delivered double digit growth in its profit before tax as it rose by 21 per cent to N70.3bn for the half year to June 2019, up from N58.1bn recorded in the similar period of 2018, just as the Profit after Tax also improved to N56.7 billion, a 29.6 percent growth compared to N43.8 billion achieved in the corresponding period of 2018. The profit for the first half of the year, translated to an annualised return on average equity of 21.7 per cent.

According to its results filed with the Nigerian Stock Exchange, UBA recorded a 14 percent year-on-year rise in top-line, with gross earnings of N293.7 billion, compared to N257.9 billion recorded in the corresponding period of 2018. Analysts say that this result emphasises the capacity of the Group to deliver a strong performance through economic cycles in spite of the overall challenging business environment.

As at 30 June 2019, the Bank’s Total Assets grew by 4.8% crossing the N5 trillion mark to N5.10 trillion. Customer Deposits also rose by 4.8 per cent to N3.51 trillion, compared to N3.35 trillion as at December 2018. This growth trajectory underscores UBA’s market share gain, as it increasingly wins customers through its revitalized customer service culture coupled with innovative digital banking offerings. The bank’s Shareholders’ Funds remained strong at N542.5 billion, reflecting its strong capacity for internal capital generation.

In line with its culture of paying both interim and final cash dividend, the Board of Directors of UBA Plc declared an interim dividend of N0.20 per share for every ordinary share of N0.50 each held by its shareholders.

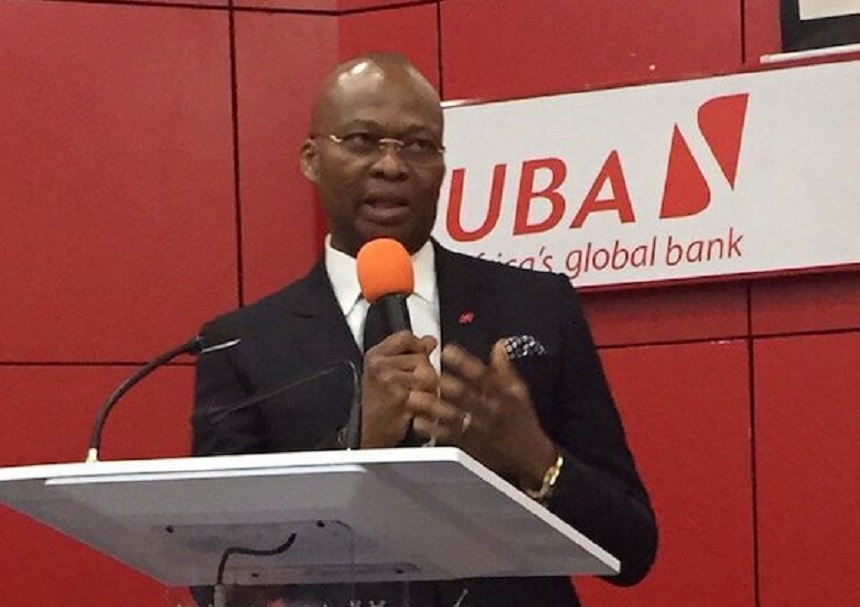

Commenting on the results, the Group Managing Director/CEO, United Bank for Africa Plc (UBA), Mr. Kennedy Uzoka said: “I am pleased with the half performance of the Group, having delivered 14% growth in gross earnings and 21% growth in profit before tax. Despite the subdued yield environment in some of our large markets, we achieved a 9% growth in interest income and defended the net interest margin. We also achieved a 39% growth in our electronic banking revenues, as we broaden and deepened our digital banking play across Africa. Revenues from our remittance and funds transfer businesses grew 69% and 53% respectively. All these factors attest to the efficacy of our strategies and the resilience of our business model.”

He further stated “I am very optimistic that the ongoing Group-wide transformation program, will in the quarters ahead, enable the Bank deliver substantial operational efficiencies and best-in-class customer service, which will ultimately boost earnings. We sustained our asset quality with the NPL ratio down to 5.62%, from 6.45% as at 2018FY. We will continue to adopt best practice standards to grow and manage the portfolio in the quarters ahead.”

United Bank for Africa, Africa’s global bank, was founded 70 years ago in Nigeria and today, operates in 20 African countries and in the United Kingdom, the USA and with presence in France. UBA serves over 17 million customers across the globe with more than 1000 branches and touch points. In 2018, the bank received the award of Africa’s Best Digital Bank by the Banker’s magazine.

Leave a comment