Keystone Bank Limited, Africa’s most innovative banking service provider shone brightly at the International Banker Awards, 2018 as the lender emerged winner in two categories beating other nominees and carting away the prize for “Africa’s Best Customer Service Provider” and “Nigeria’s Most Innovative Retail Bank of the year, 2018”.

The International Banker Awards is an annual event organized by the renowned International Banker financial magazine, one of the world’s leading sources of authoritative analysis on finance, international banking, and world affairs.

The awards were established to recognize top-ranking individuals and organizations setting new benchmarks for performance and pushing the boundaries within the financial industry. Winners are voted for by the magazine’s readership and a jury comprising financial journalists. They take account of not only growth, liquidity position and profitability of a company, but also innovation, technology, corporate governance, sustainability and transparency.

According to Mr. Simon Hughes of the International Banker Magazine, “we depend on nominations from our readers to locate the worthiest financial institutions around the world, the banks that are not just doing their jobs well but exceptionally well, that are in effect operating on the cutting edge of the industry and setting new levels of performance to which others in the field will aspire”.

“The size of the bank is not as important as the size of its impact; therefore, banks in countries from North and South America, Western and Eastern Europe, Asia and Australia, the Middle East and Africa are recognized for offering what top-of-the-line banks provide: much-needed capital for economic growth, cutting-edge innovation to improve security and efficiency, intelligent investing to maximize profits and shareholder value.”

“And I am happy to announce to you that Keystone Bank has demonstrated these qualities, hence, the recognition”. Hughes said.

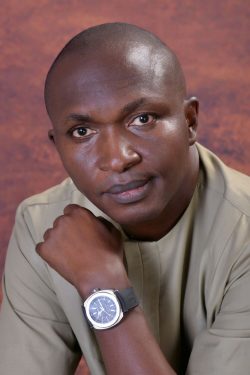

Receiving the awards on behalf of the Bank at the London Stock Exchange studio, recently, the Group Managing Director/CEO, Keystone Bank Limited, Mr. Obeahon Ohiwerei, dedicated the feat to the customers, whose loyalty, support and patronage he said has remained the fountain of the bank’s growth and competitive edge in the African continent.

“This recognition speaks volumes. It validates the strong management, staff commitment to service excellence, sound business model and prudent risk management of Keystone Bank” Ohiwerei said.

Ohiwerei further stressed that the awards were a lucid indication that the initiatives being implemented by the Bank particularly as it relates to enhancing service delivery are yielding the desired result.

Since its recent acquisition by Sigma Golf – Riverbank consortium, Keystone Bank, a technology and service-driven commercial bank, offering tailor-made convenient and reliable solutions to customer’s needs has been on upward swing.

Leave a comment