In a heavily over-subscribed $1.25 billion 12-year and $1.25 billion 20- year series, the notes will be used for the refinancing of the country’s domestic debt, the Debt Management Office said.

“With the successful pricing of our 5th Eurobond, Nigeria’s status as an Issuer of Eurobonds with a strong and diverse investor base has been further consolidated, said Patience Oniha, Director General of the DMO.

“I am particularly pleased that the issuance will enable us to refinance a portion of our existing domestic debt portfolio, with external debt at considerably lower cost, but also that the impact of the process has already led to a reduction in the cost of domestic borrowing, and so a double benefit for the cost of our broader debt portfolio, she said.

“Lower domestic rates will also benefit corporate borrowers.”

“This time Nigeria has priced a new 12-year bond at a yield of 7.143% and a 20-year bond at a yield of 7.696%, both of which are consistent in price with our existing portfolio.

The issuance, will also see a change in domestic/foreign debt ratio from 80:20 to 60:40, will further reduce the cost of government borrowing, and maintain Nigeria’s net debt levels.

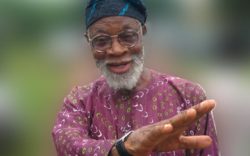

“Nigeria is focused on reducing the cost of our debt portfolio and ensuring we have the optimal mix between domestic and international debt.,” Mrs Kemi Adeosun, Minister of Finance said.

“The proceeds of the issuance, which would supplement the issuances we completed in 2017, will be used to re-finance domestic debt, which is high cost and short term, with lower-cost international debt, with a longer tenure.

“We will have a range of Eurobonds in issue, encompassing 5 year, 10 year, 12 year, 15 year, 20 year and 30 year bonds, giving investors a full basket of options to participate in.”

The offering has attracted significant interest from leading global institutional investors with a peak order book of over 450%.

The Notes, when issued will be admitted to the official list of the UK Listing Authority and available to trade on the London Stock Exchange’s regulated market.

The issuance is expected to close on 23 February 2018

Leave a comment