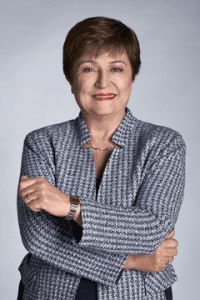

Oil prices fell on the first trading of the year on demand concerns as the International Monetary Fund’s boss Kristalina Georgieva, warned a third of the world’s economies may slide into a recession in 2023.

Brent, the benchmark for two thirds of the world’s oil, fell 0.61 per cent to $85.39 a barrel on Tuesday at 3.42am Nigerian time while West Texas Intermediate, the gauge that tracks US crude, was 0.57 per cent weaker, trading at $79.80 a barrel, Persecondnews.com reports.

Brent averaged $103.70 a barrel in 2022, gaining about 10 per cent annually, after jumping 50 per cent in 2021, while WTI ended up about 7 per cent last year, following a 55 per cent surge in 2021.

This was the second annual gain for the oil market despite the price volatility last year, which was exacerbated by the Ukraine war that disrupted global supplies.

Russia will face more disruption to its energy markets as another EU embargo comes into effect in Q1 [the first quarter], this time on refined products and markets will continue to adjust to the effects of the price cap on Russian oil,analysts say.

Meanwhile, the IMF managing director said the global economy faces “a tough year, tougher than the year we leave behind”.

“We expect one third of the world economy to be in recession,” Ms Georgieva told CBS’s news programme Face the Nation.

“Why? Because the three big economies — US, EU, China — are all slowing down simultaneously.

“While our baseline avoids a global recession over the next year, odds of one are uncomfortably high. Europe, however, will not escape recession and the US is teetering on the verge.”

The Washington-based lender had already cut its growth forecast for 2023 in October and warned of a cost-of-living crisis this year.

Leave a comment