The year 2021, no doubts, will go down in the annals of our nation as a most challenging year, not only for Nigeria and Nigerians but for the world and particularly, Africa after the outbreak of COVID-19 in 2020 and the monstrous lockdown globally.

Apart from Coronavirus-induced or triggered economic hardship, generally, Nigeria’s economic outlook is that of gloom, despair, and anguish with millions of Nigerians particularly those on the lowest rungs of the ladder – our poorest — in the throes of the agony of eating anything to stay alive as food commodities were prized beyond their reach – staple foods prices went haywire – onions, vegetables, beans, rice, gari, name it.

On the journey to economic hades, many Nigerians committed suicide across the country while some sold their children for a paltry sum of between N50,000 and N500,000 to live; akin to the Biblical days of the scourge of famine where the people killed their children following agreed roster to eat in a bid to escape the mass extinction and decimation.

READ ALSO : Man ends life over financial woes: Hangs himself outside shop

According to the Scriptural record, food insecurity, food shortage had pushed people to the extreme to take turns to boil their gifts from God to eat. The same situation was precipitated in Nigeria this year with unaffordable and exorbitant food prices, shortages as a result of the herders prowling, ravaging and wantonly killing farmers and forcefully taking over their farmlands that their cattle have destroyed.

The outlook also shows poor hawkers of orange, groundnut, knick-knacks, water, soft drink, vegetables, and other survival wares were left distraught with the seizure and destruction (and or looting) of their livelihoods by self-serving, powerful and kill-joy state environmental protection taskforce officials.

The notoriety and highhandedness of these anti-poor extortionists is more visible in Lagos State and Abuja; the Lagos State Environmental and Miscellaneous Offences Taskforce and the Abuja Environmental Protection Board are always on the loose, arresting and hounding the poor, the hapless into the Black or Green Maria.

The poor people who have become victims of the harsh economy are prosecuted, fined and released to go and start from zero level if they are able to pay off the high-interest loan of just N5,000 or N10, 000 and secure another facility; otherwise, they perish. The highhanded enforcers further damaging the informal sector of the economy largely dominated by street hawkers, market vendors, Pedicab and tricycle or motorcycle riders, home-based industries and services. A large number of okada riders (commercial motorcyclists) are being arrested, brutalized and their seized hire purchase motorcycles either rotting away at police stations, government yards or like in Lagos State Government style (economic waste) crushed – the means of livelihood of jobless graduates and other able-bodied adults.

This may result in human and welfare crisis, if it has not done that already, which may consume the country or turn them into army of life-time bandits, robbers and kidnappers. Joined with this category is the ever ballooning army of unattended unemployed – graduates especially and those whose jobs were erased as a result of Covid which the #EndSARS movement has willingly recruited.

Again, the rural and urban poverty is so grim and life-threatening while urban poverty can be that crushing and excruciating with no neighbour, the rich, or the government looking in their direction. For the ruralists, they can still have the chance of being accommodated under brotherhood or as their brothers’ keepers.

What of the millions of people without shelter or at best living in inhuman, stinking shanties, who wake up to no hope and will either out of desperation hawk anything or vandalize multi-billion naira public infrastructure and sell off such loots for peanut to live.

Of course, we have the vulnerable – the orphans, the aged, widows and widowers as well as youths on drugs, drug-addled miscreants or vagabonds, the physically or mentally challenged, and the un-rehabilitated convicts who have served out their terms.

All these classes of Nigerians have been pushed out and are on the precipice by the wicked and everybody-for-himself brand of capitalism Nigeria is practicing thereby classifying Nigerians into two main groups – the haves and the have-nots, the rich and the poor, with the middle class completely abolished and left to join the fray of a large, competitive economy.

Several small and big businesses have closed down while the media – newspapers, magazines, radio, TV and online publications – are struggling to survive as some have become extinct without bail-outs.

According to Nigeria’s demographics, the middle class constitutes about 40 percent of the population. In Sub-Saharan Africa countries with a gross domestic income per capita (GDP) of between $1,026 and $12, 475 as of 2015 were classified as middle-income countries. Nigeria and Kenya have been ranked by the United Nations as lower-middle-income countries. Nigeria’s supposed middle class keeps leaving the shores of the country in droves while it is being decimated daily.

Persecondnews recalls that in the administrations of ex-Presidents Olusegun Obasanjo and Umaru Yar’ Adu’a, the middle class rose to about 39 per cent but today it has shrunk to below 10 per cent with the potent threat of extreme poverty doubling down and becoming more tenacious.

Coupled with the current economic problems which are symptomatic of a deeper malaise is the closure of Nigeria’s land borders with other countries for more than two years with the reopening of some and the continued closure of Seme-Benin Republic (Badagry in Lagos State), Idiroko and Ilara (in Ogun State) borders.

Equally devastating on the economy is the collapse of the Naira as a result of its denigration by our leaders – who are now proudly spending dollars openly as against the Naira, the nation’s pride and symbol of unity. In short, the economy has been “dollarized’’ with an apparent lack of confidence in the Nigerian currency.

On the export drive, Nigeria has not fared well or better in the outgoing year as the Manufacturing Sector had continued to complain about inadequate foreign exchange which political leaders and those in the banking sector have access to unhindered.

The President of Manufacturers Association of Nigeria (MAN), Engr. Mansur Ahmed, cried out publicly at an occasion that the nation’s manufacturing sector is dying and gasping for breath.

According to its quarterly research, aggregate Manufacturers CEOs Confidence Index (MCCI) shows that the confidence oscillated under the 50 neutral points: 44.4 points in Q1; 40.2 points in Q2: 43.3 points in Q3; and then 42.06 in Q4 2020, noting that the trend is a strong indication of manufacturers’ lack of confidence in the economy in 2020.

Ahmed said among the challenges facing manufacturers are difficulty in accessing foreign exchange (forex) to procure raw materials not locally available, high cost of electricity/use of generators to power their operations and high cost of transportation.

Others are low demand for the commodity; difficulty in accessing funds; regulatory issues from numerous regulatory agencies; poor port administration and unavailability of raw materials; policy somersaults, but to mention a few.

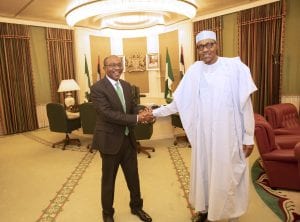

It took Ahmed’s rare courage to lead an advocacy visit of the leadership of MAN to the Presidential Villa, Abuja, on Wednesday, December 29, 2021, to beg President Buhari for his intervention in the forex crisis.

Spontaneously, Buhari promised to take “appropriate measures to improve access to foreign exchange for importation of raw materials and machines that are not available locally’’ and that the relevant Ministry would revisit their concerns about the increase in excise duties on the identified products and other tariff-related matters to enable them to contribute more to the Nigerian economy.

‘‘Our strategic plan to boost manufacturing activities in the country is on course. We will continue to improve the patronage of locally made goods, bridge the gap between skills required by industry and those provided by our tertiary institutions and ensure seamless access to long-term finance for our Small and Medium-Scale Enterprises (SMEs).

‘‘We recognize that MAN remains a key stakeholder in this journey and we will continue our engagement with you,’’ Buhari said.

However, Nigeria’s apparent failure to industrialize and diversify its export base has been brought into focus with an overwhelming disparity between the volume of imported manufactured goods and exports.

According to the National Bureau of Statistics, N40.94 trillion worth of manufactured goods were imported from January 2017 to March 2021 against N4.22 trillion exports.

This imbalance has become dangerously unsustainable in an increasingly turbulent global economy and a country beset with existential economic, political and security problems. Nigeria is spending huge sums of money (forex) importing what it can produce including items like milk and cream in powder, used vehicles and cycles.

Worried by the quagmire Nigeria is in, an Abuja-based financial consultant, Mr Tope Fasua, has canvassed strong positions on what can be done to strengthen the Naira by the CBN. He said the CBN should stop sending many people to the black market for the dollar and introduce measures that will strengthen the Naira. He wants local banks to stock several currencies just as the Bureaus-de-Change do across the world.

According to him, for example, Personal Travel Allowance being authorized by the Apex bank, people traveling to Egypt should be given Egyptian Pounds and not American dollar, those going to South Africa should get Rands. He said it will discourage those planning to round trip the funds.

Lauding CBN’s initiative to prevail onabokifx.com to take down its daily display of parallel or black market exchange rates, Fasua said:“The CBN must consolidate rapidly on its gains by beginning to expand eligible transactions with a view to squeezing out the black market – which will never disappear.

“One of the reasons for the ubiquity of the black market in Nigeria is the ease of doing business with the `Mallams’ and the fact that they seem quite good with relationship management as against the banks whose staff look down on customers seeking foreign exchange.’’

He wants the banker’s bank to diversify the country’s forex base, monitor the banks which keep foreign currencies for their use only and sanction at different levels.

“ If the CBN can show strength, diversify our forex base, monitor the banks, sanction a few at different levels, then randomly it can begin to revalue the Naira by its intervention in the market.’’

For Mr Peter Obi, a former Anambra Governor and a banker, there is a need for the government and the CBN to pull at least 40 million Nigerians out of poverty to swell the 40 million working and taxable people to increase the tax earnings of the country.

Describing the Anchor Borrowers Programme as a scam, he said the focus should be more on big commodity farmers instead of small players, alleging that the money was being shared to politicians instead of rice and other commodity farmers.

“The CBN should target big rice farmers like the man in Kano, (established in 2006) who has the biggest rice mill – Umza Rice Mill. He will harvest and process it and sell locally and then export it. Going to farmers direct will not work.

“They should pull people out of poverty first before talking of infrastructure. Nigeria is borrowing for consumption and not for investment; they should borrow specific sectors of the economy such as power, education and not for various projects. It is bad borrowing,’’

Persecondnews.com quotes Obi as saying, but adds, “CBN should also re-strategise.

“In addition, the CBN should also target Micro, Small, Medium and Small Enterprises (MSMEs), they are the engine of economic growth.’’

A veteran financial journalist, who did not his name in print, said the continued intervention of the Federal Government in the operations of the apex bank had resulted in the situation the country finds itself.

“The pressure from politicians is one of the biggest challenges affecting the management of the economy by the CBN. While the CBN will starve manufacturers of forex, yet it will find it convenient to allocate dollars and others to politicians. It needs to reduce the demand for dollars by corrupt politicians who just spray the money at social parties and not for something productive.

On export, he accused the CBN of not doing enough to make export attractive instead of funding some government projects and programmes which do not have a direct impact on the lives of the people.

As the nation transits to a new year – 2022, the CBN should aggregate the viewpoints and policies espoused by experts and put Nigeria on the road to economic recovery and prosperity and detour around the road to economic hades. It should engage with stakeholders particularly past governors of the bank, critics and analysts for a better economic outlook in 2022.

In the agric sector, the CBN created NIRSAL Plc (the Nigeria Incentive-Based Risk Sharing System) has done well in the upstream and downstream agric value-chain with visible and evidential results across the country.

Leave a comment