The Central Bank of Nigeria’s ban of sales of foreign exchange to Bureau de Change (BDCs) has forced many Nigerians to devise fraudulent and disingenuous ways of getting foreign currencies from the banks in what is referred to as round tripping of foreign currencies.

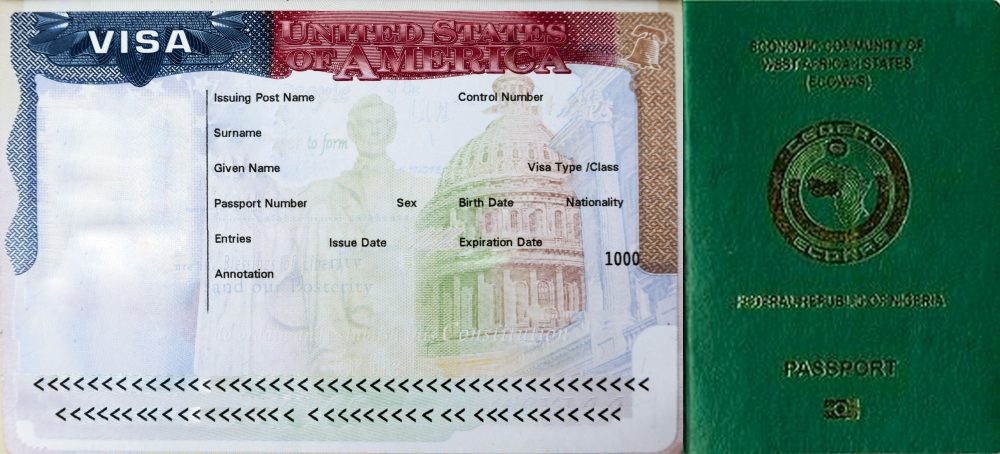

Nigerians posing as travellers have desperately procured fake U.S. visas and other visas and presented same with their passports to qualify for purchase of foreign currencies in banks.

Persecondnews investigations show that the fake travellers upon purchasing the dollars and other currencies at a relatively cheaper, official rate of about N412 to a dollar now resell the currencies for about N510 to a dollar.

On Wednesday, August 11, 2021, most banks in Lagos metropolis had a hectic time controlling and attending to the crowds of desperate forex purchasers.

Some banks had to engage the services of travellers to help them detect fake visas and other documents presented by them under the guise of travelling out of the country.

At least about three people were caught with fake visas at a bank in Lagos on Wednesday, Persecondnews learnt.

“The situation is so bad now that the CBN has banned sale of foreign currencies to Bureau de Change operators in the country that many people particularly the forex traders have taken advantage of the situations to besiege the banks for their requests.

“Some of them have resorted to procuring fake documents to approach the banks for forex and they will in turn go to the black market to sell the dollars and other currencies at a higher rate thereby making huge sums of money,’’ a senior official of a commercial bank told Persecondnews.

According to Persecondnews findings, some of them use two or three fake names in procuring passports which they use in securing visas some of which are fake.

On July 27, 2021, the CBN had announced that it has ended the sales of forex to Bureau De Change operators.

The CBN Governor, Mr Godwin Emefiele announced the ban in a live TV broadcast after the bank has retained its benchmark policy rate.

Emefiele said the ban was necessary because the parallel market has become a “conduit for illicit forex flows and graft’’.

“We are concerned that BDCs have allowed themselves to be used for graft.

“This measure is not punitive on anyone, but it is to ensure the CBN is able to carry out its legitimate mandate of serving all Nigerians,’’ he said.

According to Emefiele, the apex bank will no longer process applications for BDC licences in the country.

“Weekly sales of foreign exchange by the CBN will henceforth go directly to commercial banks.

“We will deal ruthlessly with banks allowing illegal forex dealers to use their platforms and will report the defaulting international organisations to their regulators.

“We will deal with them ruthlessly and we will report the international bodies,” Emefiele said.

Emefiele directed banks to “immediately” and transparently sell forex to customers who present the required documents, adding that all banks are to create immediately dedicated tellers for the same purpose.

He said international bodies, including some embassies and donor agencies, have been complicit in illegal forex transactions that have hindered the flow of foreign exchange into the country.

The CBN governor accused the organizations of choosing to channel forex through the black market than use the official Investors and Exporters (I&E) window, called NAFEX.

Leave a comment