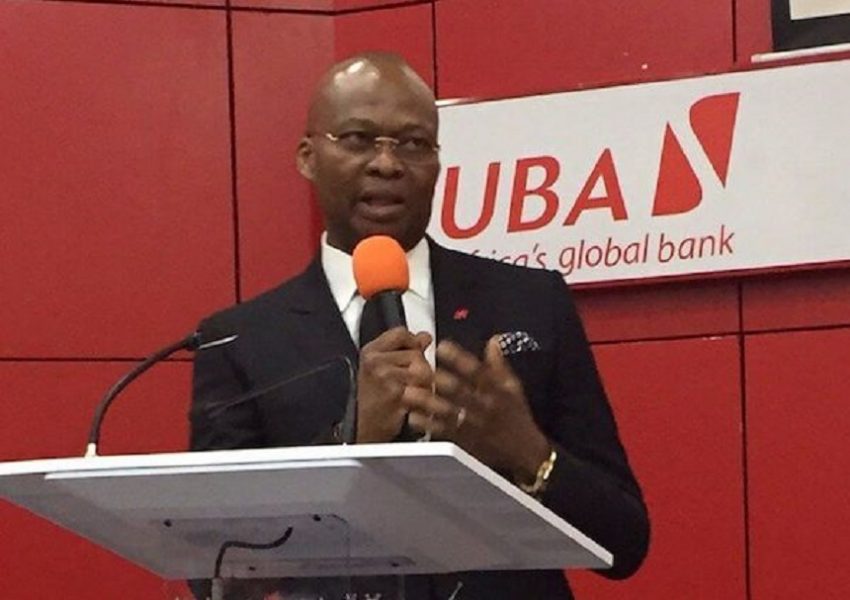

BusinessDay newspapers Thursday announced Mr. Kennedy Uzoka, the Group Managing Director/Chief Executive Officer of United Bank for Africa (UBA) Plc, the ‘BusinessDay’s Bank CEO’ of the year 2019 award.

“The visionary leadership of the bank spearheaded by Uzoka has earned UBA the digital bank of the year consistently, the newspaper said during presentation of the award to the GMD.

“The launch of LEO, an artificial intelligence chatbot in January of 2018 has witnessed UBA become the leader in artificial intelligence. Leo is available on different platforms including Whatsapp, Facebook and more recently on IOS, the mobile operating system of Apple Inc.”

Uzoka emerged tops based on his sterling achievements since he assumed the position of Group CEO at UBA three years ago.

Following Uzoka’s appointment on August 1st, 2016, UBA’s customer deposit has grown by 19.4% to N2.49tn away from the four per cent crunch which had been recorded the previous year, while net loans improved from a 3.3 per cent loss position recorded in 2015, to N1.51tn, representing a huge incline by 45.2 per cent.

The strong growth trajectory has continued, three years after Uzoka’s appointment, as seen by the 43 per cent growth in the bank’s shareholding fund to N5.01tn in the three –year period, as the bank has been enjoying excellent ratings from credible international financial rating agencies such as Fitch and Agusto and Co.

Uzoka, who received and acknowledged the award with a keen sense of humility and responsibility, said the bank has been focused on putting the customer first in all its activities, adding that this has been the focal point and driving force of the bank in the past three years. “Our commitment to customer service excellence is translating to strong, operational and financial efficiency,” Uzoka said.

He reiterated the bank’s commitment to continue to put customers at the forefront of its activities, adding, “We are focused on adding value to the customers as we strive to give them an excellent experience at all times. We do this by having a vivid understanding of our customers and their specific needs, and by effectively monitoring their satisfaction through the feedback mechanism, and more importantly, making valuable improvements from their feedback. I am pleased to see we are increasingly becoming the bank of choice for individuals and businesses across Africa.”

Leave a comment