Diamond Bank has confirmed that is its being acquired by Access Bank, following weeks of speculations and denials.

The bank, in a written statement signed by its Company Secretary/Legal Adviser, Uzoma Uja, said “completion of the merger is subject to certain shareholder and regulatory approvals. The proposed merger would involve Access Bank acquiring the entire issued share capital of Diamond Bank in exchange for a combination of cash and shares in Access Bank via a Scheme of Merger.”

This confirms Per Second News’ report last night that Diamond Bank is being acquired by Access Bank, pending an approval from the Central Bank of Nigeria (CBN).

“Immediately following completion of the merger, Diamond Bank would be absorbed into Access Bank and it will cease to exist under Nigerian law,” Uja said the statement, adding that: “The current listing of Diamond Bank’s shares on the NSE and the listing of Diamond Bank’s global depositary receipts on the London Stock Exchange will be cancelled, upon the merger becoming effective.”

Diamond Bank’s shareholders are expected to receive “a consideration of N3.13 per share, comprising of N1.00 per share in cash and the allotment of two (2) New Access Bank ordinary shares for every seven (7) Diamond Bank ordinary shares held as at the Implementation Date,” based on the agreement reached by the boards of the two financial institutions.

The bank being acquired said its board “believes that the merger is in the best interest of all stakeholders including, employees, customers, depositors and shareholders and has agreed to recommend the offer to Diamond Bank’s shareholders,” as according to it, “the offer represents a premium of 260% to the closing market price of N0.87 per share of Diamond Bank on the Nigerian Stock Exchange (“NSE”) as of December 13, 2018, the date of the final binding offer.”

Diamond Bank expects the transaction to be completed in the first half of 2019.

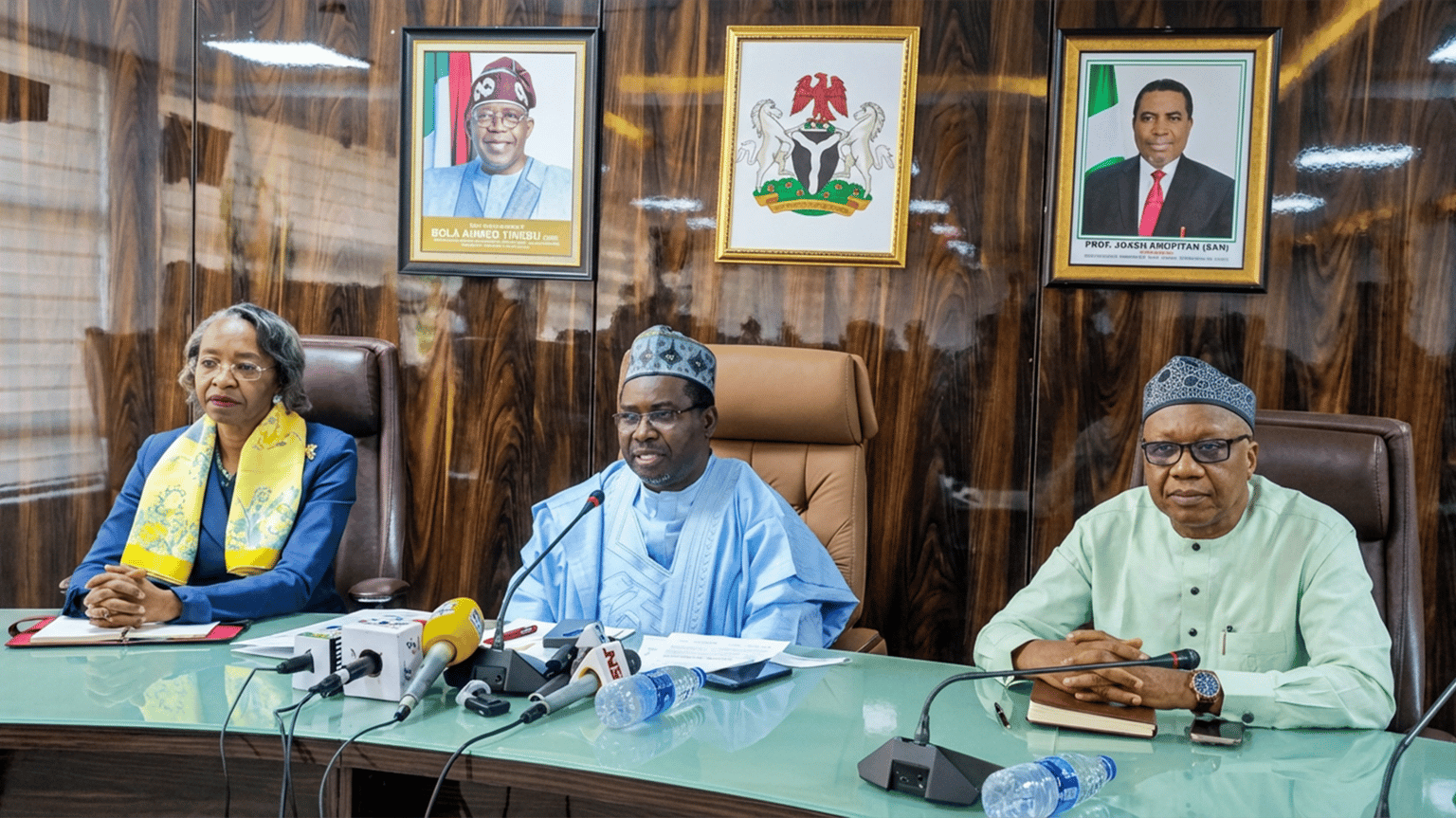

The Securities and Exchange Commission (SEC) of Nigeria in a press release this evening confirmed it is aware of the merger between Access Bank and Diamond Bank.

Leave a comment