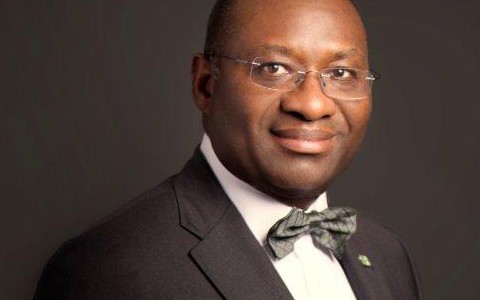

The MD/CEO of Heritage Bank Plc, Mr. Ifie Sekibo, the President/Chief Executive of the Africa Finance Corporation (AFC), Mr. Andrew Alli and other leading experts in the financial sector are expected to proffer solution to the challenges of infrastructure financing in the country, at the 2017 annual conference of the Finance Correspondents Association of Nigeria (FICAN).

Others expected at the annual event which holds at the Orchid Hotels, Lekki, Lagos, on Saturday, 16th September, include the Managing Directors/Chief Executive Officers of the Rand Merchant Bank, Mr. Micheal Larbie; SunTrust Bank Limited, Mr. Mohammed Jibrin; Viathan Engineering Limited, Mr. Ladi Sanni; as well as the Acting Director General of the Infrastructure Concession Regulatory Commission, Engr. Chidi Kingsley Izuwah.

The theme of the conference is: “Financing Nigeria’s Infrastructure: Issues, Challenges, and Options.”

FICAN in a statement stressed that the place of infrastructure in economic and social development of a country cannot be over emphasised.

Infrastructure financing, according to the association, plays critical roles in promoting economic growth, standard of living, poverty reduction by enhancing productivity, improving competitiveness and linking people and organisations together through telecommunications.

It also contributes to environmental sustainability.

Nigeria is currently faced with huge infrastructural gap that has hindered its earnest desire to exploit its rich natural and human resources for its development. For instance, in spite of the country’s huge oil and gas, sunlight and hydro resources, Nigeria cannot generate enough electricity to drive its development.

“Indeed, Nigeria’s infrastructure deficit had stymied its economic growth, restricted productivity of its economy and limited its competitiveness. The challenge of the absence of critical infrastructure continue to impact negatively on the cost of doing business, investment, and capital inflow into the country,” the statement added.

It had been projected that the country needs to invest $10 billion annually over the next 10 years for it to significantly reduce its infrastructure deficit. Some of the sectors that require huge investments include power, housing and highways, railways, ports, airports, dams, bridges and tunnels, oil and gas, water and sanitation and telecommunication.

Therefore, presently, the need to evolve creative options to generate long-term finance to tackle Nigeria’s infrastructural challenges is one of the most important questions agitating the minds of policy makers in public and private sectors.

“What are the appropriate financing vehicles to enable the federal, states and local governments in the country achieve the objective of infrastructure development? Are Nigerian banks well positioned to finance such big-ticket deals?” are among the issues the experts are experted to discuss at the conference.

Leave a comment