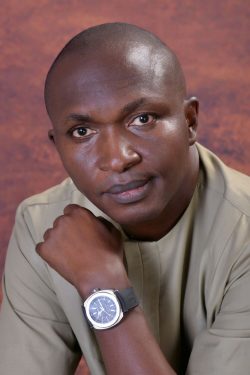

A U.S federal jury in Medford convicted Emmanuel Oluwatosin Kazeem, 34, of Bowie, Maryland and Nigeria of 19 counts of mail and wire fraud, aggravated identity theft and conspiracy to commit mail and wire fraud.

Based on evidence presented at the trial, Kazeem obtained over 125,000 stolen taxpayer identities from throughout the United States for use in a tax fraud scheme. He purchased over 91,000 of those identities from a Vietnamese hacker that originated from an Oregon company’s database. Most of those identities belonged to victims living in Oregon and Washington.

Between 2012 and 2015, the taxpayer identities were used to file fraudulent tax returns. As part of the fraud scheme, Kazeem passed many of the identities to his co-conspirators located in the Atlanta, Georgia area and in Nigeria. He instructed co-conspirators on how to use the stolen personal identifying information to obtain electronic filing PINs from the Internal Revenue Service (IRS) in the taxpayers’ names for use in filing the fraudulent tax returns; create fictitious W-2 wage documents; and acquire and register prepaid debit cards in the taxpayer’s names to receive the fraudulent tax refunds.

Kazeem also used taxpayers’ personally identifiable information to gain unauthorized access into many taxpayers’ IRS transcripts containing sensitive personal financial information. Kazeem and his co-conspirators used the information to E-file federal tax returns as well as state tax returns in Oregon. Over 2,800 fraudulent federal tax returns were linked to Kazeem with attempted refunds totaling in excess of $26 million dollars and actual losses to the U.S. Treasury totaling nearly $7 million dollars. IRS criminal investigators traced over 2,000 wire transfers involving $2.1 million dollars in fraudulent tax refunds wired to Nigeria by Kazeem and his co-conspirators.

Evidence seized from Kazeem’s Maryland residence revealed over $190,000 cash invested in the recent purchase of a newly constructed home; the purchase of a Maryland townhouse for $175,000 cash shortly before his arrest; average monthly personal credit card payments of over $8,300 during a four-year period; and recent negotiations to construct a hotel in Lagos, Nigeria. IRS criminal investigators determined Kazeem had no verifiable income sources during this period.

Kazeem is scheduled to be sentenced in the federal district court in Medford before U.S. District Court Judge Ann Aiken on November 8, 2017.

This case results from a joint investigation by IRS-Criminal Investigation (IRS CI), the U.S. Department of Health and Human Services, Office of Inspector General (HHS OIG) and the FBI. Investigative support was provided by the Treasury Inspector General for Tax Administration (TIGTA); the U.S. Postal Inspection Service (USPIS); the U.S. Department of State; the U.S. Department of Homeland Security, Homeland Security Investigations (DHS HSI) and U.S. Citizenship and Immigration Services (USCIS). The case was prosecuted by Byron Chatfield and Gavin Bruce, Assistant United States Attorneys for the District of Oregon.

Leave a comment