Nigeria has successfully raised $2.2 billion in the international capital market through its latest eurobond issuance, the Debt Management Office (DMO) has announced.

The development, which comes two years after the country’s last eurobond offering, aims to finance the N9.1 trillion deficit in the 2024 budget and bolster economic reforms.

The DMO in a statement on Monday stated that two eurobonds were auctioned on December 2, 2024: a 6.5-year bond maturing in 2031 and a 10-year bond maturing in 2034.

The bonds, priced at $700 million and $1.5 billion, respectively, were issued at coupon rates of 9.625% and 10.375%.

“The proceeds from this Eurobond issuance will be used to finance the 2024 fiscal deficit and support the government’s budgetary needs,” DMO said.

“Nigeria mandated Chapel Hill Denham, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank as joint bookrunners. FSDH Merchant Bank Limited acted as financial adviser on the issuance.”

Despite being priced at $2.2 billion, the eurobond offering attracted overwhelming investor interest, with a peak order book exceeding $9 billion.

This robust demand came from a wide range of global investors, including fund managers, insurance and pension funds, hedge funds, banks, and other financial institutions across the UK, North America, Europe, Asia, the Middle East, and Nigeria.

According to the DMO, the notes will be listed on the UK Listing Authority’s official list, the London Stock Exchange, the FMDQ Securities Exchange Limited, and the Nigerian Exchange Limited.

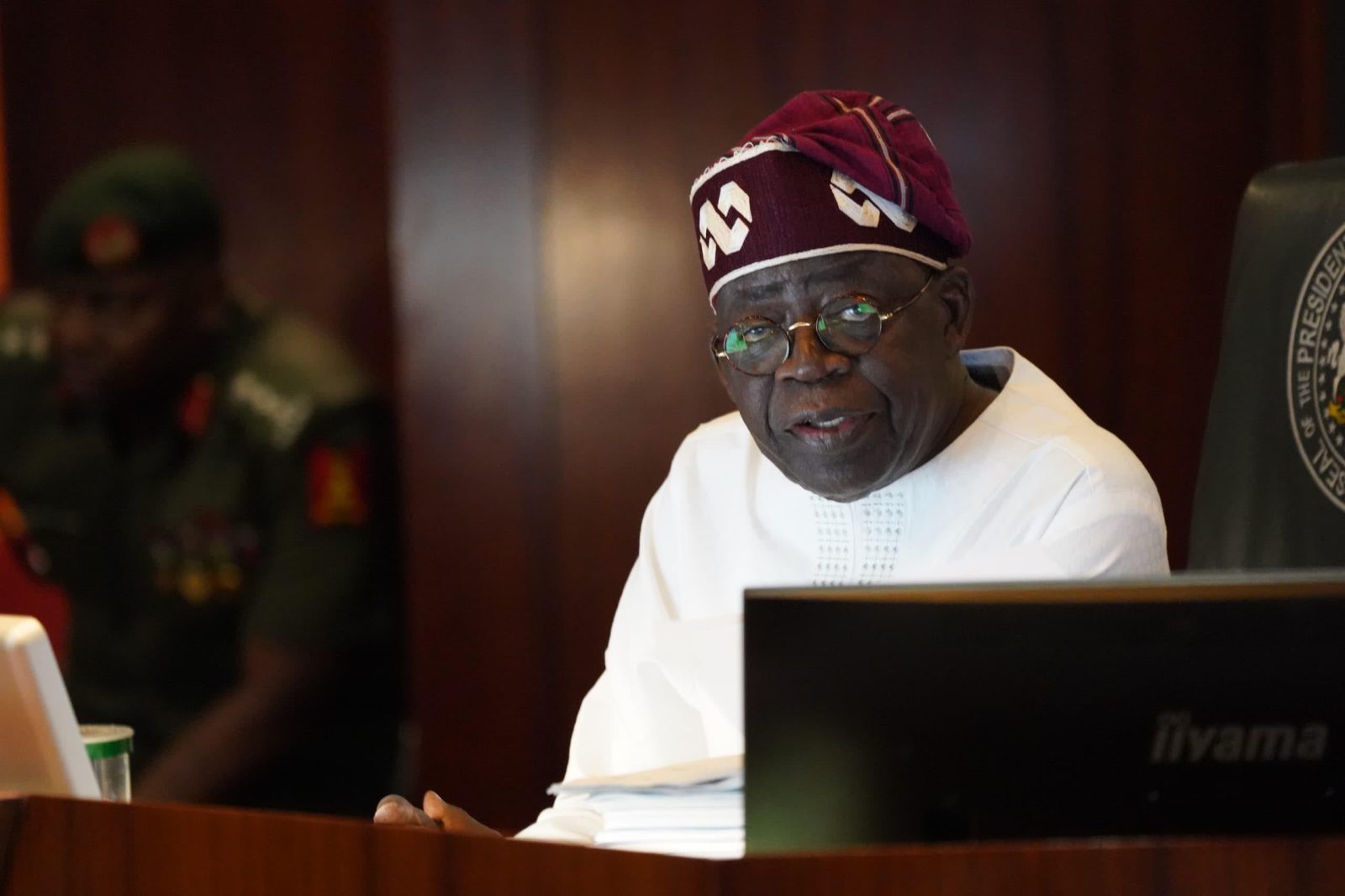

Finance Minister Wale Edun hailed the successful issuance as a signal of increasing investor confidence in Nigeria’s economic policies under President Bola Tinubu’s administration.

“The broad range of investor appetite is encouraging as we continue to diversify our funding sources and deepen engagement with international markets,” Edun said.

Central Bank of Nigeria Governor Dr. Olayemi Cardoso added that the transaction underscores Nigeria’s improving credit profile and growing investor trust.

Patience Oniha, Director-General of the DMO, described the outcome as a “landmark achievement,” highlighting the strong and diverse investor base that contributed to favourable pricing.

“The size of the order book at approximately 4.18x of the offer amount, and the strong and diverse investor base helped to price the new 6.5-year at 9.625%, while the new 10-year notes were priced at 10.375%,” she said.

The DMO reaffirmed its commitment to transparency and expressed gratitude to the international and Nigerian investors who supported the transaction.

Leave a comment