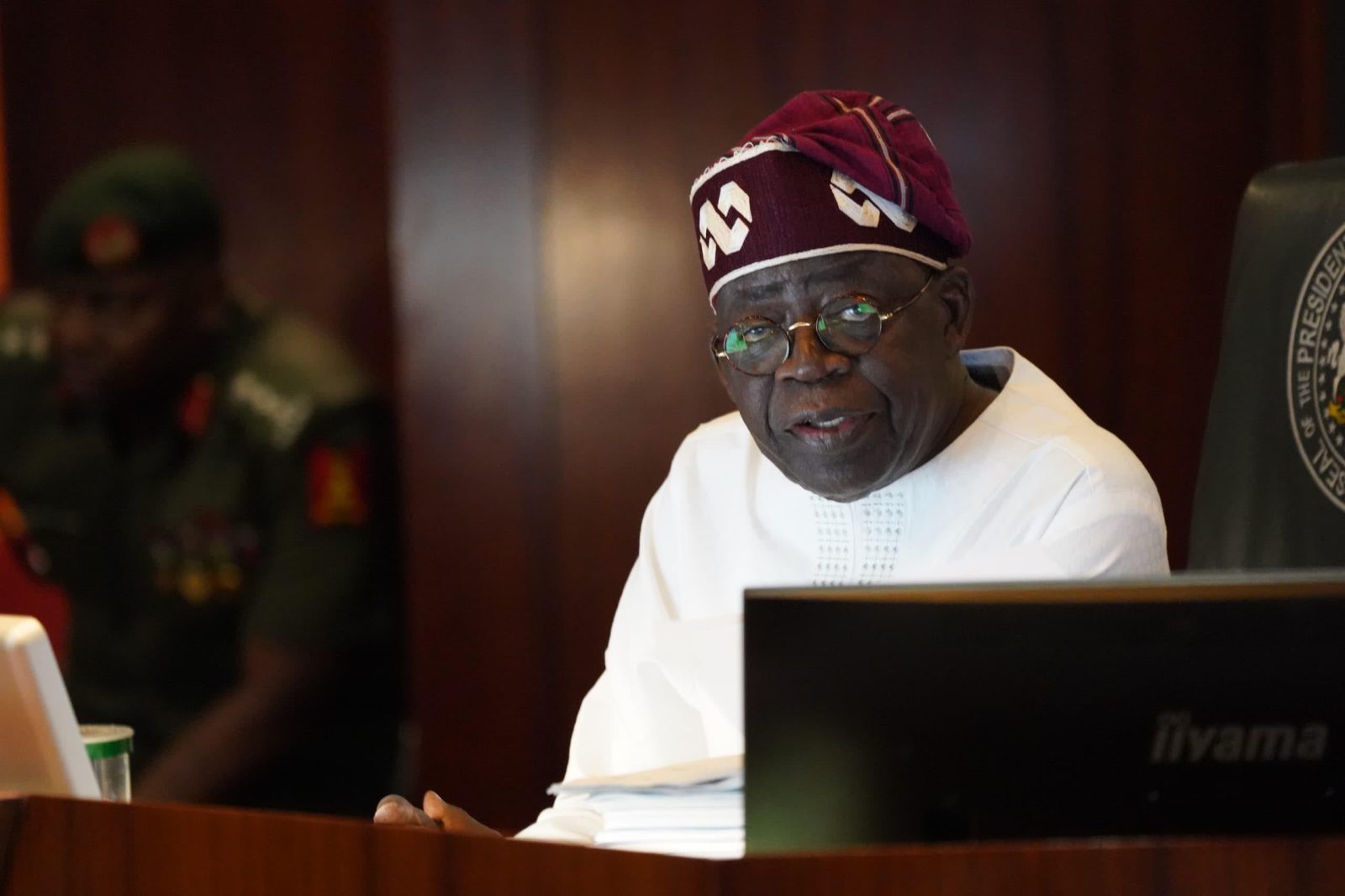

In a bold move to promote transparency and fairness in taxation, President Bola Tinubu has launched a Personal Income Tax Calculator, allowing Nigerians to estimate their tax obligations under the new tax regime.

President Tinubu, in a post on his official X handle on Friday, said the new tax laws, which take effect from January 2026, are aimed at lifting the burden on vulnerable groups and creating a path of equity, fairness, and true redistribution in the economy.

“A fair tax system must never punish poverty or weigh down the most vulnerable,” he emphasized.

“With the new tax laws I recently signed, taking effect from January 2026, we have lifted this burden and created a path of equity, fairness, and true redistribution in our economy.”

Persecondnews reports that the personal Income Tax Calculator allows individuals to compare their current tax payments with estimates under the new laws.

“It shows clearly how these reforms protect low-income earners, ensure progressivity, and simplify compliance in order to deliver a transparent system that works for all,” Tinubu explained.

This initiative is part of the administration’s broader tax reform agenda, aimed at expanding government revenue without stifling growth or disproportionately affecting ordinary Nigerians, he noted.

The Nigerian leader urged citizens to engage with the reforms, expressing optimism about their long-term benefits.

“Together, we are renewing hope in the Nigeria of our dreams. Take a bet on our country. Bet on Nigeria to work for you, your family, and your community,” he said, urging Nigerians to have faith in the country’s future.

Persecondnews recalls that in June Tinubu had signed the four Tax Reform Bills.

They include the Nigeria Tax Act (NTA), The Nigeria Tax Administration Act (NTAA), The Nigeria Revenue Service Act (NRSA) and the Joint Revenue Board Act (JRBA).

The Acts comprehensively overhaul the Nigerian tax landscape to drive economic growth, increase revenue generation, improve the business environment and enhance effective tax administration across the different levels of government.

The NTA increases the Capital Gains Tax rate from 10% to 30% for companies. This effectively aligns the CGT and Companies Income Tax rate and reduces any tax arbitrage that could have been unduly enjoyed in the classification between chargeable gains and trading income.

For individuals, capital gains will be taxed at the applicable income tax rate based on the progressive tax band of the individual

Leave a comment