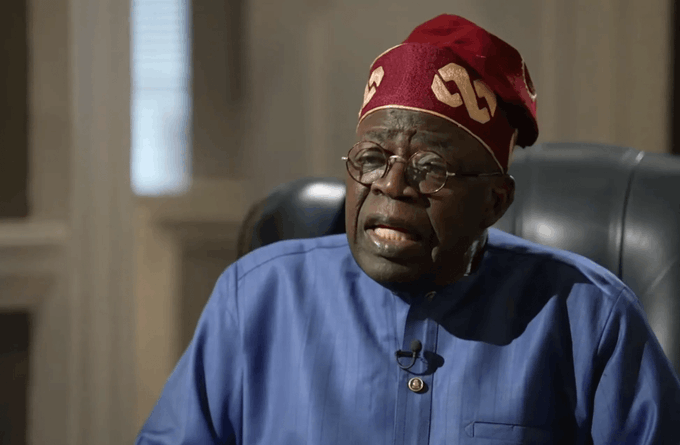

List achievements as getting Nigeria to exit recession faster than developed economies of the world, banning banks, others from facilitating trading and dealings in cryptocurrency to save the economy, making dollar available through the banks, stopping Bureau de Change from dealing in forex, etc

With the myriad globally accepted and farsighted economic policy intervention to reflate the economy coupled with the banning by the Central Bank of Nigeria (CBN) of banks, non-banking institutions and other financial institutions from facilitating trading and dealings in cryptocurrency, stakeholders and industry watchers have lauded the apex bank, who noted that China took a cue from the CBN’s action.

The stakeholders including industry watchers and economic journalists believed the proactive and foresighted measure of the CBN under the governor, Mr Godwin Emefiele, was another step in the right direction to stabilize and save the nation’s economy as well as fight money laundering, terrorism financing, purchase of small arms and light weapons and tax evasion.

They noted that the Emefiele team including a World Bank staff has conceptualized and enunciated sound policies to bring sanity to the country’s system and had helped Nigeria to exit COVID-19 induced recession faster than advanced and developed economies of the world.

Persecondnews recalls that China with its economy almost suffocating from Bitcoin, declared all cryptocurrency transactions in the country illegal. It has banned crypto mining nationwide.

According to the People’s Bank of China, “the decision was made in order to safeguard people’s properties and maintain economic , financial and social order.’’

China’s policy intervention came after Nigeria’s apex bank prohibited transactions in Bitcoin.

Ten Chinese government agencies, including the People’s Bank of China (PBC) said in a joint statement on Friday they would clamp down on cryptocurrency trading.

China has declared all transactions involving Bitcoin and other cryptocurrency trading illegal.

It has banned crypto mining nationwide.

Ten Chinese government agencies, including the PBC said in a joint statement on Friday they would clamp down on cryptocurrency trading.

Trading in crypto-assets had already been restricted in China. Beijing is trying to cease activity in crypto-assets that the government can’t control as it tests issuing its own digital Yuan.

Emefiele, announcing the ban on February 23, 2021, while briefing a joint Senate Committee on Banking, Insurance and Other Financial Institutions; ICT and Cybercrime; and Capital Market, said the anonymity, obscurity and concealment of cryptocurrencies made it suitable for those who indulge in illegal economic activities to destroy the economy.

The governor described the operations of cryptocurrencies as dangerous and opaque, said the use of cryptocurrency contravened an existing law, noting “given the fact that cryptocurrencies were issued by unregulated and unlicensed entities made it contrary to the mandate of the Bank, as enshrined in the CBN Act (2007) declaring the Bank as the issuer of legal tender in Nigeria.

Drawing a marked distinction between digital currencies and cryptocurrencies, he said while the Central Bank can issue digital currencies, cryptocurrencies are issued by unknown and unregulated entities,

Citing instances of investigated criminal activities that had been linked to cryptocurrencies, the CBN governor underscored that the legitimacy of money and the safety of Nigeria’s financial system was central to the mandate of the CBN.

“Cryptocurrency is not legitimate money because it is not created or backed by any Central Bank. Cryptocurrency has no place in our monetary system at this time and cryptocurrency transactions should not be carried out through the Nigerian banking system.

“The CBN would do everything within its regulatory powers to educate Nigerians on emerging financial risks and protect our financial system from the activities of currency speculators, money launderers, and international fraudsters,’’ Persecondnews quotes the helmsman as saying.

However, a journalist who has been covering the money market for about three decades drew a nexus between those who are hard-hit by the CBN’s pro-people policies and the calls for the scalp of the governor in recent times over foreign exchange crisis being fueled by exchange manipulators and speculators.

“It is an attestation to the robust and farsightedness of our CBN. There is so much economic and social stability with the intervention of the bank in agriculture, job creations and refunding of the SMEs and other businesses across the country.

“However, economic saboteurs within and outside the country are busy at work, circumventing and shortchanging the economy,’’ said a senior financial journalist in Lagos, who craved anonymity.

“Just like the CBN governor has fingered those speculating and manipulating the parallel exchange rate market as Nigeria’s real enemy, I equally share his position and I wish to submit that some of them are Nigerians who are making humongous money from these frauds that are killing the Naira and the economy. Just for their selfish gains,’’ he said.

An Economist, Dr Alex Shuam said any attempt to rubbish or discredit the good job of Emefiele, would fail as he has been able to give a good account of himself through the various interventionist programmes and policies.

“They are unprecedented in the history of this country. Look at CBN’s intervention in agriculture, mobilization and roll-out of stimulus package and loans to SMEs following COVID-19.

“Blaming the CBN for free fall of the Naira is laughable. There are a lot of saboteurs in the system particularly in the banks and among Nigerians. Look at how some unscrupulous Nigerians devised disingenuous ways of getting dollar from the banks as directed by the CBN.

“Some got fake travel documents including visas without travelling just to collect the dollar and go and sell at the black market – round-tripping. How is this the CBN governor’s fault? ‘’

A former top official of the apex bank (name withheld) said the CBN should be left to manage the economy without interference and undue pressure from politicians.

He said:“The truth is we are not getting enough foreign exchange from export as a nation. We import more than we export. And the dollars we have are being demanded and collected by politicians who now drive pleasure in spending dollar and not the Naira.

“The CBN should be truly independent and be allowed to do its work as the banker’s bank and managers of the economy. Prohibiting Bureau de Change from dealing in foreign exchange is a step in the right direction.’’

Aligning itself with the CBN’s interventions, the Nigerian Securities and Exchange Commission (SEC) noted that any investment in cryptocurrency is unprotected and will be unmitigated.

SEC Director-General, Lamido Yuguda, said both SEC and CBN are on the same page on the issue, clarifying:“There is no policy contradiction between the CBN directive and the pronouncements made by the SEC on the subject of cryptocurrencies in Nigeria.

Prior to the CBN directive, he said the SEC had, in 2017, cautioned the public on the risks involved in investing in digital and cryptocurrency,

“The CBN, Nigeria Deposit Insurance Corporation (NDIC) and the SEC between 2018 and 2020 had also issued warnings on the lack of protection in investments

in cryptocurrency.’’

“Following the CBN directive, the SEC had put on hold the admittance of all persons affected by CBN circular into its proposed regulatory incubatory framework in order to

ensure that only operators that are in full compliance with extant laws and regulations are admitted into the framework for regulating digital assets,’’ Yuguda said.

READ ALSO :Planning to invest in bitcoins

Leave a comment