… a deliberately misplaced, outright falsehood that is totally lacking in basic credibility. NIRSAL provides a window through its copious clarifications as contained in this publication for the purveyors of these falsehoods to retract their defamatory publications or face a libel suit’’

“It is the latest in a string of fabricated attacks against NIRSAL Plc in the ferocious and intensely personalized campaign against the Corporation’s MD/CEO, Mr Aliyu Abdulhameed’’

“Some online news platforms have flooded the online media with innuendos and outright lies against NIRSAL Plc, its Management and its Board with the sole intent of misleading the public, libellously damaging the reputation of the organization and those of its Management and Board of Directors’’

The Nigeria Incentive-Based Risk Sharing System for Agricultural Lending (NIRSAL) has described as bush telegraph a report by an online medium that is making the rounds about a “corruption scandal” allegedly perpetrated by NIRSAL Plc’s leadership.

The sponsored report which did not only lacked credibility and factualness was hinged on a document that was unofficially obtained to hoodwink the public with a distorted interpretation of privileged official communication between NIRSAL Plc and its owner, the Central Bank of Nigeria, which oversees its operations.

A routine internal communication between CBN and NIRSAL Plc to activate a workable loan repayment/recovery agreement with Anchor Borrowers’ Programme (ABP) farmers was transformed and ignorantly interpreted to a “corruption scandal” allegedly perpetrated by NIRSAL Plc’s leadership.

The unintelligible notion that a typical CBN internal administrative communication, to its own company, was tantamount to a sanction against NIRSAL Plc for “corruption” is a deliberately misplaced, outright falsehood that is totally lacking in basic credibility.

NIRSAL has, therefore, provided a window through its copious clarifications as contained in this publication for the purveyors of these falsehoods to retract their defamatory publications or face a libel suit.

The explication by NIRSAL followed enquiries from concerned stakeholders, partners and other associates about the publication of a sponsored and defamatory report by the online medium that is fast gaining notoriety for the dissemination of elaborate fictions in the name of journalism.

“The clarifications provided in this statement afford the purveyors of these falsehoods the opportunity to retract their defamatory publications, failing which a libel suit shall be instituted against all such entities that have now made it a full-scale industry to malign and spread defamatory falsehood against NIRSAL Plc and its leadership team.

“The report is not only lacking in credibility but is also totally ridiculous when clear facts and contexts are considered.

“It is the latest in a string of fabricated attacks against NIRSAL Plc in the ferocious and intensely personalized campaign against the Corporation’s MD/CEO, Mr Aliyu Abdulhameed. Some online news platforms have flooded the online media with innuendos and outright lies against NIRSAL Plc, its Management and its Board with the sole intent of misleading the public, libellously damaging the reputation of the organization and those of its Management and Board of Directors.

“It is a very meticulously designed and well-funded project that they have embarked upon and have been ferociously executing over the last two years.

“To make things clear, NIRSAL Plc is a wholly-owned investee company of the CBN, incorporated with the main mandate to de-risk agriculture and facilitate agribusiness.

“Being the sole owner of NIRSAL Plc, the CBN does have the right to assign to it other tasks that are related to its core mandates issuance of credit risk guarantees to banks and investors for agriculture and agribusiness projects, technical assistance to project owners and financiers (such as training farmers, project design and management), rating and incentivizing actors in the agricultural value chain and agricultural finance market place, etc,’’ Persecondnews quotes from a statement by NIRSAL.

The statement is titled, “NIRSAL Plc And The CBN’s Anchor Borrowers’ Programme: The Incontrovertible Facts Beyond Baseless Fictions’’.

It explained that one such assignments different from its core mandate of credit risk guarantee operations is to serve as a Participating Financial Institution (PFI) in the CBN’s Anchor Borrowers’ Programme (ABP) – a scheme through which the CBN provides loans to farmers on very concessional terms.

Over the last few years, the ABP has turned out to be one of the most successful programs of the CBN and the Federal Government of Nigeria (FGN) with outcomes that include reduction in food importation, full capacity utilization of agricultural firms, preservation of scarce foreign exchange and creation of jobs. It is important to note that the ABP has also helped Nigeria exit recession twice and in record time.

Within five years of its existence, NIRSAL has facilitated over N120 billion of critical funding into key agricultural projects.

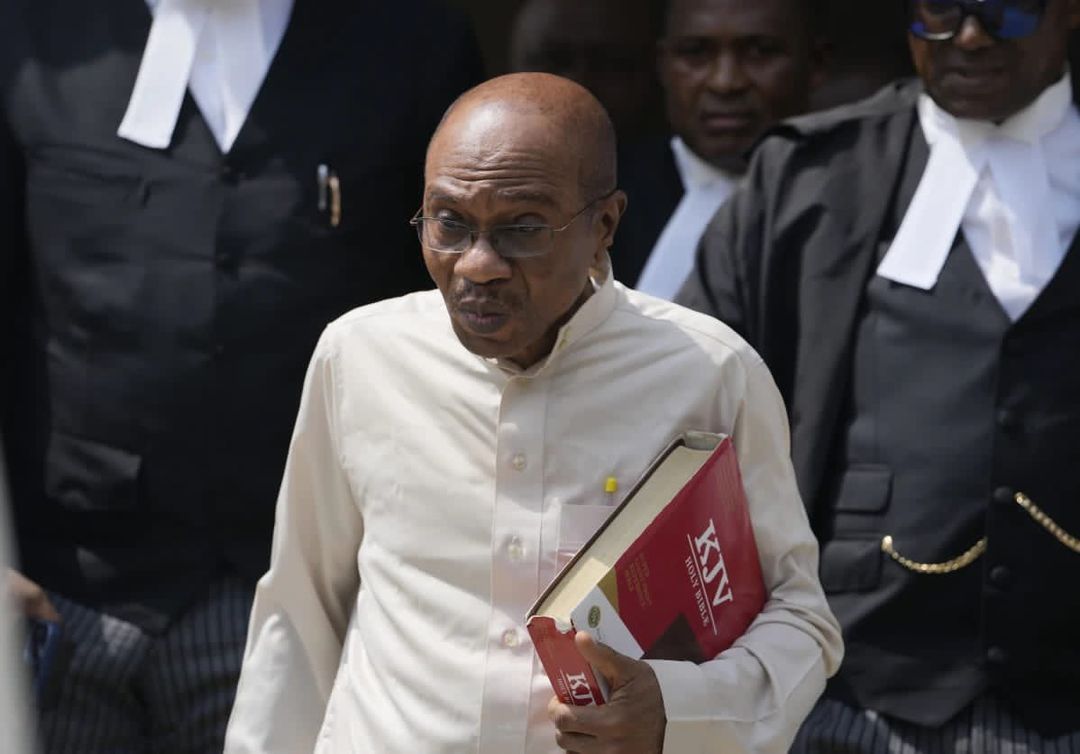

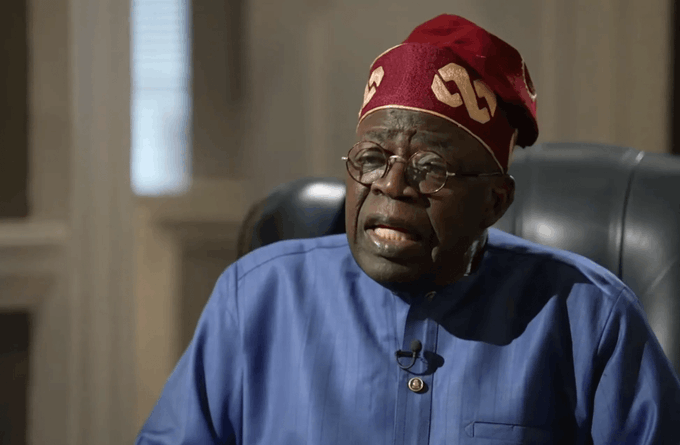

Giving kudos for the oversight and inspiration of Mr. Godwin Emefiele, CBN Governor and board Chairman of NIRSAL Plc, Mr. Abdulhameed, working with a competent and highly motivated team, has built NIRSAL Plc, from the ground up into an effective high-profile institution with a well-developed internal governance processes and controls, while remaining a steadily profitable going concern as a public liability company.

The stellar performance and strings of successes of NIRSAL have, however, become Abdulhameed’s albatross, fueling the anger of a cabal that is determined to also rubbish the successes of the Buhari administration’s passionate focus on agriculture and agribusiness in their desperation to hound and destroy Mr. Abdulhameed.

The statement said:“But we are not intimidated. We are confident that, like previous campaigns of falsehood against NIRSAL Plc’s leadership, this will also fail because our performance speaks for us and the truth will ultimately prevail.

“NIRSAL PLC will continue to focus on making progress on its mission and mandate as we strive to achieve more critical outcomes and milestones for the agricultural and financial sectors in the larger interest of Nigeria and Nigerians.

“More importantly, this statement is an expression of our commitment to rigorous transparency and accountability in the execution of our mandate and the discharge of our responsibilities to the agricultural and financial sectors and, ultimately, the farmers and the ordinary people of Nigeria who are both the inspiration and beneficiaries of our efforts.

“The incontrovertible fact is that NIRSAL PLC’s track record as a Participating Financial Institution (PFI) in the CBN Anchor Borrowers’ Programme has been a very positive one characterized by quality performance and significant milestones which have contributed a strong value to the scheme.

“It is also an unimpeachable fact that our performance in loan management and loan repayment/recovery from farmers under the ABP, a process which is still ongoing as more farmers are harvesting and selling their produce, is a solid one that compares favourably with peers in the scheme.’’

On the status of NIRSAL, the statement clarified that the organization is not synonymous with the CBN’s Anchor Borrowers’ Programme.

Contrary to the impression given in the false reports of the online medium, NIRSAL Plc is one of several Participating Financial Institutions (PFIs), not the only one involved in the ABP.

As a matter of fact, the scheme was launched in 2015 (two years before NIRSAL Plc’s involvement) by President Muhammadu Buhari to create a linkage between anchor companies involved in the processing of agricultural produce and smallholder farmers of the said produce.

“The idea that ABP is solely operated by NIRSAL Plc is completely ludicrous and incompatible with the facts.’’

NIRSAL Plc is one of several PFIs assigned by the CBN to facilitate its Anchor Borrowers’ Programme (ABP) and it is neither the borrower/obligor under the ABP nor the lender.

For the purpose of educating the uninformed, the roles of NIRSAL as an agricultural organization with field-level experience in the rural areas is to organize farmers, register them, and present them to the CBN for consideration as borrowers for its agricultural loans after due diligence and credit checks to ensure their creditworthiness.

The CBN creates these loans directly in the names of these farmers and the farmers bank accounts are credited with the loans accordingly.

“All funds are disbursed by the CBN under the ABP are accountable down to the level of the farmer and his farm. This includes farmer biometrics, home address, telephone number, bank account number, BVN number, photograph, farm location, current loan status, etc.

“NIRSAL Plc, together with field officers (DFOs) of the Development Finance Department (DFD) of the CBN, monitors these farmers to ensure proper loan utilization throughout their growing cycle.

“At harvest, farmers are expected to pay back their loans in cash or kind or both and where farmers cannot pay back over the tenor of their loan facility, the CBN in most cases provides these farmers additional time to enable them to pay back.

“Where farmers refuse to pay back, the CBN rightly suspends further loan disbursements to these farmers, gives them forbearance to pay back in return for re-consideration to re-join the program through the PFI that organized them in the first place,’’ the statement explained.

On which organization has power on the scheme, Persecondnews gathered that in line with global standards in credit management and for the proper management of schemes like the ABP, the CBN can suspend disbursement of its ABP loans to those farmers, under any PFI window, where they (Farmers) prove recalcitrant in repaying their loan obligations.

The CBN does this via the PFI window that presented these farmers for enrollment into the program in the first place. This was the right step to protect the scheme and ensure that progress towards the attainment of its objectives was not compromised.

NIRSAL pointed out:“Therefore, when accumulated loans are not paid, indebted farmers can be suspended from further accessing the facility until they repay their outstanding commitment.

“The ABP has a strict framework of roles and responsibilities defined by the CBN which NIRSAL, like other PFIs, complies with. Contrary to the false stories bandied about by some integrity-challenged journalists and their sponsors, NIRSAL Plc could not have taken liberties with ABP funds for the simple reason that (a) no such funds were under its absolute control and (b) NIRSAL itself is owned by the CBN and its entire corporate accounts are operated in and within sight of the CBN as its own banker.

“Moreover, NIRSAL’s responsibility under ABP guidelines is to organize, structure, document and present pre-qualified farmers to CBN for consideration to be enrolled into the program. The details of the ABP processes are publicly available for anyone to confirm.

“Where there were legitimate causes for poor or no harvest, insurance products are available to support farmer repayments. In addition, actors on the disbursement side of the ABP are not oblivious of the state of insecurity, though recently abating, that is confronting farmers and their farms in parts of the country.

“These posed and continue to pose serious field-level challenges that militate against full loan repayment by smallholder farmers under the ABP. Devastating floods also undermined harvests – the coin of repayment.

“More recently, the impact of COVID-19 jeopardized the business of many farmers and anchor companies. All of these strongly contribute to the time lag between expected repayment dates and the eventual repayment times by these smallholder farmers.’’

Here are the highlights of NIRSAL Plc’s involvement in the Anchor Borrowers’ Programme. For instance between 2017 and 2020, NIRSAL, in its role as a PFI in the CBN’s Anchor Borrowers’ Programme (ABP), contributed significant and measurable value to the scheme to the benefit of Nigerian farmers and Nigerian agriculture.

It is on record that NIRSAL Plc’s ABP efforts have helped to create over 415,000 direct and indirect jobs across the country. Under the ABP guidelines, it facilitated the provision of critical improved farming inputs and facilitated affordable, single-digit interest rate finance to over 130,000 farmers under the programme.

As a result of NIRSAL’s robust risk management framework, loan performance rates also improved, and default by beneficiaries significantly curbed.

On loan repayment by farmers, so far loan repayments are at a healthy 70% under the ongoing 2020 wet season repayment period.

In addition to the number one priority of ensuring that projects executed under its ambit in the ABP deliver on the defined parameters, NIRSAL Plc has also focused rigorously on loan repayments/ recoveries from farmers. This is a key component of the risk management edge it has contributed to the ABP. These outcomes are not only positive but improving.

Given NIRSAL Plc’s growing experience, field network and diversity of talent, it is the most equipped institution to be invited into the administration of the ABP by the CBN.

Providentially, the institution’s participation in the ABP shortened its learning curve in the upstream (farming) segment of the agricultural value chain, thus leading to the development of agribusiness models and commercial financing frameworks that will drive sustainable financing of agriculture in Nigeria for years to come.

Still on its loan recovery strategies, NIRSAL Plc is not resting on its oars. To improve further on the rate of loan repayment/recovery from farmers, it has adopted a robust ABP Loan Recovery Strategy that is anchored on a holistic plan that will ensure more repayment compliance by the affected farmers within the shortest possible time and these include:

- Making loan repayment by farmers in Geo-Cooperative farming groups to be an organic function of the leaders of these Agro Geo Co-operatives (AGCs), supported by peer-pressure tools and cultural/moral suasion methods, a pre-condition for the groups to be eligible for the next round of loan disbursements by the CBN

- The deployment of community-based field intelligence gathering and constant engagement of stakeholders by our project monitoring and reporting officers throughout the country with the support of ABP PMTs, CBN DFOs, traditional institutions etc.

In spite of the many challenges facing NIRSAL, it is crystal clear and incontrovertible that it has contributed significant value to the ABP as it has done to other aspects of its core mandate and related responsibilities.

A final word from NIRSAL: “We will not allow falsehood and other invented distractions to stop us from doing justice to the credible work we are doing to boost Nigeria’s agriculture/agribusiness economy and the overall economy.’’

Leave a comment