Diamond Bank Plc said it made a record N1.8 billion in mobile banking revenue in its Q1 2018 unaudited financial results on Friday.

According to documents made available to journalists, the bank recorded a growth in its mobile banking revenue from N1.2 billion in Q1 2017 to N1.8 billion in Q1 2018. Increases were recorded in customer acquisition through digital channels with increases in active account ratios, and the proportion of customers’ transactions completed on its digital platforms.

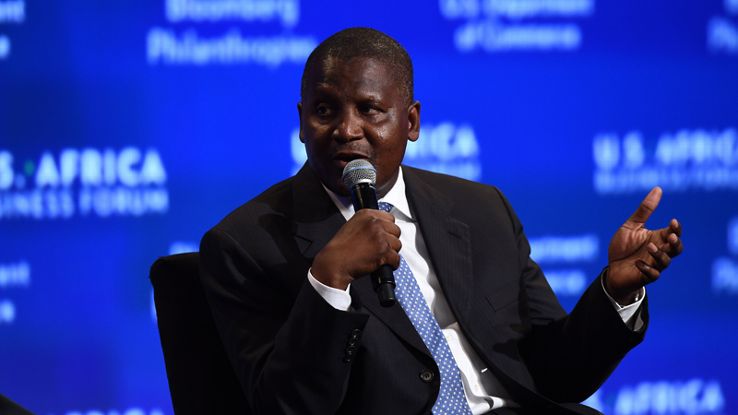

Commenting on the results, Chief Executive Officer, Mr. Uzoma Dozie said: “At a macro level, the year has begun with positive indicators, such as growth in GDP, declining inflation and rising crude oil prices. Thus, investor sentiment about the economy is becoming more positive as shown by the success of recent bond sales by the Federal Government. We expect these positive trends to continue and I am confident that Diamond Bank is well positioned to capitalize on these, particularly having disposed non-core assets to focus on the Nigerian opportunity.

Uzoma further stated that, “2018 will see Diamond Bank invest more in emerging businesses through an expanded loan offering and support for different activities in trade, agriculture and manufacturing. As emerging businesses continue to flourish, we will also continue to develop services and products to support their needs. ”

The Bank kept operating expenses flat when compared to Q1 2017, whilst its impairment charges declined 18% year-on-year, a reflection on the Bank’s improved loan underwriting and drop in non-performing loan formation. These will go to strengthen performance in the years ahead.

Giving an indication of the Bank’s business plans for the rest of the financial year, the CEO said, “The Bank will continue its drive to use technology to drive financial inclusion and convenient banking with the aid of such products as “ADA”, a 24/7 Artificial Intelligence (AI) chatbot.

“The outlook for 2018 is positive for Diamond Bank. Revenue is expected to grow; operating expense will stabilize and decisive action should result in a decline in loan impairment losses. With the economy showing signs of solid recovery, Diamond Bank has an excellent platform from which to grow and achieve long term sustainable profitability”, concluded Uzoma.

Leave a comment